So, you’re selling your small business, or perhaps buying one. Congratulations! This is a huge step, and while it can be exciting, it also comes with a lot of moving parts. One of the most crucial aspects of this process is having a solid sales agreement in place. Think of it as the roadmap that guides both parties through the transaction, ensuring everyone is on the same page and minimizing the risk of misunderstandings or disputes down the line.

Crafting a detailed sales agreement from scratch can feel overwhelming, especially when you’re already juggling so many other tasks. That’s where a small business sales agreement template comes in handy. It provides a pre-structured framework, outlining all the essential elements you need to consider, saving you time and effort. Using a template also helps to ensure you don’t overlook any crucial details that could potentially cause problems later on. It’s like having a checklist to make sure you’ve dotted all the i’s and crossed all the t’s.

But, before you jump into using the first template you find online, it’s important to understand what a sales agreement should include and how to customize it to fit your specific needs. Remember, every business is unique, and a generic template may not cover all the nuances of your particular situation. You’ll need to carefully review the template, adapt it to reflect the specifics of your deal, and consider seeking legal advice to ensure it fully protects your interests.

What Makes a Good Small Business Sales Agreement Template?

A good small business sales agreement template isn’t just a fill-in-the-blanks document; it’s a comprehensive outline covering all the essential aspects of the sale. It should be clear, concise, and easy to understand, leaving no room for ambiguity. Think of it as a well-written story, where each chapter logically follows the previous one, guiding the reader through the entire transaction. Let’s break down the key components that make a template truly effective.

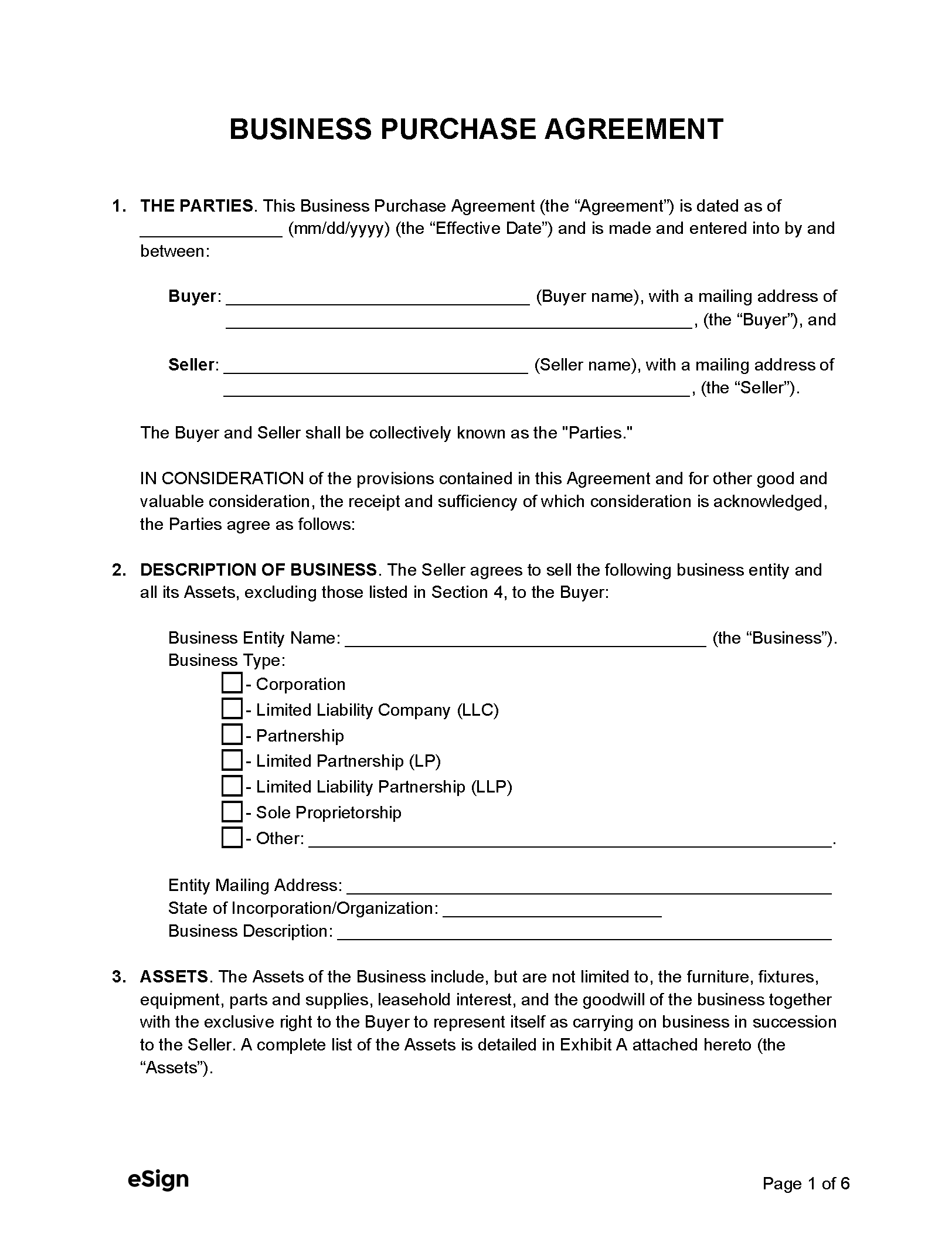

First and foremost, the template must clearly identify the parties involved: the seller and the buyer. This section should include their full legal names and addresses. Don’t just assume everyone knows who’s who; spell it out explicitly. It also needs to provide a detailed description of the business being sold. This includes its name, address, the type of business (e.g., sole proprietorship, LLC, corporation), and a list of all assets included in the sale. Are you selling just the physical assets, or are you also including intellectual property, customer lists, and goodwill? Be specific.

The purchase price and payment terms are obviously critical. The agreement needs to clearly state the total purchase price, the method of payment (e.g., cash, financing), and the payment schedule. Will there be a down payment? When are subsequent payments due? Are there any interest charges? Include a clause that addresses what happens if the buyer fails to make a payment on time. It is very important that the agreed upon payment schedule is followed.

Another important section addresses the transfer of ownership. This section outlines the date when the ownership of the business will officially transfer from the seller to the buyer. It should also specify any conditions that must be met before the transfer can occur. For example, the transfer might be contingent on the buyer obtaining financing or securing necessary permits and licenses. This section also handles the liabilities associated with the business.

Finally, a good template should also include clauses that address things like confidentiality, non-compete agreements, and dispute resolution. A confidentiality clause protects sensitive business information from being disclosed to third parties. A non-compete agreement prevents the seller from starting a competing business in the same area for a specified period. And a dispute resolution clause outlines the process for resolving any disagreements that may arise between the buyer and seller. These clauses help to protect both parties and minimize the risk of future conflicts.

Customizing Your Small Business Sales Agreement Template

While a template provides a solid foundation, it’s essential to customize it to reflect the specific details of your transaction. Remember, a template is just a starting point; it’s not a one-size-fits-all solution. Think of it as a blueprint that you need to adapt to the unique characteristics of your business and the terms of your deal. This is where you can add clauses that are tailored to your specific requirements.

Start by carefully reviewing each section of the template and asking yourself if it accurately reflects the agreement you’ve reached with the other party. Are there any provisions that need to be modified or deleted? Are there any additional clauses that need to be added to address specific concerns? For example, if your business relies heavily on a specific supplier, you might want to include a clause that requires the seller to assist with transitioning the relationship to the buyer.

Consider the assets included in the sale. A generic template might not adequately describe all the assets being transferred. Take the time to create a detailed list of all assets, including tangible items like equipment and inventory, as well as intangible assets like trademarks, patents, and customer lists. The more specific you are, the less room there is for confusion or disagreement later on.

Think about any potential liabilities associated with the business. Are there any outstanding debts, lawsuits, or other legal issues that the buyer needs to be aware of? Make sure these are clearly disclosed in the agreement and that the template specifies who is responsible for handling these liabilities after the sale. You may want to include a section that covers the transition period. How long will the seller stay on to help train the buyer and ensure a smooth handover? What will the seller’s role be during this period? These details should be clearly outlined in the agreement. Securing the transition for the buyer’s knowledge is just as important as the transfer of assets.

And finally, don’t be afraid to seek legal advice. An attorney can review your customized agreement and ensure that it fully protects your interests and complies with all applicable laws. While it might seem like an added expense, it can be a worthwhile investment that saves you time, money, and headaches in the long run. The main goal is to ensure a smooth transfer for both parties.

Going through the process of buying or selling can be daunting, yet with the right resources, you can come out the other side successfully. A small business sales agreement template can give you a running start to the end goal.

With careful planning and the right legal guidance, you will be well on your way to a smooth and legally sound transaction. Good luck!