Starting a Limited Liability Company (LLC) in Texas is an exciting step for any entrepreneur. You’ve got your business idea, you’re ready to put in the work, and you’re probably buzzing with anticipation. But before you dive headfirst into the market, there’s a crucial document you need to have in place: an operating agreement. Think of it as the constitution for your LLC, laying out the rules and guidelines for how your business will run. This is where a Texas LLC operating agreement template comes into play, providing a solid foundation for your company’s success.

Why is an operating agreement so important? Well, imagine trying to play a game without knowing the rules. That’s essentially what it’s like running an LLC without a clearly defined operating agreement. It helps prevent disagreements between members, clarifies roles and responsibilities, and provides a roadmap for how the business will handle important decisions, like profit distribution or what happens if a member decides to leave. It offers legal protection and helps you maintain the limited liability status that makes an LLC so attractive in the first place.

Navigating the legal landscape of business formation can feel overwhelming. That’s where a good Texas LLC operating agreement template becomes your best friend. It offers a structured framework to ensure you cover all the essential aspects of your LLC. While it’s not a substitute for legal advice, it’s a fantastic starting point, saving you time and potentially money. Using a template allows you to customize it to fit your specific needs, ensuring your business operates smoothly and efficiently right from the beginning.

What Should Be Included in Your Texas LLC Operating Agreement

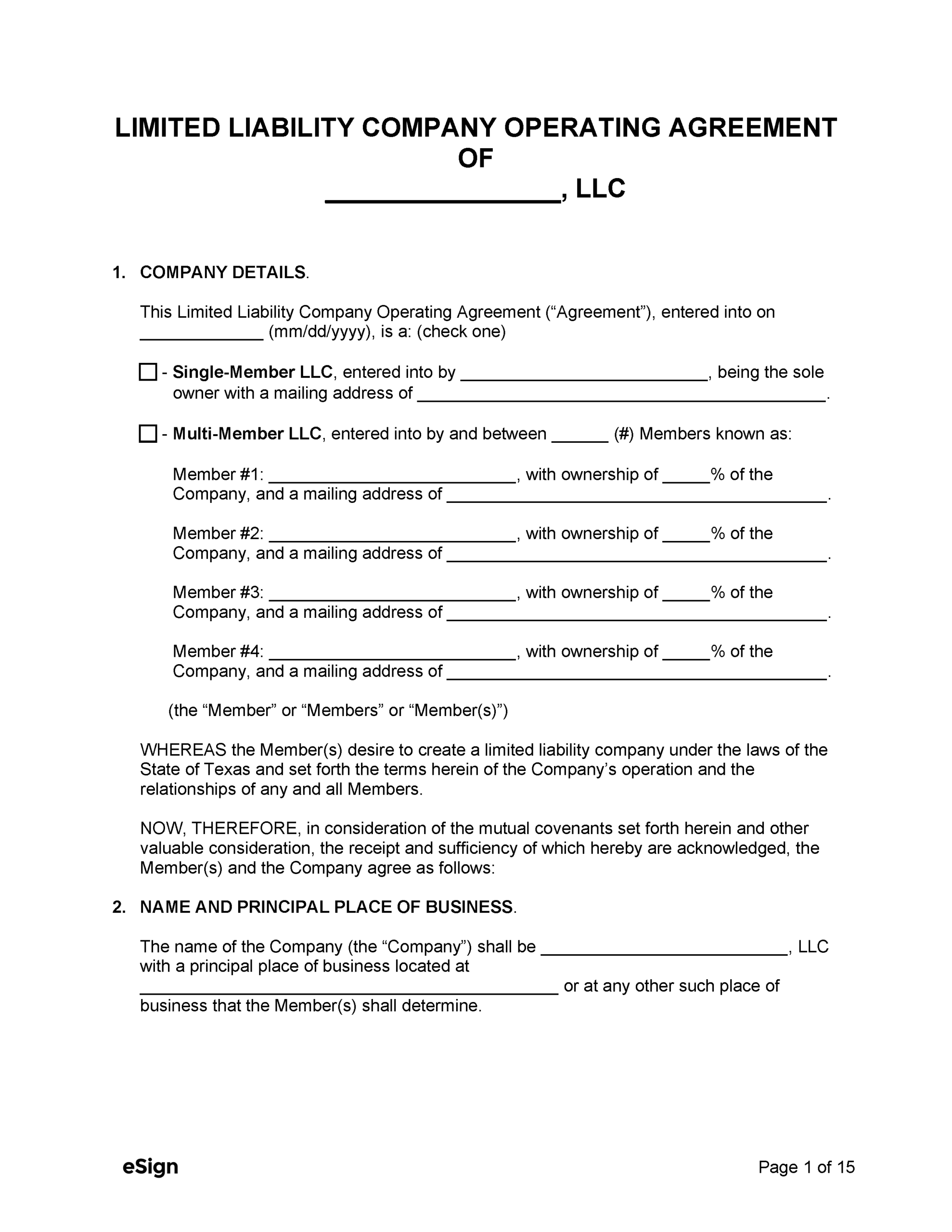

Creating a comprehensive operating agreement might seem daunting, but it’s actually quite straightforward when you break it down. The key is to be thorough and tailor the document to reflect the specific needs and dynamics of your business. A good Texas LLC operating agreement template will typically include several key sections, each addressing a critical aspect of your LLC’s operation.

First and foremost, your operating agreement should clearly identify the members of the LLC. This includes their names, addresses, and the percentage of ownership each member holds. It’s also important to specify each member’s rights and responsibilities within the company. This section outlines who is responsible for what, preventing confusion and potential conflicts down the line. Defining the management structure, whether member-managed or manager-managed, is equally crucial. This dictates who has the authority to make day-to-day decisions for the business.

Another essential element is the capital contribution section. This outlines how much each member initially invested in the LLC. It should also specify how additional capital contributions will be handled if the business requires more funding in the future. How profits and losses are allocated is another critical component. This section needs to clearly state how the net income and expenses of the business will be distributed among the members. Will it be based on ownership percentage, or will there be a different arrangement? Clarity here can prevent significant disputes later on.

The agreement should also detail the procedures for holding meetings and making decisions. What constitutes a quorum? How are votes counted? How are major decisions, such as selling the business or taking on significant debt, made? Having these processes clearly defined ensures that the LLC operates democratically and fairly. Furthermore, the operating agreement must address the process for admitting new members or allowing existing members to transfer their ownership interest. This section will outline any restrictions on transferring ownership and any approval processes that are required. It will prevent unwanted complications as the business evolves.

Finally, your Texas LLC operating agreement template must include a section on dissolution, outlining the process for winding up the affairs of the LLC in the event that it ceases to operate. This section should cover the distribution of assets, payment of debts, and other necessary steps for closing the business properly. Having a plan in place for the end of the business, even though it might seem far off, demonstrates responsible planning and protects all the members involved.

Why You Absolutely Need an Operating Agreement

While Texas does not legally require LLCs to have an operating agreement, skipping this crucial step is a mistake. Think of it as insurance for your business. While you hope you never need it, it’s invaluable when problems arise. An operating agreement offers legal protection, clarity, and a framework for resolving disputes, all of which contribute to the long-term success and stability of your LLC.

One of the most significant benefits of having an operating agreement is that it helps maintain your LLC’s limited liability status. This means that your personal assets are protected from business debts and lawsuits. Without a clear operating agreement, it becomes easier for creditors or plaintiffs to argue that your business is not truly separate from you personally, potentially jeopardizing your personal savings, home, and other assets. In other words, the operating agreement reinforces the distinction between you and your business entity.

An operating agreement also minimizes the risk of disputes between members. Businesses, like any relationship, can face disagreements. Having a written agreement that clearly outlines the rights, responsibilities, and obligations of each member provides a framework for resolving conflicts fairly and efficiently. It can prevent costly legal battles and preserve valuable business relationships. Furthermore, it eliminates ambiguity regarding decision-making processes, profit distribution, and other crucial operational aspects. This creates a clear path forward during challenging situations.

Beyond preventing disputes, an operating agreement provides operational clarity. It serves as a central reference document for all members, ensuring everyone understands how the business is run, how decisions are made, and what their individual roles are. This transparency promotes trust and accountability, creating a more positive and productive work environment. An operating agreement ensures that everyone is on the same page and working towards the same goals. This saves time, reduces confusion, and ultimately strengthens the business.

Finally, having a solid operating agreement demonstrates professionalism and credibility to potential investors, lenders, and partners. It shows that you’ve taken the time to carefully plan and structure your business, which inspires confidence in your ability to manage the company effectively. Securing funding or forming strategic alliances becomes easier when you can present a well-defined operating agreement. This demonstrates to others that you are serious about your business and are prepared for the challenges ahead.

In the world of Texas LLCs, a well crafted operating agreement serves as both a shield and a roadmap. It safeguards personal assets, clarifies roles, and lays the groundwork for success.

Taking the time to create a comprehensive and customized operating agreement, whether using a Texas LLC operating agreement template or consulting with an attorney, is one of the best investments you can make in the future of your business.