Starting a business is exciting, and choosing the Limited Liability Company (LLC) structure, especially as a single owner, can offer significant advantages. One crucial document that helps solidify your LLC and its operations is the operating agreement. Think of it as the blueprint for your business, outlining how it will be run and managed. For a sole member LLC, this document might seem less critical than for multi member LLCs, but it’s still a valuable asset that can protect your personal assets and clarify your business structure.

This agreement isn’t just about formalities; it’s about establishing credibility and providing clarity for banks, lenders, and even the IRS. A well-drafted sole member LLC operating agreement can help separate your personal finances from your business finances, a key benefit of forming an LLC in the first place. It also demonstrates that your business is a legitimate entity, managed professionally.

In this article, we’ll explore the importance of a sole member LLC operating agreement template, what it typically includes, and why having one is a smart move, even if you are the only member. We’ll break down the key components and explain how they benefit your business. By the end, you’ll have a good understanding of how this document can strengthen the foundation of your single member LLC.

Why You Need a Sole Member LLC Operating Agreement

You might be thinking, “Why do I need an operating agreement if I’m the only member of my LLC?” That’s a fair question. While many states don’t legally require single member LLCs to have an operating agreement, there are several compelling reasons to create one. Primarily, it reinforces the legal separation between you as an individual and your business. This separation is the very core of the LLC structure. Without a clear operating agreement, it can be more challenging to prove that your business is a distinct legal entity, which could leave your personal assets vulnerable in case of lawsuits or debts.

Secondly, an operating agreement acts as a written record of your business’s structure and procedures. It outlines important aspects like the LLC’s name, address, purpose, and duration. It can also specify how profits and losses will be allocated, even though you are the sole member. This documentation can be especially useful when dealing with banks, lenders, or investors. They often require proof that your business is organized and operates professionally. Having a formal operating agreement demonstrates that you’re serious about your business and have taken the necessary steps to ensure its legitimacy.

Consider also the possibility of future events. While you might be the sole member now, things can change. You might decide to bring in partners, sell the business, or pass it on to your heirs. An operating agreement provides a framework for these transitions. It can outline procedures for adding new members, transferring ownership, or dissolving the LLC. Having these provisions in place from the beginning can save you time, money, and potential headaches down the road.

Furthermore, an operating agreement can address issues that aren’t explicitly covered by state law. For example, you can specify how disputes will be resolved, how decisions will be made, and what happens in the event of your death or disability. This level of detail can provide clarity and prevent misunderstandings, especially in complex situations.

In short, while it might seem like an extra step, creating a sole member LLC operating agreement template is a worthwhile investment that can protect your personal assets, establish credibility, and provide a solid foundation for your business. It’s a proactive measure that shows you’re serious about running a legitimate and well-organized enterprise.

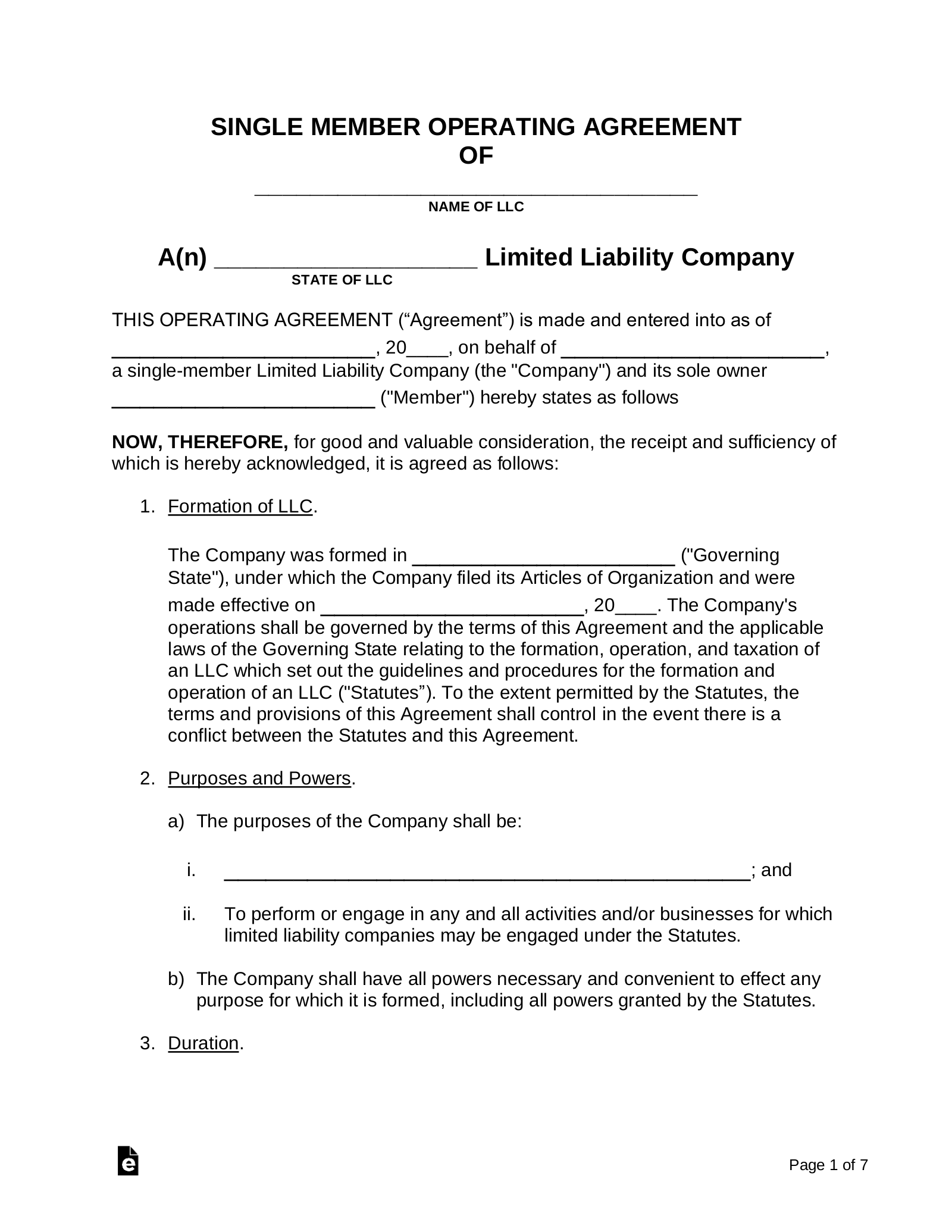

Key Components of a Sole Member LLC Operating Agreement Template

A comprehensive sole member LLC operating agreement template typically includes several key sections that define the structure, operation, and management of your business. Let’s explore these components in detail.

The first section usually covers basic information about your LLC, such as its name, principal place of business (address), registered agent’s name and address, and the LLC’s purpose. The purpose clause can be broad, stating that the LLC’s purpose is to engage in any lawful activity, or it can be more specific, outlining the particular type of business the LLC will conduct. The duration of the LLC is also typically included, which is often perpetual, meaning the LLC will continue to exist indefinitely unless dissolved.

Another crucial section outlines the ownership and membership details. Even though you are the sole member, this section still specifies your name and address as the sole owner of the LLC. It also clarifies that you have complete control over the LLC’s operations and management. This section may also include provisions for future members, outlining the process for adding new members if you ever decide to expand your business.

The operating agreement also addresses financial matters, such as how profits and losses will be allocated, how capital contributions will be made, and how distributions will be handled. In a sole member LLC, profits and losses are typically allocated entirely to the single member. This section also specifies how the member will be compensated for their services to the LLC.

Management and voting rights are another essential aspect covered in the operating agreement. As the sole member, you have full authority to manage the LLC and make all decisions on its behalf. This section clarifies your responsibilities and powers as the sole manager. It may also outline procedures for making decisions, such as holding meetings or keeping records of decisions.

Finally, the operating agreement should include provisions for amendments, dissolution, and governing law. The amendment section specifies how the agreement can be modified in the future. The dissolution section outlines the process for terminating the LLC, including how assets will be distributed and debts will be paid. The governing law section specifies the state whose laws will govern the interpretation and enforcement of the agreement. This is usually the state where the LLC was formed.

Creating a solid sole member LLC operating agreement template isn’t just a formality; it’s a proactive step that protects your interests and ensures your business operates smoothly and professionally. Taking the time to create a comprehensive agreement can save you time, money, and potential legal complications in the future.

Completing this paperwork is an important step when you are ready to operate as a single-member LLC. Creating an LLC is not a difficult process if you follow the steps.

Whether you choose to write your own or customize a sole member LLC operating agreement template, the important thing is to have one. It provides a foundation for your business and clarifies its structure and operations. It might not seem essential at the outset, but it can prove invaluable as your business grows and evolves. It’s an investment in the long term success and stability of your business.