Ever wondered how businesses secure loans when they don’t have traditional assets like real estate? That’s where the UCC 1 security agreement template comes in handy. It’s a legal document that allows a lender to have a security interest in a borrower’s personal property. Think of it as a safety net for the lender, ensuring they can recover their funds if the borrower defaults on the loan. It’s a critical tool in the world of commercial finance, but understanding the basics can feel a little overwhelming at first.

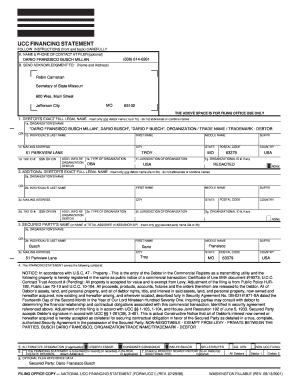

Essentially, a UCC 1 filing is a public notice that a lender has a claim on certain assets of a borrower. It’s recorded with the relevant state agency, usually the Secretary of State’s office, and it puts other potential lenders on notice that the assets are already encumbered. This helps prevent multiple lenders from claiming the same collateral. The UCC 1 security agreement template itself is the document that details exactly what assets are being used as collateral, the terms of the loan, and the rights and responsibilities of both the borrower and the lender.

For business owners seeking financing, and lenders looking to safeguard their investments, knowing the ins and outs of a UCC 1 security agreement template is crucial. It establishes clear parameters and protects everyone involved. In the following sections, we will break down exactly what it is, how it works, and why it is such a pivotal instrument in the business world. It’s like having a detailed map for a financial agreement – ensuring everyone stays on the right path.

Understanding the Nuances of a UCC 1 Security Agreement Template

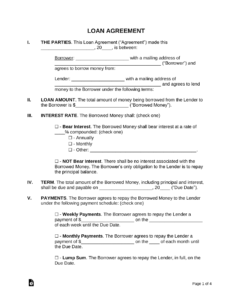

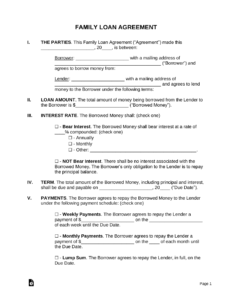

A UCC 1 security agreement template is more than just a piece of paper; it’s a legally binding contract that outlines the terms of a secured transaction. The Uniform Commercial Code (UCC) is a set of laws adopted by most states in the United States to regulate commercial transactions. Article 9 of the UCC specifically deals with secured transactions, and the UCC 1 form is the instrument used to perfect a security interest. In simple terms, “perfecting” means giving public notice of the lender’s claim to the collateral.

The agreement itself specifies the debtor (the borrower), the secured party (the lender), and a detailed description of the collateral. The description of the collateral needs to be specific enough to reasonably identify the assets subject to the security interest. This can include things like inventory, equipment, accounts receivable, and even intellectual property. It is absolutely imperative to ensure accuracy in this section.

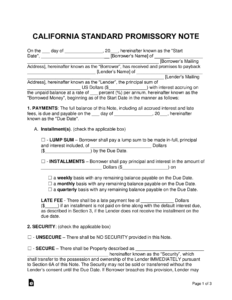

One of the key aspects of a UCC 1 filing is its “priority.” When multiple lenders have claims on the same collateral, the first lender to properly file a UCC 1 usually has priority over subsequent lenders. This is often referred to as the “first-to-file” rule. This priority is crucial because if the borrower defaults, the lender with the highest priority gets paid first from the proceeds of the collateral sale.

The UCC 1 filing isn’t permanent. Typically, it’s effective for five years from the date of filing. After that, the lender needs to file a continuation statement to extend the effectiveness of the filing. Failing to do so means that the security interest lapses and other lenders might be able to claim priority. Keeping on top of filing deadlines is vitally important.

Beyond the filing itself, the ucc 1 security agreement template governs the relationship between borrower and lender. It outlines the events that constitute default, what remedies the lender can pursue in the event of default, and how the collateral will be handled. A well-drafted agreement is explicit and precise, leaving no room for ambiguity and minimizing potential disputes. It’s the bedrock of a strong and reliable secured lending relationship.

Key Considerations When Using a UCC 1 Security Agreement Template

Choosing the right UCC 1 security agreement template is only the first step. Understanding how to use it correctly is equally important. One critical element is identifying the correct legal name and address of the debtor. Any errors in this information can render the filing ineffective. This is because the UCC filing system relies on searches based on the debtor’s name, and an incorrect name will make it difficult or impossible for other lenders to find the filing. Double checking this information with official documents is extremely prudent.

The description of the collateral must also be accurate and sufficiently detailed. While a broad description like “all assets” is sometimes acceptable, it’s generally better to be more specific. For example, if the collateral is equipment, list the type of equipment, manufacturer, and serial numbers. For inventory, specify the types of goods included. The more detail, the less room for confusion or disputes later on.

Another essential consideration is the location where the UCC 1 should be filed. Generally, it’s filed in the state where the debtor is located, which is typically the state of its incorporation or principal place of business. However, there are exceptions to this rule, so it’s important to consult with legal counsel to ensure that the filing is made in the correct jurisdiction. Filing in the wrong location can render the security interest unperfected, leaving the lender vulnerable.

Finally, remember that a ucc 1 security agreement template is a starting point. It’s always advisable to have a qualified attorney review the agreement and tailor it to the specific circumstances of the transaction. Each deal is unique, and standard templates might not adequately address all of the potential risks and issues. Seeking legal guidance can help ensure that the security agreement accurately reflects the parties’ intentions and provides the lender with adequate protection.

Additionally, always keep meticulous records of the UCC 1 filing, including the filing date, filing number, and any continuation statements. These records are crucial for proving the priority of the security interest in the event of a dispute. Remember, a well-executed UCC 1 filing is a powerful tool for securing loans and protecting lenders’ interests, but it requires careful attention to detail and a thorough understanding of the applicable laws.

The intricacies of finance are often overlooked, but a grasp of these elements is indispensable to navigate this world. A UCC 1 filing is a cornerstone of secure transactions.

By properly understanding and utilizing a UCC 1 security agreement template, both lenders and borrowers can establish transparent and legally sound financial arrangements. This will ultimately promote stability and growth in the business landscape.