Thinking about taking control of your retirement savings? A Solo 401k can be a powerful tool for self-employed individuals and small business owners with no employees (other than a spouse). It allows for much higher contribution limits than traditional IRAs, offering significant tax advantages and a path to a more secure financial future. But before you start contributing, you need a legally sound foundation: the adoption agreement. Choosing the right adoption agreement template for your Solo 401k is paramount to ensuring compliance and setting your retirement plan up for long-term success. It’s like the blueprint for your retirement savings journey, outlining all the rules and regulations for your plan.

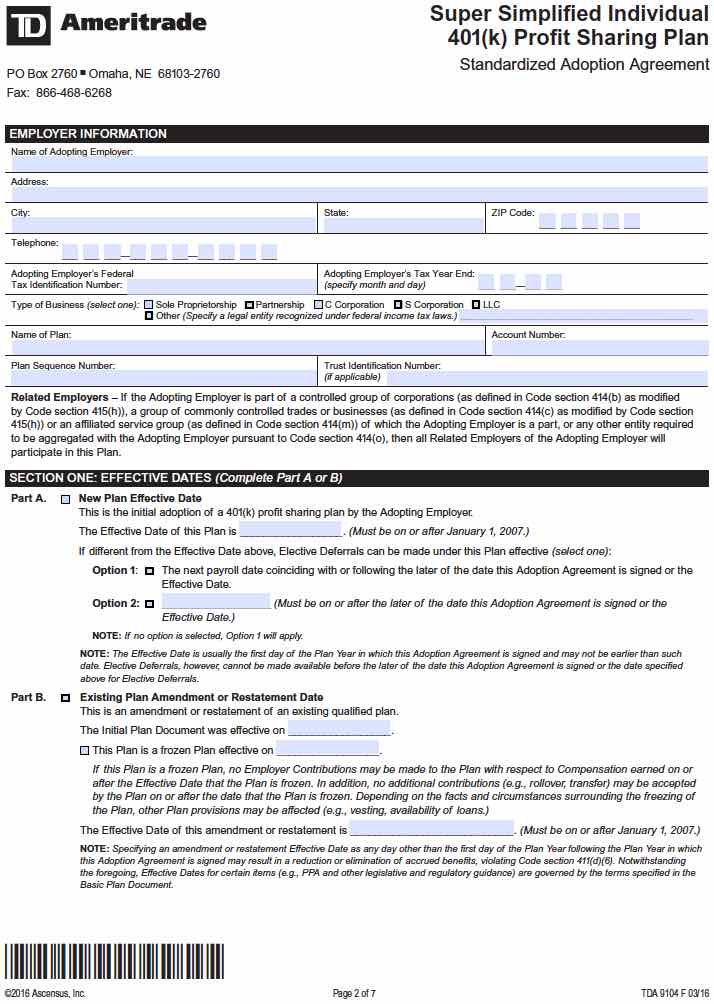

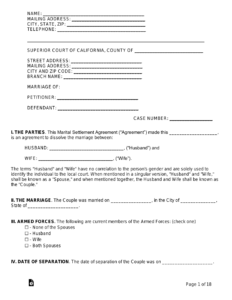

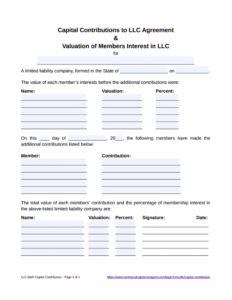

So, what exactly is a Solo 401k adoption agreement template? Simply put, it’s a document that formally establishes your Solo 401k plan. It spells out the terms and conditions of the plan, including contribution limits, eligibility requirements, investment options, distribution rules, and other essential details. Think of it as the official rulebook for how your Solo 401k will operate. It’s crucial to have a well-drafted agreement in place to avoid any potential issues with the IRS down the road.

Navigating the world of retirement plans can feel overwhelming, but it doesn’t have to be. This article will guide you through understanding the significance of the adoption agreement, what key elements it should include, and where to find a reliable solo 401k adoption agreement template to get you started. We’ll break down the complex jargon and provide you with practical insights to confidently establish your own Solo 401k plan. We’ll also talk about the importance of customizing the template to perfectly fit your unique needs and circumstances.

Understanding the Importance of a Solid Solo 401k Adoption Agreement

A Solo 401k adoption agreement isn’t just a formality; it’s the cornerstone of your retirement plan. It’s the document that legally establishes your plan and outlines all its rules and regulations. Without a properly executed agreement, your Solo 401k could be deemed non-compliant by the IRS, leading to penalties and the potential loss of tax advantages. Therefore, understanding its components and ensuring its accuracy are vital for a successful retirement savings strategy.

The adoption agreement serves multiple crucial functions. First and foremost, it documents your intent to establish a Solo 401k plan. It clearly defines the roles of the parties involved – you as both the employer and the employee. It also specifies the plan’s effective date, which is the date your contributions begin. This date is significant for tracking your contributions and ensuring they align with IRS guidelines.

Furthermore, the adoption agreement outlines the contribution limits applicable to your plan. This includes both employee (salary deferral) contributions and employer (profit sharing) contributions. Staying within these limits is crucial for maintaining the plan’s tax-qualified status. The agreement typically references the IRS guidelines for contribution limits, which are updated annually.

Another important aspect of the adoption agreement is its explanation of the plan’s investment options. While you have considerable flexibility in choosing investment vehicles for your Solo 401k, the agreement may outline any restrictions or guidelines regarding investments. It also clarifies how investment gains and losses will be allocated within the plan.

Finally, the adoption agreement addresses distribution rules, specifying when and how you can access your retirement savings. It outlines the conditions under which distributions are permitted, such as retirement, disability, or financial hardship. It also details the tax implications of distributions, ensuring you understand the tax consequences before withdrawing funds. So it’s very important to make sure that you have the right solo 401k adoption agreement template.

Key Elements to Look for in a Solo 401k Adoption Agreement Template

When searching for a Solo 401k adoption agreement template, several key elements should be present to ensure its comprehensiveness and compliance. A high-quality template will cover all the essential aspects of your plan and provide a solid foundation for your retirement savings.

First, the template should clearly identify the plan sponsor, which is you as the business owner. It should also specify the plan’s name and effective date. These details establish the plan’s identity and provide a starting point for all subsequent documentation.

Second, the template should comprehensively address contribution limits. It should outline the maximum employee and employer contributions allowed under IRS regulations, as well as any catch-up contributions for those age 50 and older. It should also explain how contributions are calculated and the deadlines for making them.

Third, the template should include provisions for investment options and account management. It should specify the types of investments permitted under the plan, such as stocks, bonds, mutual funds, and real estate. It should also outline the process for opening and managing accounts, as well as any associated fees.

Fourth, the template should clearly explain the distribution rules and procedures. It should specify the conditions under which distributions are allowed, such as retirement, disability, or financial hardship. It should also outline the tax implications of distributions and the process for requesting and receiving payments.

Finally, the template should include provisions for plan amendments and terminations. It should explain how the plan can be amended to reflect changes in IRS regulations or your personal circumstances. It should also outline the process for terminating the plan and distributing the assets. A well-designed solo 401k adoption agreement template will serve as a valuable resource throughout the life of your plan, helping you navigate the complexities of retirement savings and ensure compliance with all applicable laws and regulations. The template should be up-to-date and easy to understand, allowing you to confidently manage your Solo 401k and achieve your retirement goals.

Choosing a Solo 401k and understanding the adoption agreement process shows a commitment to securing your financial future. A well-structured plan, founded on a solid agreement, allows for greater control over your investments and maximizes the potential for retirement savings growth.

By understanding the key elements of the adoption agreement and taking the time to find a template that suits your needs, you can confidently establish your Solo 401k and embark on a path toward a more secure and comfortable retirement.