So, you’re thinking about boosting your retirement savings? That’s fantastic! One of the smartest ways to do that is through a salary sacrifice arrangement with your employer. It sounds complicated, but trust me, it’s not. Basically, you agree to have a portion of your pre-tax salary contributed directly into your superannuation fund. This can be a win-win, potentially reducing your taxable income while simultaneously fattening up your retirement nest egg. And to formalize this arrangement, you’ll need a superannuation salary sacrifice agreement template.

The beauty of salary sacrificing is that it’s tax-effective. Because the money goes into your super fund before tax is calculated, you’re essentially reducing your overall tax liability. It’s like getting a discount on your future retirement! Of course, it’s always wise to get personalized financial advice to make sure it aligns perfectly with your individual circumstances. Everyone’s financial situation is unique, and a professional can help you navigate the ins and outs of salary sacrificing to make the most informed decision.

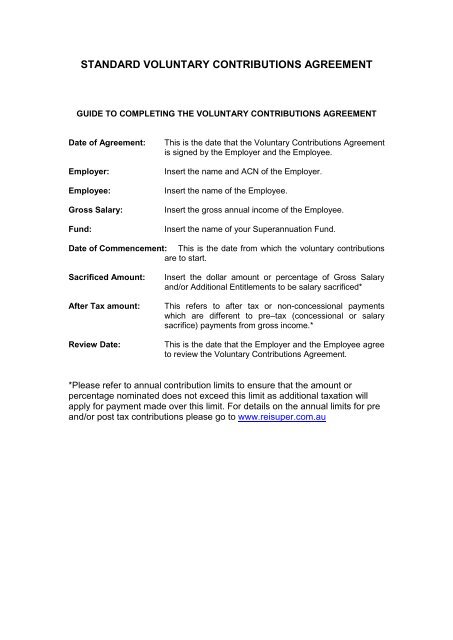

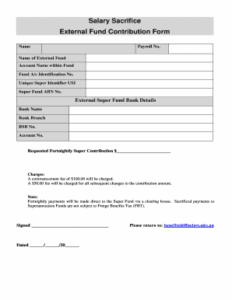

But where do you start? Well, that’s where the superannuation salary sacrifice agreement template comes in handy. This document outlines the terms of the agreement between you and your employer, specifying how much you want to contribute, how often, and other important details. Let’s delve deeper into what this agreement entails and how you can make the most of it. Finding the right template is important, as it sets the foundation for a smooth and compliant arrangement.

Understanding the Superannuation Salary Sacrifice Agreement

A superannuation salary sacrifice agreement is a legally binding document that outlines the terms of your salary sacrifice arrangement. Think of it as a contract between you and your employer. It clarifies exactly how much of your pre-tax salary will be directed into your superannuation fund. This agreement is crucial for ensuring both parties are on the same page and that the arrangement is implemented correctly, complying with all relevant regulations.

The agreement typically includes several key components. First and foremost, it will state the agreed-upon salary sacrifice amount – whether it’s a fixed dollar amount per pay period or a percentage of your salary. It also specifies the superannuation fund the contributions will be directed to. Make sure the details are accurate! The agreement will also outline the start date of the arrangement and how it can be amended or terminated. It’s important to review the terms carefully to ensure they reflect your intentions and are in line with your financial goals.

It’s also worth understanding how salary sacrifice interacts with other aspects of your employment, such as your superannuation guarantee. Employers are legally required to contribute a certain percentage of your salary (currently 11% as of July 2023) to your super fund, known as the superannuation guarantee. Salary sacrifice contributions are in addition to this. Understanding the interplay of these contributions helps you plan your financial future more effectively. Always keep track of your contributions and regularly check your superannuation balance.

Before signing anything, take the time to research and understand the implications of salary sacrificing. While it’s generally tax-effective, it might affect other entitlements or benefits you receive from your employer, such as workers’ compensation or income protection insurance. Consult with a financial advisor or your employer’s HR department to get a comprehensive understanding of how it will impact your specific situation.

Remember, a well-crafted and understood superannuation salary sacrifice agreement is the cornerstone of a successful salary sacrifice strategy. By taking the time to review the details, seek professional advice when needed, and stay informed about the relevant regulations, you can maximize the benefits of this powerful retirement savings tool and use the right superannuation salary sacrifice agreement template.

Key Considerations When Using a Template

While a superannuation salary sacrifice agreement template provides a solid starting point, it’s essential to customize it to fit your specific needs and circumstances. Templates are general in nature, so it’s crucial to tailor the document to accurately reflect the agreement between you and your employer. Don’t just blindly fill in the blanks; take the time to thoroughly review and modify each section.

One of the first things to consider is the accuracy of the information. Double-check all the details, including your name, your employer’s name, your superannuation fund details, and the agreed-upon salary sacrifice amount. Even a small error could lead to complications down the line. Make sure the start date is clearly stated and that the method for calculating the salary sacrifice amount is unambiguous.

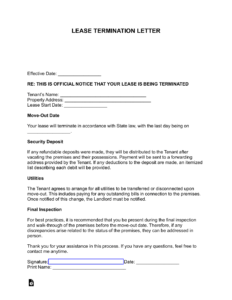

Also, pay attention to the termination clause. The agreement should clearly outline the process for terminating the salary sacrifice arrangement. What happens if you change jobs or want to adjust the contribution amount? Understanding these details upfront will help you avoid potential headaches in the future. The termination clause should be fair to both you and your employer.

It’s also a good idea to seek legal or financial advice before finalizing the agreement, especially if you have any doubts or concerns. A professional can review the document and ensure it complies with all relevant laws and regulations. They can also help you understand the potential tax implications of salary sacrificing and how it might affect your overall financial situation.

Finally, remember that a template is just a tool. The real value comes from understanding the underlying principles of salary sacrificing and tailoring the agreement to meet your individual needs. By taking the time to research, customize, and seek professional advice, you can create a solid and effective superannuation salary sacrifice agreement that helps you achieve your retirement savings goals.

It’s a powerful tool for building wealth for the future. It provides a structured way to boost your superannuation savings while potentially reducing your taxable income. However, it’s crucial to approach this strategy with careful planning and informed decision-making.

By understanding the key components of a superannuation salary sacrifice agreement template, customizing it to your specific needs, and seeking professional advice when needed, you can make the most of this opportunity to secure a comfortable retirement.