So, you’re starting an LLC in South Carolina, huh? Congratulations! That’s a fantastic step toward building your business. Now, you’re probably wondering what all the fuss is about with an operating agreement. Think of it as the instruction manual or the internal rulebook for your LLC. It’s not strictly required by the state of South Carolina for single-member LLCs (though highly recommended!), but it’s absolutely essential for multi-member LLCs and a really smart move regardless of how many members you have.

Why? Because an operating agreement spells out exactly how your LLC will operate, who owns what percentage, how profits and losses are distributed, and what happens if a member leaves or wants to sell their share. Without one, you’re essentially leaving these crucial decisions up to South Carolina state law, which might not align with your specific wishes or the unique needs of your business. In short, using a south carolina operating agreement template gives you control and clarity.

This article is here to guide you through the process of understanding the importance of a South Carolina operating agreement, whether you choose to create one from scratch, customize a template, or seek professional legal assistance. We’ll delve into the key sections, why they matter, and how a well-drafted agreement can protect your business and your personal assets.

Why You Absolutely Need a South Carolina Operating Agreement

Even though South Carolina might not mandate an operating agreement for single-member LLCs, it’s a document that provides numerous benefits. For multi-member LLCs, it’s practically non-negotiable. Think of it as a proactive measure to prevent future disputes and ensure everyone is on the same page. It’s much easier to agree on these things upfront than to try and sort them out when disagreements arise later, especially since those disagreements can be quite costly.

One of the most important reasons to have an operating agreement is to reinforce the separation between your personal assets and your business assets. This separation is what shields you from personal liability for business debts and lawsuits. Without a clearly defined operating agreement, a court might find it harder to recognize your LLC as a separate entity, potentially putting your personal savings, home, and other assets at risk.

Furthermore, an operating agreement provides clarity on key aspects of your business, such as member responsibilities, decision-making processes, and how profits and losses are allocated. Imagine two partners disagreeing on how to handle a significant business opportunity or how to deal with a financial setback. An operating agreement can prevent these situations by pre-defining the procedures for such situations.

The agreement also addresses what happens if a member wants to leave the LLC, becomes disabled, or passes away. It outlines the process for transferring ownership, valuing their share, and ensuring a smooth transition for the remaining members. This proactive planning can prevent significant disruption to the business.

Finally, a south carolina operating agreement template allows for flexibility and customization. You can tailor the agreement to the specific needs and goals of your LLC, rather than being bound by default state laws. This is especially important if your business has unique features or operating structures.

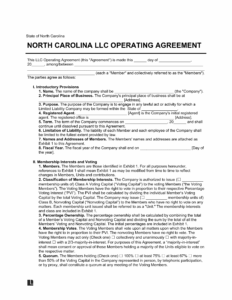

Key Sections of a South Carolina Operating Agreement

While every operating agreement can be customized, there are some fundamental sections that every agreement should include. These sections lay the foundation for how the LLC operates and provides clear guidelines for all involved.

- Company Information: This section includes the name of the LLC, its principal place of business, registered agent information, and the date the agreement was created.

- Member Information: This section lists the names and addresses of all members, their contributions to the LLC (financial or otherwise), and their percentage of ownership.

- Management Structure: This specifies whether the LLC is member-managed (members directly manage the business) or manager-managed (one or more managers are appointed to run the business).

- Profit and Loss Allocation: This details how profits and losses will be distributed among the members. It can be based on ownership percentage, contributions, or another agreed-upon method.

- Decision-Making Process: This outlines how decisions will be made within the LLC, including voting rights and required majorities for certain decisions.

- Transfer of Ownership: This specifies the process for transferring ownership shares, including any restrictions or requirements.

- Dissolution: This outlines the circumstances under which the LLC can be dissolved and the procedures for winding up the business.

Finding and Using a South Carolina Operating Agreement Template

Now that you understand the importance of an operating agreement, you’re probably wondering where to find one. Fortunately, there are several resources available. One option is to search online for a “south carolina operating agreement template.” You’ll find numerous websites offering free or paid templates. Be cautious when using free templates, as they may not be state-specific or comprehensive enough for your needs. Always review them carefully and consider having an attorney review them as well.

Another option is to use a legal document service. These services offer customized operating agreements based on your specific business needs. They typically guide you through a questionnaire to gather the necessary information and then generate a document tailored to your situation. These services often offer more support and guidance than simple templates.

If you’re concerned about the complexity of creating an operating agreement, it’s always a good idea to consult with an attorney specializing in business law. They can help you understand the legal implications of each section and ensure that your agreement complies with South Carolina law. While this is the most expensive option, it provides the greatest peace of mind.

When using a template, be sure to carefully review and customize it to fit your LLC’s specific circumstances. Don’t just fill in the blanks blindly. Pay close attention to sections like profit and loss allocation, decision-making processes, and transfer of ownership, as these are often the most contentious areas. Tailoring the agreement to your unique business needs is crucial for it to be truly effective.

Remember, an operating agreement is a living document. As your business evolves, you may need to amend it to reflect changes in ownership, management structure, or other key aspects of your operation. It’s a good practice to review your operating agreement periodically, especially when significant changes occur within the LLC.

It’s clear that putting in the time and effort to create a solid operating agreement is well worth it. This document will shape the framework for your company.

Ultimately, a well-drafted operating agreement can provide clarity, protect your personal assets, and prevent disputes among members, setting your South Carolina LLC up for success.