Need to borrow money from a friend, family member, or even a private lender without putting up any collateral? Then you’re likely looking for an unsecured personal loan agreement template. This handy document outlines the terms and conditions of the loan, protecting both the lender and the borrower. Think of it as a friendly handshake, but with legally binding power. It clearly states how much is being borrowed, the interest rate (if any), the repayment schedule, and what happens if things go sideways. It’s all about ensuring everyone is on the same page and minimizing potential misunderstandings down the road.

Creating a solid unsecured personal loan agreement is crucial, especially when dealing with substantial amounts of money or complex repayment plans. While verbal agreements can sometimes hold up in court, they are notoriously difficult to prove. A written agreement provides clear evidence of the loan terms, leaving little room for ambiguity or disputes. This peace of mind can be priceless, especially when dealing with loved ones. Having everything in black and white protects your relationship as much as it protects your financial interests.

So, where do you start? You might be tempted to just wing it, but that’s generally not a good idea. Luckily, many resources are available to help you create a legally sound agreement. This article will guide you through the key components of an unsecured personal loan agreement template, explaining why each section is important and providing helpful tips for customizing it to your specific needs. By the end, you’ll feel confident in your ability to create a document that protects your interests and promotes a smooth lending experience.

Why Use an Unsecured Personal Loan Agreement?

The primary reason to use an unsecured personal loan agreement is to clearly define the terms of the loan. This might seem obvious, but many informal loans between friends or family members go sour because expectations weren’t properly communicated. An agreement eliminates guesswork and ensures everyone understands their rights and responsibilities. It can prevent hurt feelings, damaged relationships, and even legal battles. A well-drafted agreement serves as a roadmap for the loan, outlining how it will be repaid and what happens if unforeseen circumstances arise.

Without a written agreement, proving the existence of a loan can be extremely challenging. What if the borrower claims the money was a gift? Or what if the lender demands repayment sooner than the borrower expected? These types of disputes can quickly escalate and become costly to resolve. An unsecured personal loan agreement acts as tangible proof of the loan, making it easier to enforce the terms if necessary. It’s like having a safety net in case things don’t go as planned.

Furthermore, a formal agreement can help to clarify tax implications. Depending on the amount of the loan and the interest rate, there may be tax consequences for both the lender and the borrower. Consulting with a tax advisor is always recommended, but having a detailed agreement in place will make the process much smoother. The agreement can serve as documentation for tax purposes, ensuring compliance with relevant laws and regulations.

Beyond the practical benefits, using an unsecured personal loan agreement demonstrates professionalism and respect. It shows that you take the loan seriously and are committed to fulfilling your obligations. This can strengthen the relationship between the lender and the borrower, fostering trust and open communication. It transforms what could be an awkward or uncomfortable situation into a transparent and business-like transaction.

Finally, using a template can save you time and effort. There are numerous templates available online that you can adapt to your specific needs. This eliminates the need to start from scratch, which can be daunting and time-consuming. However, it’s crucial to review the template carefully and ensure that it accurately reflects the terms of your loan. Don’t hesitate to seek legal advice if you have any doubts or concerns.

Key Elements of an Unsecured Personal Loan Agreement

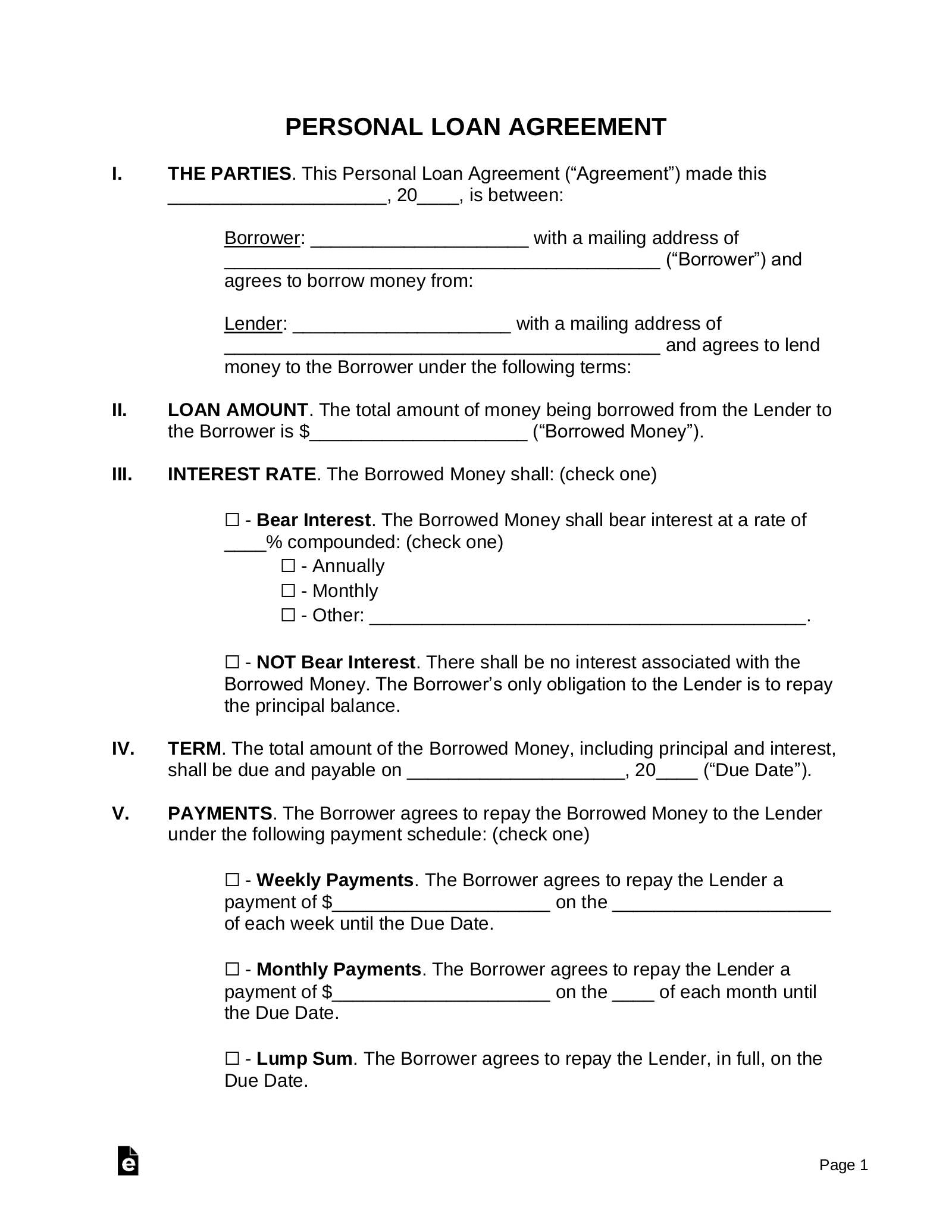

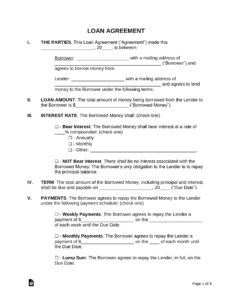

A comprehensive unsecured personal loan agreement should include several key elements to ensure its validity and enforceability. First and foremost, it must clearly identify the parties involved: the lender and the borrower. Include their full legal names and addresses to avoid any confusion. This is a foundational element, as it establishes who is responsible for fulfilling the terms of the agreement.

Next, the agreement should specify the loan amount. This is the principal amount being borrowed and should be stated clearly in both numerical and written form (e.g., 10000 Dollars (Ten Thousand Dollars)). This prevents any ambiguity about the amount owed. Similarly, the agreement needs to detail the interest rate, if any. If interest is being charged, specify the annual percentage rate (APR) and how it will be calculated. If no interest is being charged, state that explicitly.

The repayment schedule is another crucial element. Outline how the loan will be repaid, including the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date for each payment. If there is a balloon payment at the end of the loan term, specify the amount and the due date. A clear repayment schedule helps both the lender and the borrower track progress and avoid late payments.

The agreement should also address what happens in the event of default. Define what constitutes a default (e.g., missing a payment, filing for bankruptcy) and outline the consequences of default. This might include late fees, increased interest rates, or legal action. Having a clear default clause protects the lender’s interests and provides a roadmap for resolving disputes. It also incentivizes the borrower to adhere to the repayment schedule.

Finally, include a section on governing law. This specifies which state’s laws will govern the agreement. This is important because laws vary from state to state, and this clause clarifies which jurisdiction’s laws will be applied in the event of a dispute. Don’t forget to include spaces for both the lender and borrower to sign and date the agreement. These signatures demonstrate that both parties have read and understood the terms of the agreement and agree to be bound by them.

Taking the time to carefully craft an unsecured personal loan agreement, using an unsecured personal loan agreement template as a starting point, is an investment in protecting your financial interests and relationships. It’s a worthwhile effort that can save you headaches and heartache down the road.

Remember, while templates can be helpful, they are not a substitute for legal advice. If you have any concerns about the terms of the agreement or its enforceability, it’s always best to consult with an attorney. They can provide personalized guidance and ensure that the agreement meets your specific needs.