So, you’re a small business owner looking for some extra capital to fuel your growth, or maybe you’re the generous soul lending a helping hand to a budding entrepreneur. Either way, you’ve likely stumbled upon the phrase “small business loan agreement template.” It might sound intimidating, all legal and formal, but trust me, it’s a vital piece of the puzzle when it comes to securing a loan responsibly. Think of it as a roadmap for your financial journey together, ensuring everyone is on the same page and knows what to expect along the way.

Without a solid loan agreement, you’re essentially navigating uncharted waters. Disagreements can arise, misunderstandings can fester, and relationships can sour. A well-drafted template acts as a safety net, protecting both the lender and the borrower. It clearly outlines the terms of the loan, leaving no room for ambiguity. This document isn’t just about legalese, it is about building trust and fostering a healthy business relationship built on transparency.

This article will break down the ins and outs of using a small business loan agreement template. We’ll discuss its importance, key components, and how to tailor it to your specific needs. By the end of this, you’ll feel confident in your ability to navigate the process and create a loan agreement that works for everyone involved. Let’s dive in!

Why Use a Small Business Loan Agreement Template?

Using a template is a smart move for several reasons. First and foremost, it saves you time and money. Hiring a lawyer to draft a loan agreement from scratch can be expensive. A template provides a solid foundation, a pre-built structure that you can customize to reflect the unique details of your loan. You’re not starting from zero, which drastically cuts down on the time and legal fees involved.

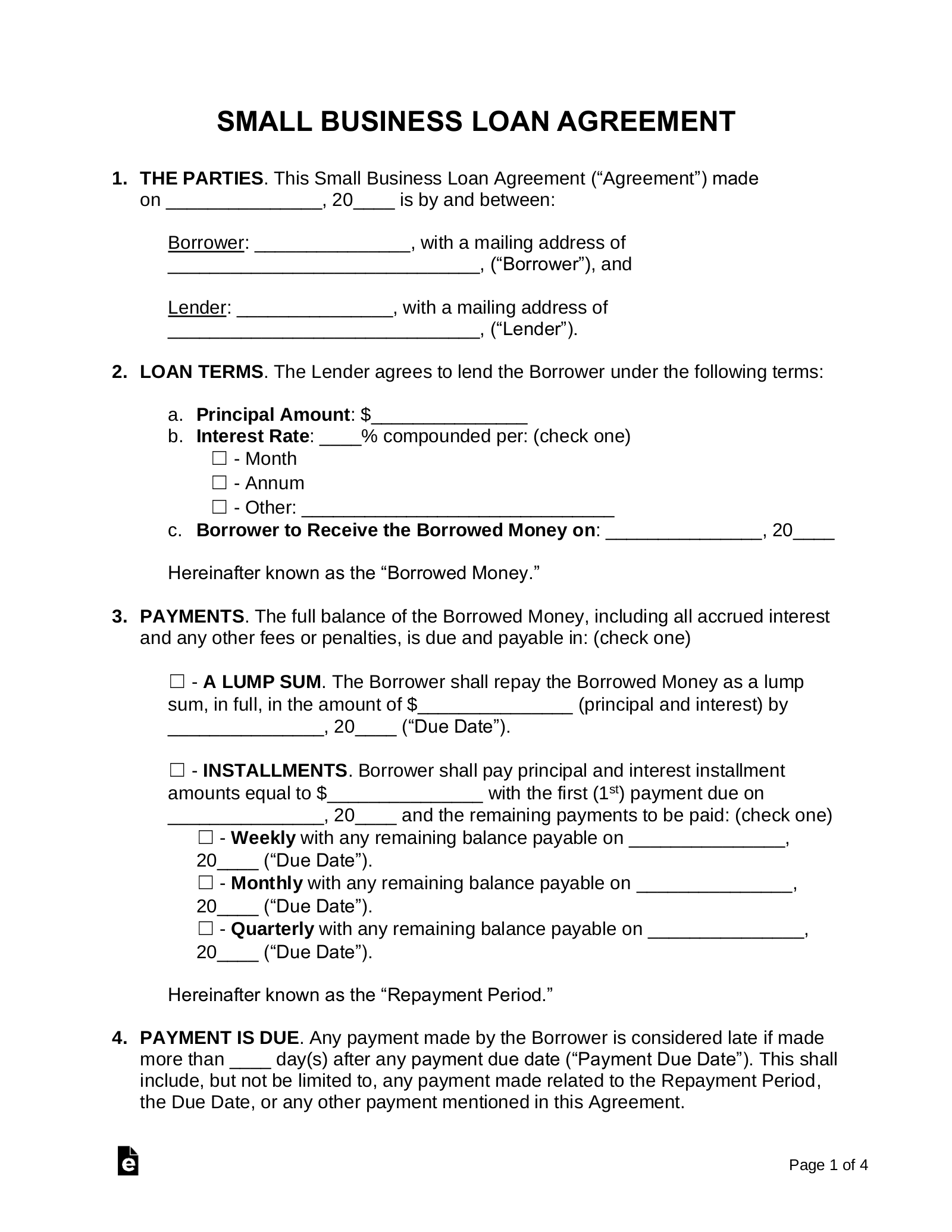

Secondly, a good template helps ensure you’re covering all your bases. These documents are designed to address essential elements of a loan, such as the principal amount, interest rate, repayment schedule, collateral (if any), and default provisions. By using a template, you’re less likely to overlook crucial aspects that could lead to problems down the road. It’s like having a checklist that keeps you on track and prevents costly omissions.

Beyond saving time and mitigating risks, a template also promotes clarity and understanding. The standardized language used in most templates helps prevent misunderstandings. Both the lender and the borrower can clearly see their rights and obligations, which fosters a sense of trust and transparency. This is particularly important in small business lending, where relationships often play a significant role.

Of course, it’s crucial to remember that a template is just a starting point. You shouldn’t simply fill in the blanks without carefully considering the specific circumstances of your loan. Every business is different, and every loan has its own unique characteristics. Take the time to customize the template to reflect those differences, ensuring that it accurately captures the agreement between the parties.

Consider the type of loan. Is it secured or unsecured? What is the term length? Are there any specific conditions attached to the loan? These are all factors that will influence the details you need to include in your agreement. Seeking legal advice, even if you’re using a template, is always a wise decision, especially for complex loan arrangements.

Key Components of a Small Business Loan Agreement

A well-structured loan agreement will typically include the following sections: the parties involved (lender and borrower), the loan amount, the interest rate, the repayment schedule (frequency and amount of payments), any collateral offered as security, default provisions (what happens if the borrower fails to repay), governing law (which state’s laws apply), and signatures from both parties.

Essential Elements to Include in Your Template

Let’s break down some of the most crucial elements you’ll find in any good small business loan agreement template. First, you absolutely must have clear identification of the parties involved. This includes the legal names and addresses of both the lender and the borrower. If the borrower is a corporation or LLC, make sure to include its full legal name and registered address, not just a trade name. This detail is paramount for legal enforceability.

Next, the loan amount needs to be explicitly stated. Don’t leave any room for ambiguity. Include the exact principal amount being loaned, expressed in US dollars (or whatever currency is applicable). This is the foundation upon which all other terms are built, so accuracy is key.

The interest rate is another critical component. Specify the annual interest rate, and whether it is fixed or variable. If it’s variable, clearly explain how it will be calculated and how often it will be adjusted. Transparency around interest rates is crucial for building trust and avoiding disputes.

Repayment terms are equally important. Outline the repayment schedule in detail, including the frequency of payments (weekly, monthly, quarterly), the amount of each payment, and the due date. Also, specify where the payments should be sent or how they should be made (e.g., check, electronic transfer). Consider including a section on prepayment options, outlining whether the borrower is allowed to prepay the loan (either partially or in full) and whether any penalties will apply.

Finally, address the consequences of default. This section should clearly define what constitutes a default (e.g., failure to make payments, breach of other terms), and what actions the lender can take in the event of a default (e.g., acceleration of the loan, foreclosure on collateral, legal action). Including a well-defined default clause helps protect the lender’s interests and provides a clear roadmap for resolving disputes.

Remember, a small business loan agreement template is a valuable tool, but it’s only effective if it’s tailored to your specific needs and used responsibly. Take the time to understand each section, customize it appropriately, and seek legal advice when necessary. This approach will help you create a loan agreement that is fair, enforceable, and beneficial for everyone involved.

Creating a loan agreement that works for both parties is possible. By approaching it with an open mind and a willingness to compromise, you can build a strong foundation for a successful and mutually beneficial relationship.

The path to securing funding for a small business can feel overwhelming, but it doesn’t have to be. By understanding the intricacies of a small business loan agreement template and taking the time to customize it to your specific needs, you can navigate the process with confidence and clarity.