Starting a Limited Liability Company (LLC) in Washington State is an exciting step for any entrepreneur. You’re building something new, laying the foundation for your business dreams. But before you get too caught up in the excitement of launching your product or service, it’s crucial to take care of some fundamental legal paperwork. One of the most important documents is your LLC operating agreement. Think of it as the blueprint for how your LLC will run. It’s not just some formality; it’s the backbone that keeps your business organized and protected.

Why is this document so important? Well, even though Washington State doesn’t legally require you to have one, having a well-drafted operating agreement can save you a lot of headaches down the road. It clarifies the roles, responsibilities, and ownership percentages of each member (owner) of the LLC. It also outlines how profits and losses will be distributed, how decisions will be made, and what happens if a member decides to leave or if the LLC needs to be dissolved. Without it, your business could be subject to default state rules, which might not align with your specific business needs or goals.

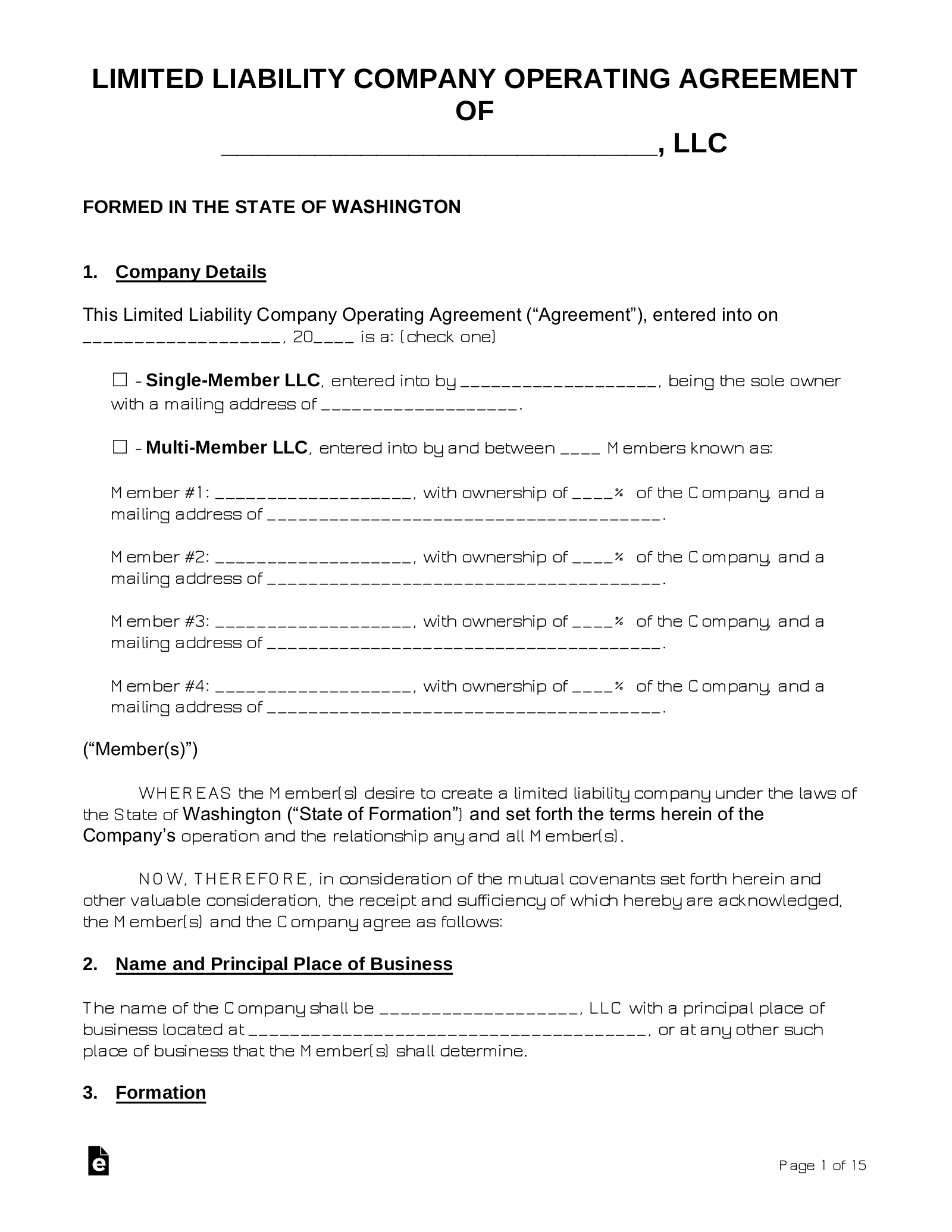

So, where do you start? Many entrepreneurs choose to use a Washington State LLC operating agreement template to get a head start. These templates provide a framework that you can customize to fit your specific business structure and agreements between members. But remember, not all templates are created equal. It’s important to choose a template that is comprehensive, up-to-date with Washington State laws, and easily adaptable to your unique situation. The right template can save you time and legal fees, while also ensuring that your business is properly protected.

Why You Absolutely Need an Operating Agreement for Your Washington LLC

Let’s dive a little deeper into why an operating agreement is so vital for your Washington State LLC. While the state might not mandate it, operating without one is like sailing a ship without a rudder. You might get somewhere, but you’re far more likely to drift off course or run into trouble. The operating agreement clearly defines the internal rules and regulations of your LLC. It covers everything from the day-to-day operations to the big-picture strategic decisions. This clarity minimizes misunderstandings and conflicts among members, which can be detrimental to any business partnership.

One of the most significant benefits of an operating agreement is that it helps to maintain your LLC’s limited liability status. This means that the personal assets of the members are generally protected from business debts and lawsuits. However, this protection can be jeopardized if the LLC is not properly structured and managed. An operating agreement demonstrates that your LLC is a separate legal entity from its members, reinforcing the separation between personal and business liabilities.

Furthermore, an operating agreement provides a framework for resolving disputes. Let’s face it, disagreements are inevitable in any business partnership. A well-written operating agreement outlines the procedures for resolving conflicts, whether through mediation, arbitration, or other methods. This can save you significant time and money in legal fees down the road, not to mention the emotional stress of prolonged disputes.

Consider, too, the flexibility an operating agreement provides. Washington State law has default rules for LLCs, but these might not be ideal for your specific business. The operating agreement allows you to customize the rules to fit your unique needs and circumstances. For example, you can specify how profits and losses will be distributed, how members can transfer their ownership interests, and what happens if a member becomes incapacitated or dies. This level of customization ensures that your LLC operates in a way that aligns with your vision and goals.

Finally, remember that an operating agreement can be a valuable tool for attracting investors or securing loans. Lenders and investors often want to see that your LLC is well-organized and professionally managed. A comprehensive operating agreement demonstrates that you have thought through the key aspects of your business and have a clear plan for its future. It shows that you are serious about your business and are committed to its success.

Essential Elements to Include in Your Washington State LLC Operating Agreement Template

When you’re selecting or creating a Washington State LLC operating agreement template, there are certain essential elements you absolutely must include. These elements form the core of the agreement and ensure that it covers all the necessary aspects of your LLC’s operations. First and foremost, the agreement should clearly identify the name and address of the LLC, as well as the names and addresses of all the members. This establishes the legal identity of the LLC and its owners.

Next, you’ll need to define the purpose of your LLC. This section should clearly state the business activities that your LLC will engage in. While you can be relatively broad in your description, it’s important to be specific enough to avoid any ambiguity. The agreement should also outline the duration of the LLC. Most LLCs are formed for an indefinite period, but you can specify a termination date if desired.

A crucial section of the operating agreement is the allocation of profits and losses. This section specifies how profits and losses will be distributed among the members. In many LLCs, profits and losses are distributed in proportion to each member’s ownership percentage. However, you can customize this to fit your specific agreements. For example, you might allocate profits based on the amount of work each member contributes to the business.

The operating agreement should also address the management structure of the LLC. Will it be member-managed, meaning that the members themselves are responsible for the day-to-day operations? Or will it be manager-managed, meaning that one or more managers are appointed to run the business? This section should clearly define the roles and responsibilities of the members or managers.

Finally, the operating agreement should include provisions for admitting new members, transferring ownership interests, and dissolving the LLC. These provisions outline the procedures that must be followed in these situations. For example, you might require unanimous consent from all members to admit a new member. You might also restrict the transfer of ownership interests to prevent unwanted changes in the LLC’s ownership structure. And the agreement should specify the events that will trigger the dissolution of the LLC, such as the death or bankruptcy of a member.

Crafting a solid operating agreement for your Washington State LLC is a worthwhile investment in your business’s future.

Using a Washington State LLC operating agreement template is a practical starting point, tailoring it is how you protect your long-term business interests.