So, you’ve got a small business, a dream, and maybe even a few customers banging down your door. But you need capital to really take things to the next level. Enter the world of investors. Securing investment is exciting, but it’s crucial to protect yourself and your business. That’s where a solid small business investment agreement template comes in. Think of it as a roadmap for your financial future, ensuring everyone is on the same page and understands the terms of the deal.

This isn’t just some legal jargon you can skip over. It’s a vital document that outlines the rights, responsibilities, and expectations of both you and the investor. It clarifies exactly how much money is being invested, what stake the investor gets in return, and how the profits (and losses) will be distributed. It’s about setting clear boundaries and establishing a framework for a successful, long-term relationship.

Without a well-defined agreement, you’re essentially navigating uncharted waters, vulnerable to misunderstandings and potential disputes. Imagine promising an investor a certain level of control only to find out later that they expected far more involvement in your day-to-day operations. That’s a recipe for disaster. Using a small business investment agreement template helps you avoid these pitfalls and protects both your interests and the investor’s.

Why a Detailed Investment Agreement is Non-Negotiable

An investment agreement serves as a legal shield, protecting both the business owner and the investor. It’s more than just a formality; it’s a foundation for a thriving business relationship built on transparency and mutual understanding. Think of it as a prenuptial agreement for your business – nobody wants to think about things going wrong, but it’s always better to be prepared. A comprehensive agreement ensures that everyone knows their roles and responsibilities, mitigating the risk of future conflicts.

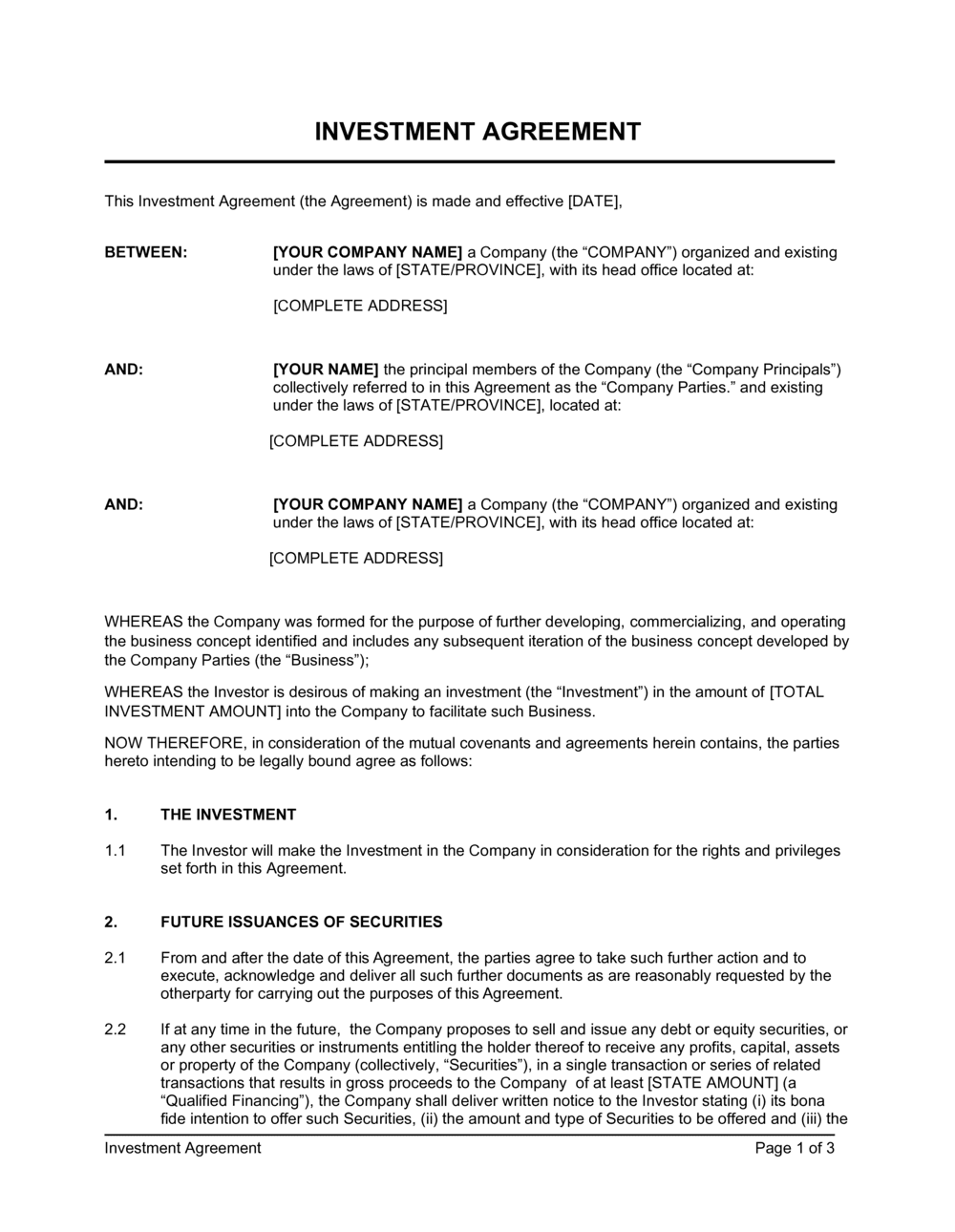

The core purpose of the small business investment agreement template is to clearly define the terms of the investment. This includes the amount of money being invested, the equity stake the investor receives, and the valuation of the company. Without a clear valuation, disputes can arise later on regarding the true worth of the business and the fairness of the investment. The agreement should also outline the rights and responsibilities of the investor, such as voting rights, board representation, and access to information. These details ensure that the investor is confident in their investment and that the business owner retains control over their company’s direction.

Furthermore, the agreement should cover various scenarios that could potentially impact the business, such as a sale, merger, or acquisition. These clauses, often referred to as “exit strategies,” specify how the investor will be compensated in the event of a major change in the company’s ownership or structure. Addressing these possibilities upfront prevents disagreements down the line and provides a clear path forward for all parties involved.

Another crucial aspect of the agreement is the confidentiality clause. This clause protects the company’s sensitive information, such as trade secrets, customer lists, and financial data, from being disclosed to competitors. Investors typically have access to confidential information during the due diligence process and throughout their involvement with the business. The confidentiality clause ensures that this information remains protected, safeguarding the company’s competitive advantage.

Finally, a well-drafted investment agreement should include provisions for resolving disputes. This might involve mediation, arbitration, or litigation. Having a clear dispute resolution process in place can save time and money in the event of a disagreement. It provides a structured framework for resolving conflicts and prevents them from escalating into costly legal battles. A good agreement should anticipate potential problems and offer solutions before they even arise.

Key Elements to Include in Your Agreement

A robust small business investment agreement template should cover all the essential aspects of the investment. This isn’t just about filling in the blanks; it’s about carefully considering each clause and tailoring it to your specific situation. One of the first and most important elements is the definition of the investment amount. This section should clearly state the exact amount of money being invested and the currency in which it will be paid. It should also specify the payment schedule, outlining when and how the funds will be transferred.

Next, the agreement should detail the equity stake being granted to the investor. This includes the percentage of ownership the investor will receive in exchange for their investment, as well as the type of shares being issued (e.g., common stock, preferred stock). It’s important to clearly define the rights and privileges associated with these shares, such as voting rights, dividend rights, and liquidation preferences. These details ensure that the investor understands exactly what they’re getting in return for their investment.

Another essential element is the representation and warranties section. This section includes statements made by the business owner about the company’s financial condition, legal compliance, and ownership of assets. These statements are considered to be legally binding promises, and the investor relies on them when making their investment decision. If any of these statements turn out to be false, the investor may have grounds to sue for breach of contract.

Furthermore, the agreement should include covenants, which are promises made by the business owner to take certain actions or refrain from taking certain actions. For example, the business owner might covenant to maintain certain financial ratios, obtain certain insurance policies, or refrain from taking on excessive debt. These covenants are designed to protect the investor’s investment and ensure that the business is managed responsibly.

Finally, the agreement should include provisions for termination. This section specifies the circumstances under which the agreement can be terminated, such as a breach of contract or a material adverse change in the company’s business. It should also outline the consequences of termination, such as the repayment of the investment or the forfeiture of equity. These provisions provide a clear exit strategy for both the business owner and the investor in the event that the relationship sours.

Navigating the world of small business investment can feel daunting, but with a clear understanding and a carefully crafted agreement, you can set your business up for success. Remember to seek professional legal advice to ensure your agreement is tailored to your specific needs and protects your interests.

Having the right small business investment agreement template isn’t just about ticking a box; it’s about creating a solid foundation for growth and a trusting partnership with your investor. It’s an investment in your future, and one that will pay dividends in the long run.