So, you’re lending money to someone or borrowing it yourself? That’s a big step, and it’s always a good idea to have everything down in writing. A verbal agreement might work between close friends or family, but when larger sums are involved, or even just to protect a relationship, a written agreement is essential. That’s where a standard personal loan agreement template comes in handy. It’s like a safety net, clearly outlining the terms and conditions for both the lender and the borrower, helping to avoid misunderstandings and potential conflicts down the road.

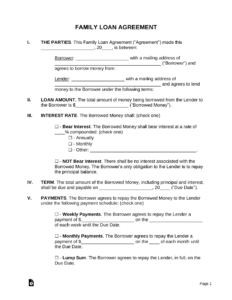

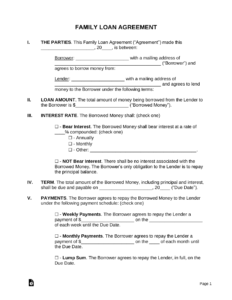

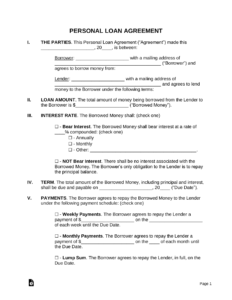

Think of it as creating a roadmap for the loan. The template will guide you through important details such as the loan amount, interest rate (if any), repayment schedule, and what happens if payments are late. Filling out a standard personal loan agreement template might seem a bit daunting at first, especially if you’re not familiar with legal jargon, but don’t worry, it’s usually quite straightforward. Many online templates are designed to be user-friendly and easy to understand, even for those with limited legal knowledge.

Using a standard personal loan agreement template can save you time and money compared to hiring a lawyer to draft a custom agreement from scratch. While legal counsel is always a good idea for complex situations, a template offers a solid starting point for most personal loan scenarios. Plus, having everything in writing gives both parties peace of mind, knowing that everyone is on the same page and that there’s a clear understanding of the terms involved. Let’s dive into what makes a good template and how to use it effectively.

What to Look For in a Standard Personal Loan Agreement Template

Not all personal loan agreement templates are created equal. Some are more comprehensive than others, and it’s important to choose one that fits your specific needs. A good template should cover all the essential elements of a loan agreement and be clear, concise, and easy to understand. Look for a template that allows you to customize it to reflect the specific details of your loan arrangement.

One of the first things to check is whether the template includes sections for the following key information: the full legal names and addresses of both the lender and the borrower, the principal loan amount (the actual amount of money being loaned), the interest rate (if any), the repayment schedule (including the frequency and amount of payments), the date of the first payment, and any late payment penalties. Without these basic elements, the agreement is incomplete and potentially unenforceable.

Beyond the basics, consider whether the template addresses issues like default. What constitutes a default on the loan? What are the lender’s options if the borrower fails to make payments as agreed? A well-drafted template will clearly outline the consequences of default, such as the lender’s right to demand immediate repayment of the entire loan balance or to pursue legal action.

Another important consideration is whether the template includes a section for security or collateral. If the loan is secured by an asset (like a car or a piece of jewelry), the template should clearly describe the asset and specify the lender’s rights in case of default. A secured loan offers the lender more protection, as they can seize and sell the collateral to recover their losses.

Finally, ensure the template has a section for governing law. This specifies which state’s or jurisdiction’s laws will govern the interpretation and enforcement of the agreement. This is particularly important if the lender and borrower reside in different states or countries. Selecting a governing law helps ensure that any disputes are resolved in a consistent and predictable manner. Finding the right standard personal loan agreement template will help make the whole process much smoother.

How to Effectively Use a Personal Loan Agreement Template

Once you’ve found a suitable standard personal loan agreement template, the next step is to fill it out accurately and completely. Don’t rush through the process or leave any blanks. Pay close attention to the instructions and ensure that all information is correct and consistent. Inaccurate or incomplete information can create ambiguity and lead to disputes later on.

Before filling it out, both the lender and the borrower should carefully review the entire template and discuss any questions or concerns they may have. It’s important to be on the same page about all the terms and conditions before signing the agreement. If there are any disagreements or areas of confusion, it’s best to address them upfront rather than hoping they will resolve themselves later.

When entering the loan amount, be precise. Don’t round up or down. Specify the exact amount of money being loaned. Similarly, when setting the interest rate, be clear about whether it’s a fixed rate or a variable rate. If it’s a variable rate, explain how it will be calculated and how often it will be adjusted. This transparency is key to avoiding misunderstandings.

The repayment schedule is another critical aspect of the agreement. Clearly specify the frequency of payments (e.g., weekly, bi-weekly, monthly), the amount of each payment, and the date on which each payment is due. Consider including a provision for early repayment, allowing the borrower to pay off the loan ahead of schedule without penalty. This can be a win-win for both parties.

After completing the template, both the lender and the borrower should sign and date the agreement in the presence of a witness. The witness should also sign and date the agreement, attesting that they observed both parties signing it voluntarily. Having a witness provides additional evidence of the agreement’s authenticity and can be helpful in case of a dispute. Keep a copy of the signed agreement for your records. Securely store the document so that both parties can easily access it if needed. Properly using the template leads to a strong agreement.

Ultimately, a standard personal loan agreement template serves as a foundation for a transparent and mutually beneficial lending relationship. It’s a document that promotes clarity, understanding, and accountability for both the lender and the borrower involved.

By taking the time to carefully consider the terms of the loan and document them in writing, you can minimize the risk of misunderstandings and disputes, and foster a healthy and respectful financial arrangement. Remember, a well-crafted agreement is an investment in peace of mind.