Ever felt like managing payments is a bit like juggling flaming torches? It can get complicated, especially when you involve someone else handling the money. Whether you’re a business outsourcing payment processing or an individual entrusting someone to manage your funds, a clear agreement is crucial. That’s where a third party payment agreement template comes in handy. It’s your safety net, ensuring everyone’s on the same page and protecting your interests.

Think of a third party payment agreement template as a rule book for how funds are handled. It spells out the responsibilities of each party involved – the payer, the payee, and the third party handling the transaction. This includes everything from how payments are collected and processed to what happens if something goes wrong. Without a solid agreement, misunderstandings can quickly escalate into costly disputes, so having a well-defined framework is incredibly important.

This document isn’t just legal jargon; it’s a roadmap for a smooth financial relationship. By clearly outlining the terms and conditions, you can minimize the risk of errors, fraud, and other issues. Plus, a third party payment agreement template provides a valuable reference point if any questions or disagreements arise down the line. It’s about establishing trust and transparency from the outset, building a solid foundation for successful financial dealings.

Why You Need a Third Party Payment Agreement

Navigating the world of finance can feel like traversing a minefield without a map. When you involve a third party in payment processing, the complexities multiply. This is where a third party payment agreement becomes absolutely essential. It’s more than just a piece of paper; it’s a shield against potential pitfalls and a compass guiding you through the financial landscape. Without it, you’re essentially operating without a safety net, leaving yourself vulnerable to various risks.

Consider the perspective of a business owner outsourcing payment processing to a third-party company. You need assurance that your customers’ data is secure, that transactions are handled efficiently, and that funds are deposited into your account accurately and on time. The third party payment agreement should clearly define these responsibilities, including data security protocols, transaction processing procedures, and dispute resolution mechanisms. This level of detail ensures that both parties understand their obligations and are held accountable for their actions.

Furthermore, the agreement should address potential scenarios like transaction errors, fraud, or service interruptions. What happens if a payment is processed incorrectly? Who is responsible for covering the losses if fraud occurs? What recourse do you have if the third party’s services are disrupted? These are critical questions that the agreement should answer, providing a clear path forward in the event of unforeseen circumstances.

Think about the peace of mind that comes with knowing your financial interests are protected. With a robust third party payment agreement in place, you can focus on growing your business or managing your personal finances without constantly worrying about potential risks. It’s an investment in security and stability, allowing you to operate with confidence and minimize the likelihood of costly disputes.

Ultimately, a third party payment agreement template is about establishing trust and clarity in financial relationships. It’s a tool that empowers you to protect your interests, manage risks effectively, and foster a more secure and transparent financial environment. Ignoring the importance of such an agreement can have significant consequences, so taking the time to draft a comprehensive and well-defined document is an essential step for anyone involved in third-party payment processing.

Key Elements of a Comprehensive Agreement

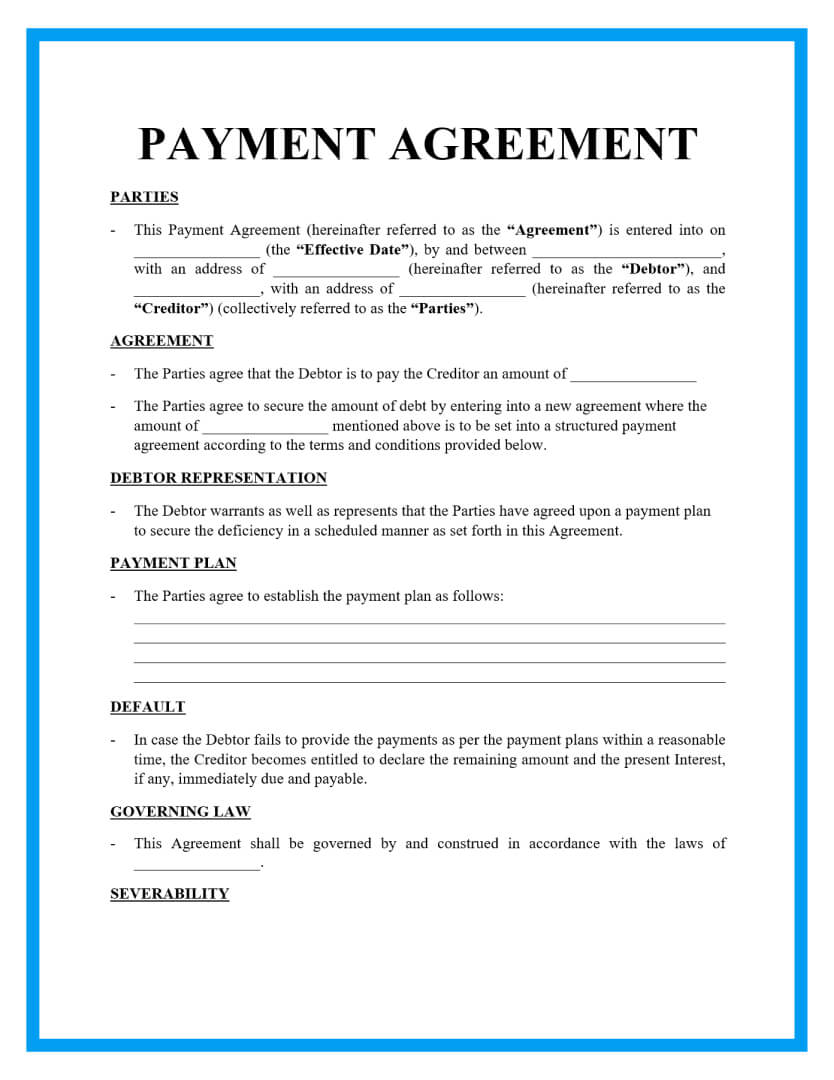

Creating a watertight third party payment agreement requires careful consideration of several key elements. It’s not just about filling in blanks; it’s about crafting a document that accurately reflects the specific terms and conditions of your arrangement. A well-structured agreement will leave no room for ambiguity, ensuring that all parties involved are crystal clear about their rights and responsibilities. From identifying the parties involved to defining payment schedules and outlining dispute resolution mechanisms, each section plays a crucial role in safeguarding your interests.

The agreement should begin by clearly identifying all parties involved – the payer, the payee, and the third-party payment processor. Include their full legal names, addresses, and contact information to avoid any confusion. Next, the agreement should precisely define the scope of services to be provided by the third party. What types of payments will they process? What are their responsibilities in handling customer data? What security measures will they implement to protect against fraud? The more detail you provide, the better.

Payment terms are another critical component of the agreement. Specify the fees charged by the third party, the payment schedule, and the method of payment. Will the third party receive a percentage of each transaction, a flat fee per transaction, or a monthly retainer? How often will they remit payments to the payee? What happens if there are delays in payment? These are all important considerations that should be addressed in the agreement.

Furthermore, the agreement should address issues of confidentiality and data security. The third party should commit to protecting sensitive customer data and complying with all applicable privacy regulations. The agreement should also outline the circumstances under which the agreement can be terminated, including the process for notifying the other parties and any penalties for early termination.

Finally, include a dispute resolution mechanism to address any disagreements that may arise. Will disputes be resolved through mediation, arbitration, or litigation? By addressing these key elements, you can create a comprehensive third party payment agreement template that provides clarity, protects your interests, and fosters a more secure and transparent financial relationship.

So, taking the time to get it right is crucial. The more detailed and specific you are, the better protected you will be.

Remember, a well-crafted agreement is an investment in peace of mind, allowing you to focus on your core business or personal finances without the constant worry of potential problems.