So, you’re thinking about selling your small business? Congratulations! That’s a huge step, and it can be incredibly rewarding. But before you pop the champagne, there’s some serious paperwork to tackle. One of the most important documents you’ll need is a small business sale agreement template. Think of it as the roadmap for the entire transaction. It lays out all the details, protecting both you (the seller) and the buyer.

This agreement isn’t just some formality; it’s a legally binding contract. It outlines everything from the assets included in the sale (like equipment, inventory, and customer lists) to the payment terms and closing date. Without a solid agreement, you could find yourself in a messy legal battle down the road. Nobody wants that! Getting it right can mean the difference between a smooth, profitable sale and a stressful, drawn-out ordeal.

Finding the right template can feel a bit daunting, especially if you’re not a legal expert. But don’t worry, we’re here to break it down and make it a little less intimidating. We’ll walk you through what a small business sale agreement template typically includes, why it’s so crucial, and where you can find a reliable one to get you started. So, let’s dive in!

Why You Absolutely Need a Small Business Sale Agreement Template

Let’s face it: selling a business is a big deal. It involves a lot of moving parts, and a simple handshake just won’t cut it. A small business sale agreement template acts as a comprehensive guide, ensuring everyone is on the same page and protecting your interests throughout the entire process. It helps avoid misunderstandings, disputes, and potential legal headaches later on.

Think of it this way: imagine selling your car without a written agreement. What if the buyer claims you promised to include the premium sound system, even though you never discussed it? A similar situation can easily arise when selling a business if the terms aren’t clearly defined in writing. A well-drafted small business sale agreement template leaves no room for ambiguity.

Another critical reason to have a solid agreement is to protect yourself from potential liabilities. The agreement should clearly outline who is responsible for what after the sale. For example, who is responsible for outstanding debts or potential lawsuits related to the business’s past operations? The small business sale agreement template will have clauses to address this.

Furthermore, a solid agreement gives the buyer confidence. It demonstrates that you’re serious about the sale and that you’ve considered all the important details. This can lead to a smoother negotiation process and a more favorable outcome for both parties. When buyers feel secure and informed, they’re more likely to proceed with the purchase. Think of it as building trust through transparency.

Finally, remember that a small business sale agreement template is just a starting point. It’s essential to have a lawyer review the agreement and tailor it to your specific situation. Every business is unique, and the agreement should reflect the particular circumstances of the sale. While a template provides a valuable framework, legal advice ensures that your interests are fully protected.

Key Components of a Small Business Sale Agreement Template

So, what exactly goes into one of these agreements? While specific details will vary depending on the business being sold, several key components are typically included in every small business sale agreement template. Understanding these components will help you navigate the process and ensure that you’re covering all the necessary bases. Let’s take a closer look at some of the essential elements.

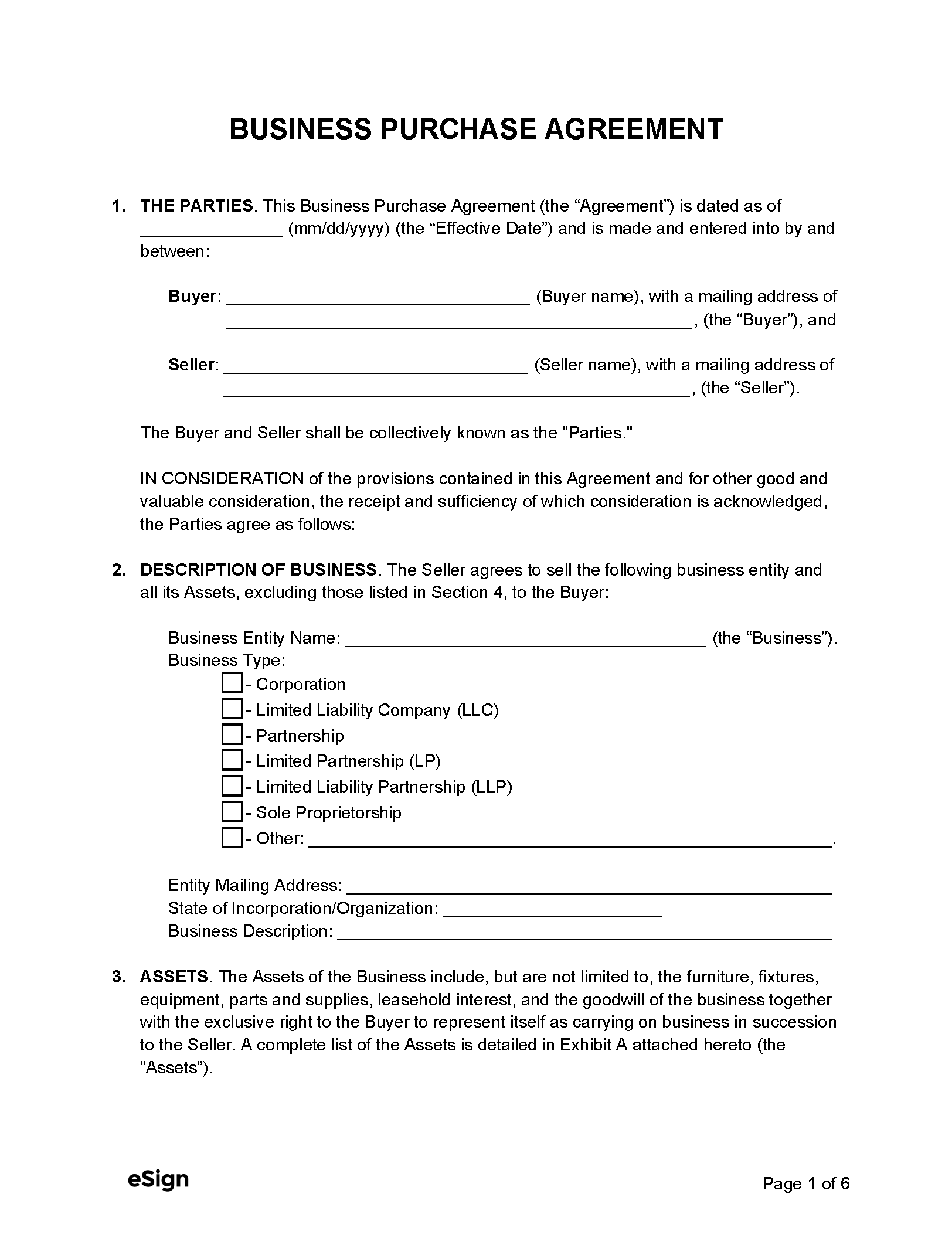

First and foremost, the agreement should clearly identify the parties involved: the seller and the buyer. This includes their full legal names and addresses. This may seem obvious, but it’s crucial for legal clarity. Next, you’ll need a detailed description of the business being sold. This should include the business name, address, and a brief overview of its operations. Specifying exactly what is being sold is paramount.

One of the most important sections outlines the assets being transferred. This can include tangible assets like equipment, inventory, and real estate, as well as intangible assets like goodwill, trademarks, and customer lists. Be as specific as possible in listing these assets to avoid any disputes later on. If the sale includes intellectual property, those details must be recorded as well.

The purchase price and payment terms are, of course, critical components. The agreement should clearly state the total purchase price, the form of payment (cash, financing, etc.), and the schedule for payments. It should also address any contingencies, such as financing falling through or the buyer not meeting certain performance targets. This protects the seller and the buyer.

Finally, the agreement should include clauses addressing warranties, representations, and indemnification. Warranties are promises made by the seller about the business’s condition. Representations are statements of fact about the business’s operations. Indemnification clauses protect the buyer from potential liabilities arising from the seller’s actions. Including all these clauses can ensure the transaction is well structured. These clauses are there to protect both parties should a claim arise after the business has been sold.

The process of selling your business may seem intimidating but it’s also an exciting and rewarding transition. Taking the time to get the agreement right will help you sail through this process.

A solid understanding of the small business sale agreement template, along with competent legal advice, helps you achieve a smooth and profitable sale. This is a vital step in any business sale.