So, you’re thinking about buying or selling a small business? Exciting times! But before you pop the champagne, there’s a crucial piece of paperwork you need to nail down: the purchase agreement. Think of it as the roadmap for the entire transaction, ensuring both the buyer and seller are on the same page and protected. It outlines all the details, from the price and payment terms to what exactly is being bought and sold. Without a solid agreement in place, you’re basically navigating uncharted waters, and that’s a recipe for potential headaches down the road.

A purchase agreement might sound intimidating, full of legal jargon and complex clauses. And while it’s true that these documents can be lengthy and detailed, the core purpose is simple: to create a clear and legally binding record of the sale. The good news is that you don’t necessarily need to start from scratch. A well-structured small business purchase agreement template can be a lifesaver, providing a solid foundation that you can customize to fit your specific situation.

This article will walk you through the essentials of a small business purchase agreement, explaining what key elements should be included and why they’re so important. We’ll also explore how using a small business purchase agreement template can simplify the process and help you avoid common pitfalls. So, whether you’re a seasoned entrepreneur or a first-time business owner, read on to gain valuable insights into navigating this crucial step in the world of buying and selling businesses.

Understanding the Key Components of a Small Business Purchase Agreement

A robust small business purchase agreement is more than just a handshake deal. It’s a comprehensive document that leaves no room for ambiguity. It meticulously details every aspect of the transaction, safeguarding the interests of both parties involved. Let’s break down some of the critical components you’ll typically find in a purchase agreement template.

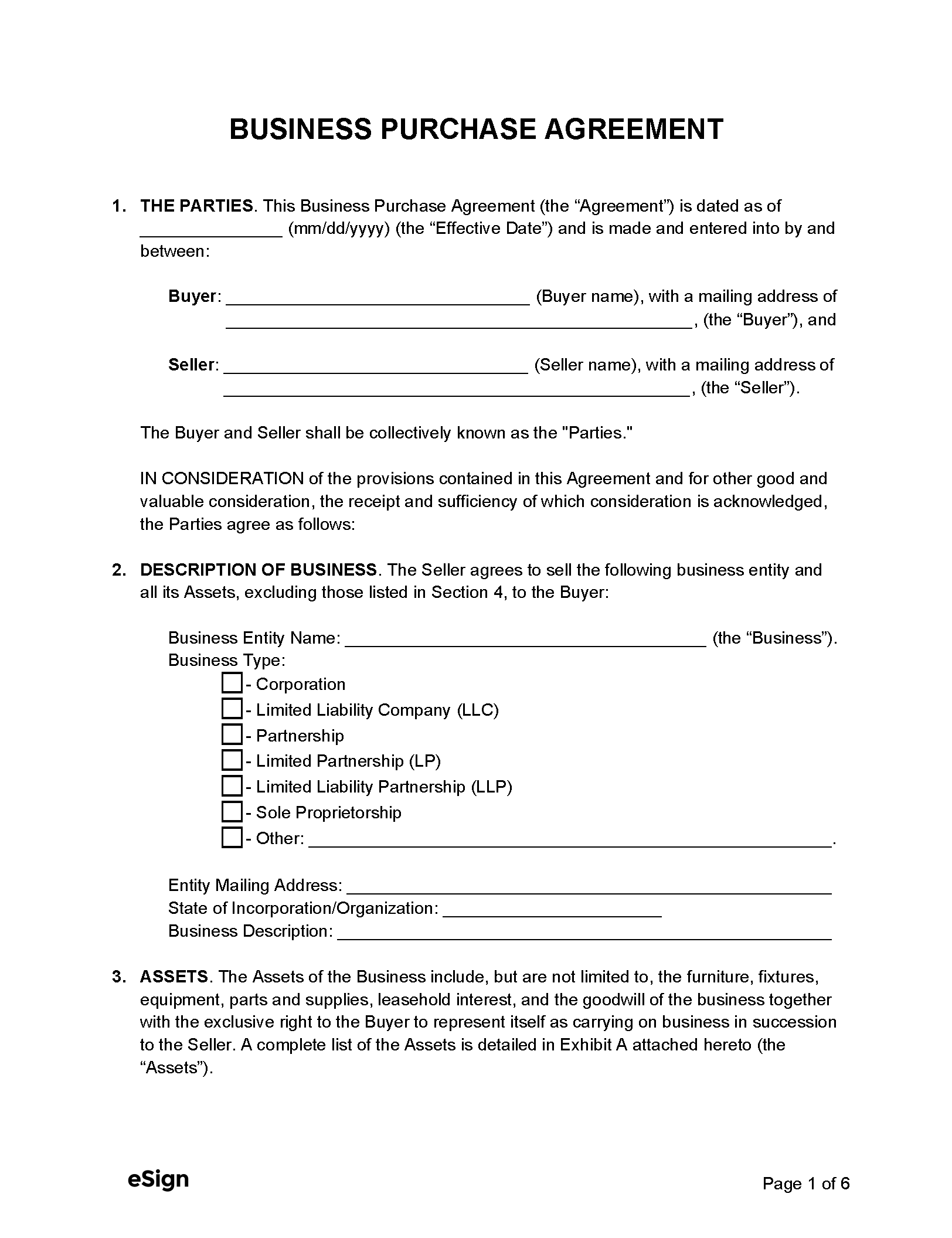

First and foremost, you’ll need clear identification of the parties involved. This means accurately stating the full legal names and addresses of both the buyer and the seller. This seems obvious, but it’s a fundamental step in ensuring the agreement is legally sound. Secondly, a detailed description of the business being sold is essential. This isn’t just the name of the business; it’s a complete inventory of assets, including tangible items like equipment, inventory, and real estate (if applicable), as well as intangible assets like goodwill, customer lists, trademarks, and patents. Specify what is included and, equally important, what is *not* included in the sale.

The purchase price and payment terms are, of course, central to the agreement. Clearly state the total purchase price and how it will be paid. Will it be a lump sum payment, installment payments, or a combination of both? Specify the payment schedule, any interest rates applied to installment payments, and any security or collateral securing the payment obligation. This section should also address escrow arrangements, if applicable, where funds are held by a neutral third party until certain conditions are met.

Representations and warranties are another crucial element. These are statements of fact made by the seller about the business. For example, the seller might warrant that the financial statements are accurate, that the business is in compliance with all applicable laws, and that there are no undisclosed liabilities. These warranties provide the buyer with assurance and recourse if the statements prove to be false. Buyers should carefully scrutinize these representations and warranties and conduct thorough due diligence to verify their accuracy.

Finally, the agreement should address the closing date and procedures. This is the date on which the sale is finalized and ownership transfers to the buyer. The agreement should outline the steps that need to be taken to prepare for closing, such as transferring licenses and permits, notifying customers and suppliers, and executing the final transfer documents. It should also specify the consequences of failing to close the transaction, such as forfeiture of earnest money or other penalties.

Additional Clauses to Consider

Beyond the core elements, consider including clauses that address specific aspects of the business or transaction. For example, a non-compete agreement may prevent the seller from starting a competing business in the same area for a certain period. A confidentiality agreement protects sensitive information about the business from being disclosed to third parties. An indemnification clause allocates responsibility for potential liabilities, such as lawsuits or environmental claims. These clauses can provide added protection and clarity for both the buyer and the seller.

Benefits of Using a Small Business Purchase Agreement Template

Drafting a purchase agreement from scratch can be a daunting task, even for experienced legal professionals. This is where a small business purchase agreement template comes in handy. It offers a pre-structured framework that covers the essential elements of the transaction, saving you time, money, and potential headaches. But the benefits go beyond mere convenience.

One of the primary advantages is cost-effectiveness. Hiring an attorney to draft a complete purchase agreement can be expensive. A template provides a solid starting point that can significantly reduce legal fees. You can review the template, customize it to fit your specific needs, and then have an attorney review the final document to ensure it’s legally sound. This approach strikes a balance between professional guidance and cost savings.

Templates also help ensure thoroughness. They act as a checklist, reminding you of key provisions that should be included in the agreement. This reduces the risk of overlooking important details that could lead to disputes or misunderstandings later on. A well-designed template covers a wide range of potential issues, prompting you to consider aspects you might not have thought of otherwise.

Furthermore, a template can expedite the negotiation process. Having a clear and comprehensive document from the outset facilitates discussions between the buyer and seller. It provides a common ground for negotiations and helps identify potential areas of disagreement early on. This can streamline the process and lead to a faster and more efficient resolution.

Using a small business purchase agreement template also empowers you to understand the intricacies of the transaction. By reviewing and customizing the template, you gain a deeper understanding of the legal and financial implications of the sale. This knowledge can help you make more informed decisions and protect your interests throughout the process. Remember to always have a legal professional review any template you use to ensure it aligns with local laws and your specific circumstances.

Ultimately, the goal of any purchase agreement is to ensure a smooth and fair transfer of ownership. By using a small business purchase agreement template as a foundation, you can significantly increase your chances of achieving that goal. It’s a smart investment that can pay dividends in the form of reduced risk, lower legal fees, and a more efficient transaction.

Navigating the sale or purchase of a small business can feel like a huge undertaking. Remember, thorough preparation and a solid understanding of the legal framework are your best allies. Using a well-crafted small business purchase agreement template is a significant step in the right direction, offering a roadmap to a successful transaction.

Take your time, do your due diligence, and don’t hesitate to seek professional advice when needed. A carefully crafted agreement protects everyone involved and sets the stage for a bright future for the business and its new owner.