Starting a small business is exciting, but it also involves navigating a maze of legal documents. One of the most important documents you’ll encounter is a lease agreement, especially if you plan on renting a commercial space. A well-crafted lease agreement protects both you and the landlord, outlining the terms and conditions of your tenancy. Finding the right small business lease agreement template can seem daunting, but it doesn’t have to be. Think of it as setting the ground rules for a successful landlord-tenant relationship.

This article will guide you through the process of understanding and utilizing a small business lease agreement template. We’ll break down the key components of a commercial lease, explaining why each section is important and how it protects your business. We will also discuss what to consider when customizing a template to fit your specific needs. Remember, taking the time to carefully review and customize your lease agreement can save you headaches and potential legal disputes down the road.

So, whether you’re a seasoned entrepreneur or just starting out, this guide will provide you with the essential information you need to confidently approach your commercial lease. Let’s dive in and learn how to protect your business with a solid small business lease agreement template.

Key Components of a Small Business Lease Agreement

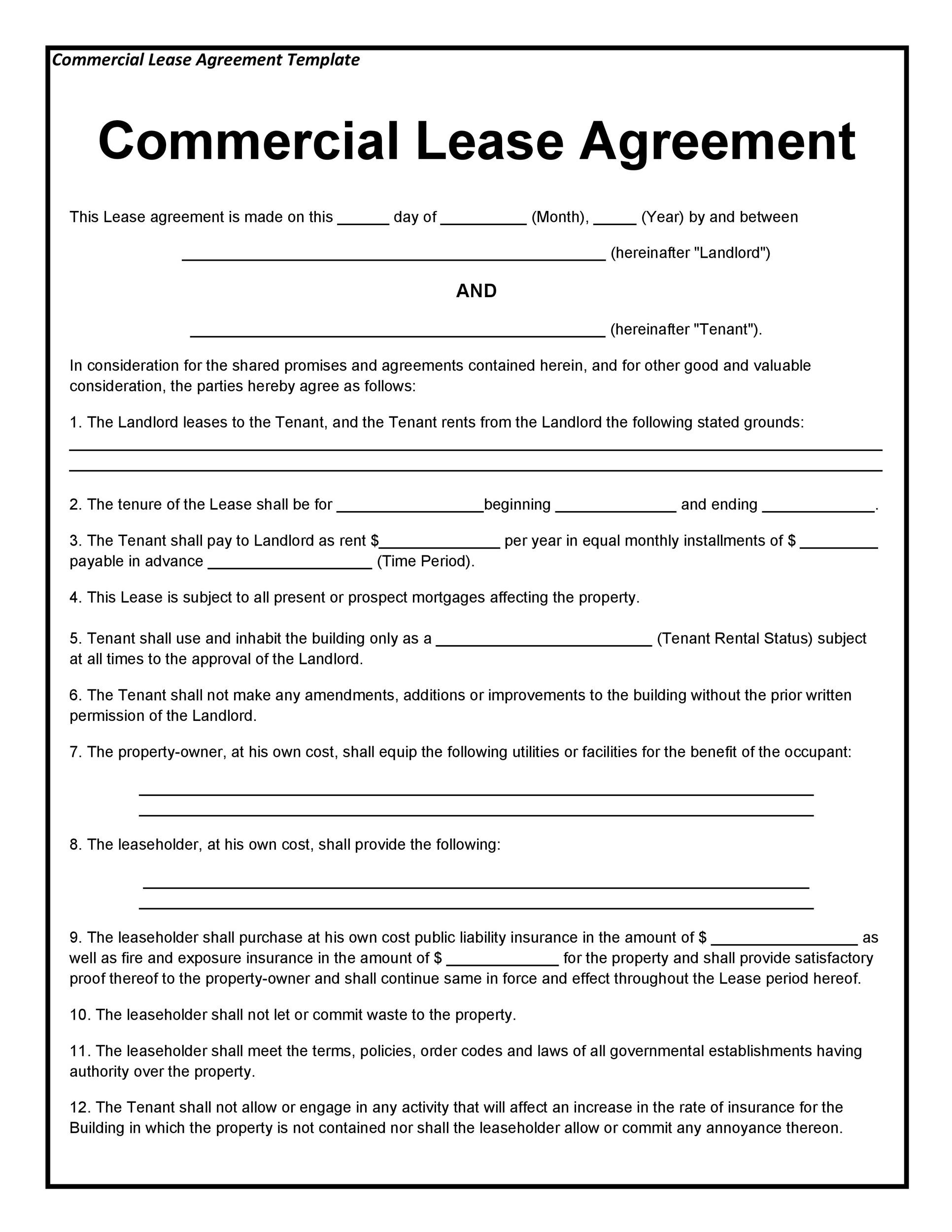

A commercial lease agreement is a legally binding contract between a landlord and a tenant. It outlines the rights and responsibilities of both parties. Understanding the key components of the agreement is crucial for ensuring a smooth and successful tenancy. Let’s explore some of the essential elements you’ll find in a standard small business lease agreement template.

First and foremost, the lease agreement will clearly identify the parties involved: the landlord (lessor) and the tenant (lessee). It will state the full legal names and addresses of both. This section is critical for establishing who is legally bound by the agreement. Make sure this information is 100% accurate.

Next, the agreement will describe the leased property. This description should be as specific as possible, including the street address, suite number (if applicable), and a detailed explanation of the space being leased. A floor plan or diagram might even be included as an attachment to the lease. The clarity here avoids future disputes about exactly what space your lease covers. It also is critical that the permitted use of the property is clearly stated. This clause restricts the tenant to using the premises only for the business purpose agreed upon in the lease.

The lease term, or the duration of the lease, is another vital component. This section specifies the start and end dates of the lease. Options for renewal are often included, outlining the process and timeframe for potentially extending the lease beyond the initial term. Some leases include automatic renewal clauses, so be sure to read this section very carefully!

Of course, rent is a major component! The lease agreement will clearly state the amount of rent due each month, the payment schedule, and the acceptable methods of payment. It will also detail any late payment penalties or fees associated with bounced checks. Additionally, the lease should specify how and when rent increases might occur throughout the lease term. Don’t forget to address who is responsible for utilities, property taxes, and insurance.

Customizing Your Small Business Lease Agreement Template

While a small business lease agreement template provides a great starting point, it’s essential to remember that every business and property is unique. Therefore, you’ll likely need to customize the template to accurately reflect your specific situation. Failing to do so could leave you vulnerable to unforeseen issues down the road. Here are some key areas to consider when personalizing your lease agreement.

One crucial aspect of customization involves addressing potential maintenance and repair responsibilities. The standard template might not clearly define who is responsible for specific repairs, such as plumbing issues, electrical problems, or roof leaks. Negotiate these responsibilities with your landlord and clearly document them in the lease. Determine who is responsible for interior versus exterior maintenance, and set clear expectations for turnaround times on repairs.

Another critical area for customization is the “improvements and alterations” clause. If you plan on making any modifications to the property, such as painting walls, installing new fixtures, or building out additional space, you’ll need to obtain written permission from your landlord. The lease agreement should clearly outline the process for requesting and receiving approval for these types of changes. It’s also good to define who owns any improvements upon the end of the lease term.

Consider adding a clause related to signage. Most businesses need to display signage to attract customers. The lease agreement should specify the type and size of signage allowed, as well as any restrictions imposed by the landlord or local regulations. Failure to address this could result in having to remove or modify your signage later.

Subleasing rights are something you should also consider. If your business needs change, you might want the option to sublease the property to another tenant. The lease agreement should clearly state whether subleasing is permitted and, if so, the conditions under which you can sublease the space.

Finally, don’t overlook the importance of clearly defining what constitutes a default under the lease. This section should outline the specific actions or inactions that could lead to a termination of the lease, such as failure to pay rent, violation of the lease terms, or abandonment of the property. Be sure you understand the consequences of a default and the steps the landlord can take to remedy the situation.

A well-crafted lease safeguards your business interests and fosters a positive relationship with your landlord. By taking the time to review, understand, and customize your lease agreement, you are setting your business up for success.

Remember, if you’re unsure about any aspect of your commercial lease, it’s always a good idea to seek legal advice from an experienced attorney. Their expertise can help you navigate the complexities of commercial real estate law and ensure that your lease agreement accurately reflects your needs and protects your rights.