So, you’re looking to protect your business, huh? Smart move! Running a business is like navigating a wild river, and a business buy sell agreement template is like having a sturdy raft to keep you afloat. It’s a legally binding document that outlines what happens when a co-owner decides to leave the business, retires, passes away, or becomes disabled. Think of it as a prenuptial agreement for business partners, ensuring a smooth transition and preventing potential conflicts down the road.

Without a clear agreement in place, the departure of a partner can create chaos. Imagine trying to figure out how to value their shares, who gets to buy them, and how the payments will be structured, all while dealing with the emotional fallout of their departure. A well-crafted buy sell agreement eliminates the guesswork and provides a clear roadmap for handling these situations. It offers peace of mind, knowing that the future of your business is secure, no matter what life throws your way.

That’s why understanding the ins and outs of a business buy sell agreement template is crucial for any business with multiple owners. It’s not just a piece of paper; it’s a vital tool for ensuring the long-term stability and success of your company. It’s about planning for the future and protecting the interests of all involved. So, let’s dive in and explore what makes these agreements so important and how you can create one that works for your unique business situation.

Understanding the Importance of a Business Buy Sell Agreement

A business buy sell agreement is far more than just a formality; it’s a cornerstone of sound business planning. Its primary function is to dictate what happens to a business when a significant life event impacts one of its owners. This could be anything from retirement and voluntary departure to unexpected situations like death, disability, divorce, or bankruptcy. Without a buy sell agreement in place, these events can trigger complex legal battles, financial instability, and even the dissolution of the business.

Imagine a scenario where one partner unexpectedly passes away. Without a buy sell agreement, their shares might pass to their heirs, who may not have the knowledge, skills, or desire to actively participate in the business. This could lead to disagreements, power struggles, and a decline in the company’s performance. A buy sell agreement can specify who has the right to purchase those shares, how they will be valued, and the terms of the sale, ensuring a smooth transition and preserving the integrity of the business.

Furthermore, a buy sell agreement can protect the remaining owners from being forced to partner with someone they don’t know or trust. It allows them to maintain control over the future direction of the company and prevent unwanted interference from outside parties. By clearly defining the terms of ownership transfer, it fosters a sense of stability and security among the remaining partners, allowing them to focus on running the business effectively.

Another crucial aspect of a buy sell agreement is establishing a fair and consistent valuation method for the departing owner’s shares. This eliminates the potential for disputes and ensures that everyone receives a fair price for their stake in the business. The agreement can specify how the business will be valued, whether through an independent appraisal, a formula-based approach, or a predetermined price. This transparency and predictability can save time, money, and emotional stress during a difficult transition.

In essence, a business buy sell agreement is a proactive measure that anticipates potential challenges and provides a clear framework for resolving them. It safeguards the interests of all stakeholders, protects the continuity of the business, and fosters a sense of trust and security among the owners. It’s a critical investment in the long-term success and stability of any multi-owner business.

Key Components to Include in Your Agreement

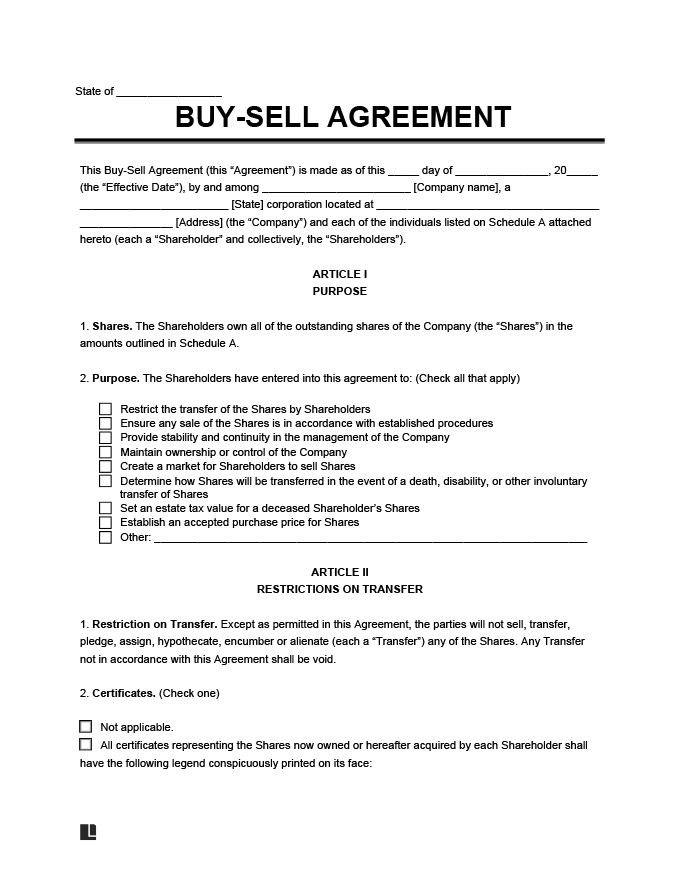

Creating a comprehensive business buy sell agreement involves carefully considering several key components to ensure it effectively addresses the unique needs of your business. One of the most critical aspects is clearly defining the triggering events that will activate the agreement. These events typically include death, disability, retirement, voluntary departure, divorce, bankruptcy, or any other situation that could lead to a change in ownership. The more specific you are in defining these events, the less room there is for ambiguity or dispute.

Another crucial element is the valuation method used to determine the fair market value of the departing owner’s shares. There are several common approaches, including independent appraisal, formula-based valuation, and predetermined price. An independent appraisal involves hiring a professional appraiser to assess the value of the business based on its assets, earnings, and market conditions. A formula-based valuation uses a specific formula, such as a multiple of earnings or revenue, to calculate the value of the shares. A predetermined price sets a fixed value for the shares, which may be adjusted periodically. The choice of valuation method should be carefully considered to ensure it reflects the true value of the business and is fair to all parties involved.

The agreement should also outline the purchase terms, including who has the right to purchase the shares, the payment schedule, and any financing arrangements. Common options include a right of first refusal, where the remaining owners have the first opportunity to purchase the shares, and a mandatory purchase, where the remaining owners are obligated to buy the shares. The payment schedule can be structured as a lump sum payment, installment payments, or a combination of both. The agreement should also address any financing arrangements, such as whether the business will use its own funds, obtain a loan, or use life insurance proceeds to fund the purchase.

Furthermore, the agreement should specify the process for transferring ownership and any related legal procedures. This includes the steps for notifying the other owners of the triggering event, executing the necessary documents, and transferring the shares to the buyer. It’s essential to consult with legal counsel to ensure that the transfer process complies with all applicable laws and regulations. Using a business buy sell agreement template can be a great starting point, but tailoring it to your specific needs with the help of a legal professional is crucial.

Finally, the agreement should include provisions for dispute resolution, such as mediation or arbitration. These provisions can help resolve any disagreements that may arise during the implementation of the agreement, saving time and money compared to traditional litigation. Mediation involves a neutral third party facilitating a discussion between the parties to help them reach a mutually agreeable solution. Arbitration involves a neutral third party hearing evidence and making a binding decision. By including these provisions, you can create a more efficient and cost-effective process for resolving disputes and preserving the business relationship.

Drafting a business buy sell agreement template might seem daunting, but it’s an essential step toward securing your business’s future. By addressing these key components, you can create a comprehensive agreement that protects the interests of all stakeholders and ensures a smooth transition in the event of a significant life event.

The future stability of your business hinges on having a solid plan in place. Taking the time to create a well-crafted agreement will prove invaluable in the long run. It’s an investment in peace of mind and the continued success of your company.