So, you’re thinking about buying or selling a small business share? That’s a big step, and it’s one that requires careful planning and, most importantly, a solid agreement. This is where a small business buyout agreement template comes into play. It’s like a roadmap for the transition, ensuring everyone is on the same page and minimizing potential headaches down the line. Think of it as protecting yourself and your investment, no matter which side of the deal you’re on.

Navigating the world of business acquisitions can feel like walking through a minefield. There are so many things to consider, from valuation and financing to legal compliance and future operations. Without a clear and comprehensive agreement, you could be setting yourself up for disputes, misunderstandings, and even legal battles. Nobody wants that, especially when you’re already dealing with the complexities of a business transaction.

A well-drafted small business buyout agreement template isn’t just a formality; it’s a crucial tool for protecting your interests and ensuring a smooth and successful transition. It clarifies the terms of the sale, outlines the responsibilities of each party, and provides a framework for resolving any issues that may arise. Let’s dive in and see what elements make up a solid buyout agreement and how it benefits everyone involved.

Understanding the Core Components of a Small Business Buyout Agreement

At its heart, a small business buyout agreement is a legally binding contract that outlines the terms and conditions under which one party (the buyer) will purchase the ownership stake of another party (the seller) in a small business. It’s far more detailed than a simple handshake deal and addresses numerous critical aspects of the transaction. This is the document that prevents future “he said, she said” scenarios and protects both parties involved.

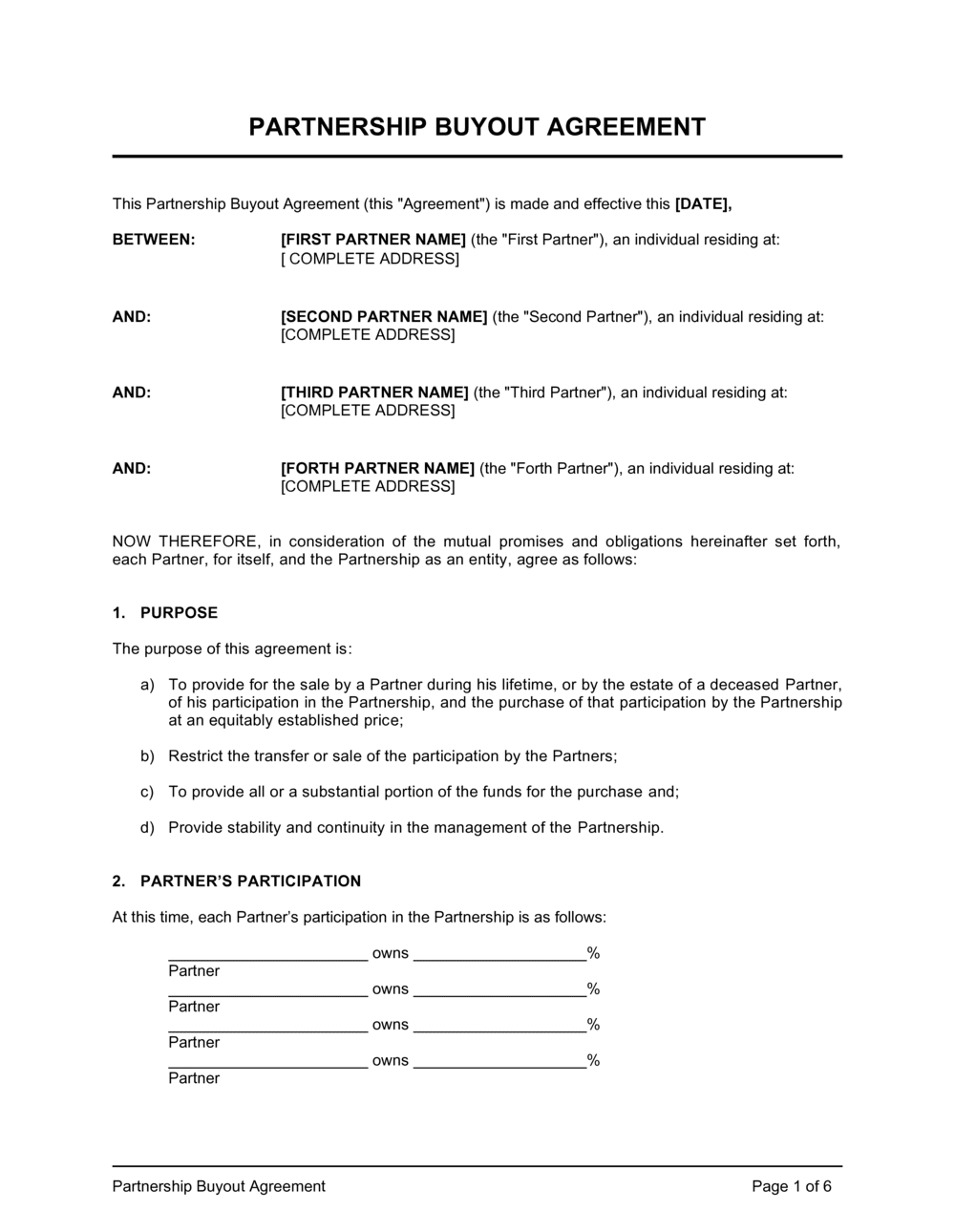

One of the most important elements is the precise identification of the parties involved. This may seem obvious, but it’s essential to clearly state the legal names and addresses of both the buyer and the seller. This avoids any ambiguity about who is responsible for fulfilling the obligations outlined in the agreement. Get this wrong, and the whole agreement could be challenged.

Next, the agreement must clearly define what is being sold. Is it the entire business? A percentage of ownership? Specific assets? This section should be incredibly detailed to prevent any misunderstandings about what the buyer is actually acquiring. List any intellectual property, physical assets, inventory, and customer lists that are part of the transaction.

The purchase price and payment terms are, of course, central to any buyout agreement. This section should specify the total purchase price, the method of payment (e.g., cash, financing, stock), and the schedule for payments. It’s crucial to consider factors like potential adjustments to the purchase price based on future performance or due diligence findings.

Finally, the agreement should address the closing date, which is the date on which the ownership of the business officially transfers to the buyer. This section also typically outlines the responsibilities of each party leading up to the closing date, such as completing due diligence, obtaining financing, and transferring assets.

Important Clauses to Consider

Beyond the core components, several specific clauses are commonly included in a small business buyout agreement to provide additional protection for both parties. These can vary depending on the specific circumstances of the transaction, but some of the most common include:

- Non-compete clause: This restricts the seller from starting a competing business within a certain geographic area and for a specified period of time. This protects the buyer’s investment by preventing the seller from using their knowledge and experience to compete against the business they just sold.

- Confidentiality clause: This requires both parties to keep the terms of the agreement and any confidential information about the business secret. This protects the business’s trade secrets and prevents the disclosure of sensitive information to competitors.

- Indemnification clause: This protects the buyer from any liabilities or losses that may arise from the seller’s actions prior to the closing date. For example, if the seller failed to pay certain taxes, the indemnification clause would require them to reimburse the buyer for any resulting penalties.

Benefits of Using a Small Business Buyout Agreement Template

Opting for a small business buyout agreement template brings a multitude of advantages to the table, particularly when dealing with the complexities of transferring ownership in a small enterprise. One of the most immediate benefits is cost-effectiveness. Hiring an attorney to draft a custom agreement can be expensive. A template provides a solid foundation, reducing legal fees. This can be particularly helpful for small businesses operating on a tight budget. It’s a cost-effective way to ensure legal compliance and protect your interests.

Templates also save a significant amount of time. Rather than starting from scratch, you have a pre-structured document that can be easily customized to fit your specific needs. This accelerates the negotiation process and allows you to focus on other important aspects of the transaction, such as due diligence and financing. Time is money, especially when closing a deal. A template helps keep things moving efficiently.

Moreover, a well-designed template ensures that all essential elements are included in the agreement. It serves as a checklist, prompting you to consider aspects of the transaction that you might otherwise overlook. This minimizes the risk of leaving out critical details that could lead to disputes down the line. It prompts you to ask the right questions and ensures a more comprehensive agreement.

Clarity and consistency are other key advantages. A template provides a standardized framework, making it easier for all parties to understand the terms of the agreement. This reduces the potential for misunderstandings and promotes smoother negotiations. Everyone benefits from a clear and concise agreement, especially when emotions are running high.

Finally, many templates are designed with legal compliance in mind. They incorporate standard legal clauses and provisions that are commonly required in buyout agreements. While it’s still advisable to have an attorney review the final agreement, using a template can help ensure that it meets basic legal requirements. It’s a good starting point for ensuring the agreement is legally sound, even before consulting with an attorney.

So, whether you’re on the buying or selling end, remember that a well-structured agreement is the key to a smooth and successful transaction. It’s an investment in your future, protecting your interests and minimizing potential risks.

In essence, the right document acts as a compass, guiding both parties through what can be a complex journey and ensuring everyone arrives at the destination feeling confident and protected. It’s more than just a piece of paper; it’s the foundation for a successful future.