Starting a small business is an exciting venture filled with possibilities. You’ve got the vision, the drive, and hopefully, a solid business plan. But before you dive headfirst into the daily grind, there’s a crucial document you should consider having in place: a small business operating agreement template. Think of it as the constitution for your company, laying the groundwork for how your business will be run, how decisions will be made, and what happens if things change down the road.

An operating agreement isn’t just some legal mumbo jumbo designed to confuse you. It’s a practical tool that can protect your personal assets, prevent misunderstandings between partners, and provide clarity in the event of disputes. It outlines the ownership structure, member responsibilities, profit and loss distribution, and the procedures for adding or removing members. Without one, you’re essentially navigating the business world without a map, leaving yourself vulnerable to potential legal and financial headaches.

The good news is, you don’t have to be a legal expert to create a basic operating agreement. Many resources offer customizable templates that can be adapted to fit the specific needs of your business. While it’s always advisable to consult with an attorney to ensure your agreement is comprehensive and legally sound, a small business operating agreement template can be a great starting point for getting your business foundation in order. This article will explore the ins and outs of operating agreements and how to use a template effectively.

Why You Absolutely Need a Small Business Operating Agreement

So, you might be asking yourself, “Do I really need an operating agreement?”. The short answer is almost always, yes! Even if you’re the sole owner of your business, having a written agreement offers significant benefits. For multi-member LLCs or partnerships, it’s virtually non-negotiable. Let’s break down some of the key reasons why you should seriously consider drafting one.

First and foremost, an operating agreement can help protect your personal assets. Without a clear separation between your personal and business finances, you risk being held personally liable for business debts and obligations. A well-drafted operating agreement reinforces the limited liability status of your LLC, shielding your personal savings, home, and other assets from creditors. This separation is critical for peace of mind and financial security.

Beyond liability protection, an operating agreement establishes clear rules and procedures for how your business will operate. It outlines the roles and responsibilities of each member, how decisions will be made, and how profits and losses will be distributed. This clarity can prevent misunderstandings and disagreements down the line, which can be costly and time-consuming to resolve. Imagine two partners disagreeing on how to handle a major business decision. Without a predetermined procedure outlined in the operating agreement, the situation could quickly escalate into a serious conflict.

Moreover, an operating agreement provides flexibility in managing your business. Unlike corporations, LLCs have a great deal of freedom to customize their operating procedures. Your agreement can specify unique management structures, profit-sharing arrangements, and voting rights. This allows you to tailor the operation of your business to your specific needs and goals. This also helps in setting the expectations of what each member will be contributing to the company and what can happen if anyone violates the agreement.

Finally, having a written operating agreement demonstrates professionalism and legitimacy. It shows that you’ve taken the time to think through the important aspects of your business and that you’re committed to operating it in a responsible and organized manner. This can be particularly important when seeking funding from investors or applying for loans. Lenders and investors are more likely to trust businesses that have a solid legal foundation in place, including a comprehensive operating agreement.

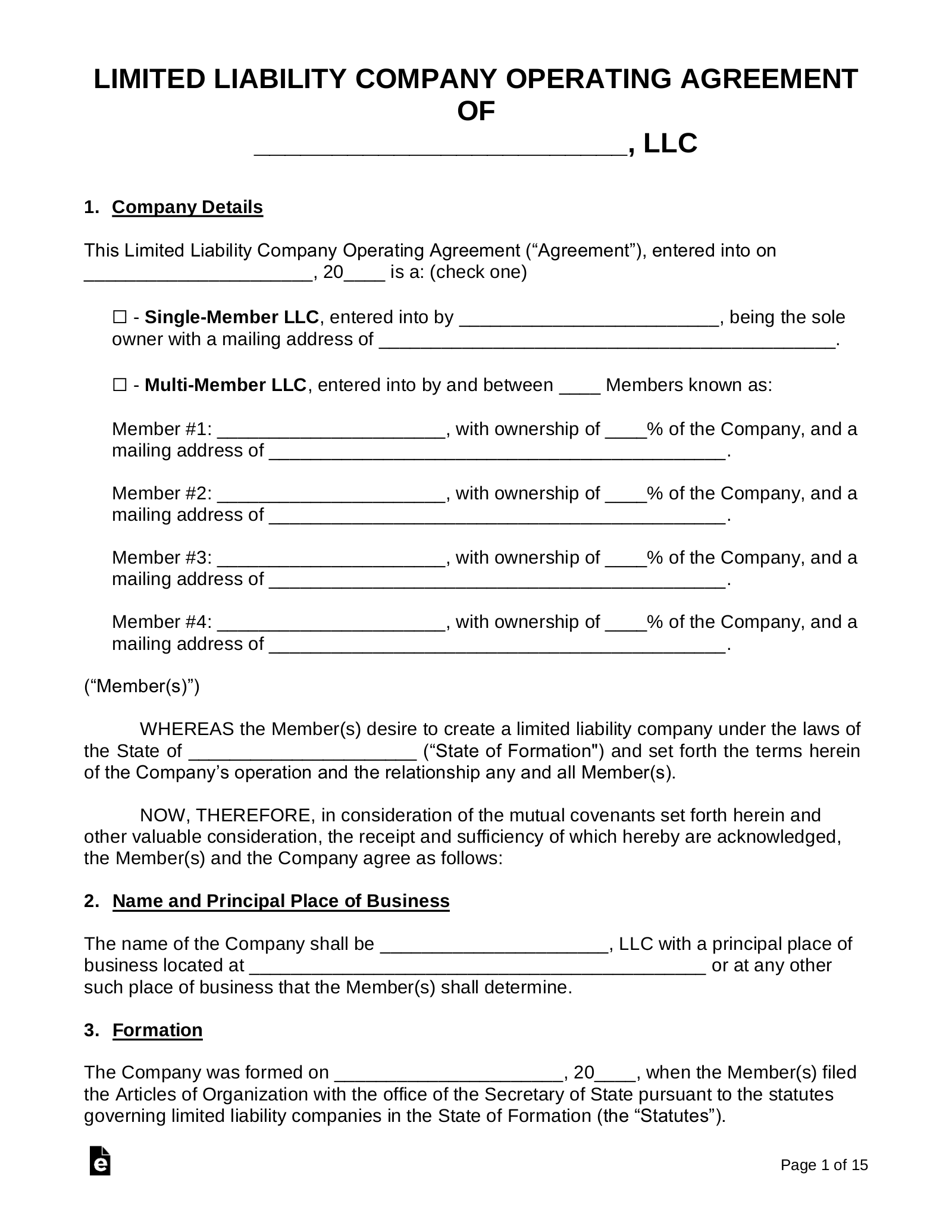

What to Include in Your Small Business Operating Agreement Template

Now that you understand the importance of an operating agreement, let’s take a look at some of the key provisions you should include in your small business operating agreement template. While every business is unique, there are certain essential elements that should be addressed in almost every agreement.

First, you’ll need to clearly identify the members of the LLC, their ownership percentages, and their initial capital contributions. This section should also specify the roles and responsibilities of each member, including who will be responsible for managing the day-to-day operations of the business. Being as specific as possible can prevent future disagreements.

Next, you’ll need to outline the procedures for making decisions, including how votes will be conducted and what constitutes a majority vote. You should also specify how profits and losses will be allocated among the members. Will profits be distributed in proportion to ownership percentages, or will there be a different arrangement? Addressing these issues upfront can prevent disputes over financial matters.

The operating agreement should also address the process for adding or removing members. What happens if a member wants to sell their ownership interest? What happens if a member becomes disabled or passes away? These are difficult questions, but it’s important to have a plan in place. The agreement should specify the procedures for transferring ownership, valuing ownership interests, and handling the departure of a member. It may include a buy-sell agreement outlining these issues in detail.

Another important provision to include is a dispute resolution mechanism. In the event of a disagreement, how will the members resolve the issue? Will they attempt to mediate the dispute, or will they resort to arbitration or litigation? Specifying a dispute resolution process can save time and money in the long run.

Finally, your operating agreement should include any other provisions that are specific to your business. This could include provisions related to confidentiality, non-compete agreements, or intellectual property rights. Remember, the goal is to create a comprehensive document that addresses all of the key issues related to the operation of your business, so don’t be afraid to add provisions that are tailored to your specific needs.

Creating a strong operating agreement is like building a house on a solid foundation. It provides the structure and stability you need to weather the storms of the business world. Remember to be specific, clear, and thorough in your drafting, and don’t hesitate to seek professional legal advice if you have any questions.

Take your time to customize your small business operating agreement template and create something that works for all members. This is not a document that you create and forget. It’s a guide that will steer the business throughout its operation.