Ever bought a house and found yourself in that weird limbo between closing and actually moving in? Or maybe you sold your place but need a few extra days to pack up your life? That’s where a use and occupancy agreement comes in handy. It’s basically a temporary agreement that allows someone to use a property for a specific period, even though they don’t own it yet, or no longer do.

Think of it as a short-term lease, but with a twist. It’s most commonly used in real estate transactions when there’s a delay in closing or when the buyer needs to move in before the sale is finalized. It outlines the terms of the occupancy, including the rent, duration, and responsibilities of both parties. It can save everyone a lot of headaches when unforeseen circumstances arise.

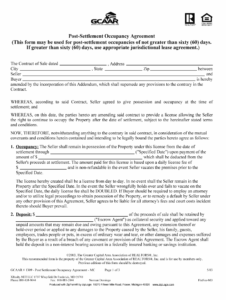

While it sounds simple, it’s important to get the details right. A well-drafted use and occupancy agreement template can protect both the buyer and seller, ensuring a smooth transition during a potentially stressful time. Let’s dive deeper into what these agreements are all about, and how to use one effectively.

Understanding the Nitty-Gritty of Use and Occupancy Agreements

A use and occupancy agreement, often abbreviated as U&O, is a legal contract that grants someone the right to occupy a property for a limited time. This agreement is separate from the purchase agreement or lease agreement. The key difference is its temporary nature and its usual connection to a real estate transaction that’s already in progress or has just concluded. Unlike a typical lease, a U&O doesn’t establish a long-term landlord-tenant relationship.

These agreements typically arise in two main scenarios. First, when a buyer needs to move into a property before the closing date. Maybe their current lease ended, or they need to start a new job in the area. Second, when a seller needs to remain in the property after the closing date. This could be due to difficulties finding a new home or needing extra time to finalize moving arrangements. In both cases, a use and occupancy agreement provides a legal framework for this temporary arrangement.

A well-written use and occupancy agreement template should cover several key aspects. These include the names of the parties involved (buyer and seller, or sometimes landlord and tenant), the address of the property, the duration of the agreement (start and end dates), the amount of rent or occupancy fee, and details about who is responsible for utilities, maintenance, and insurance. It is essential to clearly define these responsibilities to avoid disputes later on.

It’s also crucial to address what happens if the agreement is breached. What are the consequences if the occupant fails to pay the agreed-upon fee or damages the property? What are the procedures for terminating the agreement early? These clauses provide a safety net for both parties in case something goes wrong. Having an attorney review the agreement before signing is always a wise decision.

One often overlooked aspect of a use and occupancy agreement is the insurance coverage. The seller’s insurance may no longer be valid once the buyer takes occupancy. The buyer’s insurance may not fully cover the situation until they officially own the property. Therefore, it’s vital to have clear language outlining who is responsible for maintaining adequate insurance coverage during the occupancy period. Consulting with an insurance professional is highly recommended to ensure everyone is protected.

Key Considerations When Using a Use and Occupancy Agreement Template

Before jumping into using a use and occupancy agreement template, it’s important to understand the potential risks and rewards. For the seller, allowing the buyer to occupy the property before closing carries the risk of the deal falling through. If the sale doesn’t go through, the seller could face legal hurdles in evicting the buyer. For the buyer, moving in before closing means they’re investing time and effort into a property they don’t yet own. If the sale falls apart, they could lose that investment.

The duration of the agreement should be clearly defined and kept as short as possible. The longer the occupancy period, the greater the risk for both parties. It’s best to limit the agreement to only the time absolutely necessary to bridge the gap between closing and moving. This minimizes the potential for complications.

When determining the occupancy fee, consider factors such as the fair market rental value of the property, the costs of utilities, and any potential inconvenience to the owner. The fee should be high enough to compensate the owner for allowing occupancy but reasonable enough to be acceptable to the occupant. It’s also a good idea to include a security deposit to cover potential damages to the property during the occupancy period.

The agreement should explicitly state that the occupant is not a tenant and does not acquire any tenant rights. This is crucial to avoid any confusion or disputes about the nature of the occupancy. The agreement should also include a clause stating that the occupant agrees to vacate the property promptly upon termination of the agreement.

Finally, always consult with a qualified real estate attorney before entering into a use and occupancy agreement. An attorney can review the template, ensure that it complies with local laws, and advise you on any potential risks or concerns. They can also help you tailor the agreement to your specific circumstances and protect your interests. They are invaluable to ensure you understand the implications of the use and occupancy agreement template. Using a lawyer gives you peace of mind throughout the process.

Ultimately, this document can be a useful tool. But like any legal agreement, it’s essential to approach it with caution and due diligence.

It’s about protecting your investment, be it your soon-to-be former home or your dream property. Clear communication and careful planning will help ensure a smooth and successful transition.