So, you’re thinking about buying or selling some business assets? That’s a big step, and you want to make sure you get it right. One of the most crucial documents in this process is a business asset purchase agreement. Think of it as the roadmap for the entire transaction, outlining exactly what’s being bought and sold, how much it costs, and what everyone’s responsibilities are. It can seem daunting, but with the right understanding and a good business asset purchase agreement template, you can navigate this process with confidence.

Imagine trying to build a house without blueprints. You might end up with walls in the wrong places and a leaky roof! A business asset purchase agreement serves as those blueprints, ensuring that both the buyer and the seller are on the same page and that there are no nasty surprises down the road. It protects both parties by clearly defining the terms of the sale and minimizing the potential for future disputes. After all, no one wants a handshake deal to turn into a legal headache.

This article will help you understand the importance of a business asset purchase agreement template and how to use it effectively. We’ll explore the key components of such an agreement and offer insights to help you draft a document that is comprehensive, fair, and legally sound. Whether you’re a seasoned business owner or a first-time entrepreneur, this guide will give you the knowledge you need to approach the asset purchase process with confidence.

Understanding the Business Asset Purchase Agreement

A business asset purchase agreement is a legally binding contract that outlines the terms and conditions for the sale of a business’s assets. This differs from a stock purchase agreement, where the buyer acquires the company’s stock and, therefore, its liabilities. In an asset purchase, the buyer only acquires the specific assets listed in the agreement, leaving the seller with the remaining assets and liabilities. This type of transaction can be attractive to buyers because they can pick and choose which assets they want, potentially avoiding unwanted debt or legal issues.

The assets included in an asset purchase agreement can vary greatly depending on the nature of the business. Common examples include equipment, inventory, accounts receivable, intellectual property (like trademarks and patents), customer lists, and even goodwill. Goodwill represents the intangible value of a business, such as its reputation and customer relationships. The agreement will clearly specify which assets are being transferred, leaving no room for ambiguity. This detailed description is crucial for protecting both the buyer and the seller.

One of the key benefits of using a business asset purchase agreement template is that it provides a framework for covering all the essential legal points. These templates typically include sections addressing the purchase price, payment terms, closing date, representations and warranties made by the seller, indemnification clauses, and dispute resolution mechanisms. By using a template, you can ensure that you’re not overlooking any important legal considerations that could potentially cause problems later on.

However, it’s essential to remember that a template is just a starting point. You should always customize the agreement to fit the specific circumstances of your transaction. For example, if the business has unique intellectual property, you’ll want to ensure that the agreement clearly addresses the transfer of ownership and any related licensing rights. Similarly, if the business is heavily reliant on certain customer relationships, you might want to include a provision that requires the seller to assist with the transition of those relationships to the buyer.

Finally, it’s always a good idea to consult with an attorney when drafting or reviewing a business asset purchase agreement. An attorney can provide valuable legal advice and help you ensure that the agreement adequately protects your interests. They can also identify any potential risks or issues that you might have overlooked and help you negotiate more favorable terms. While using a business asset purchase agreement template can save you time and money, the cost of legal advice is a worthwhile investment in the long run.

Key Components of a Business Asset Purchase Agreement Template

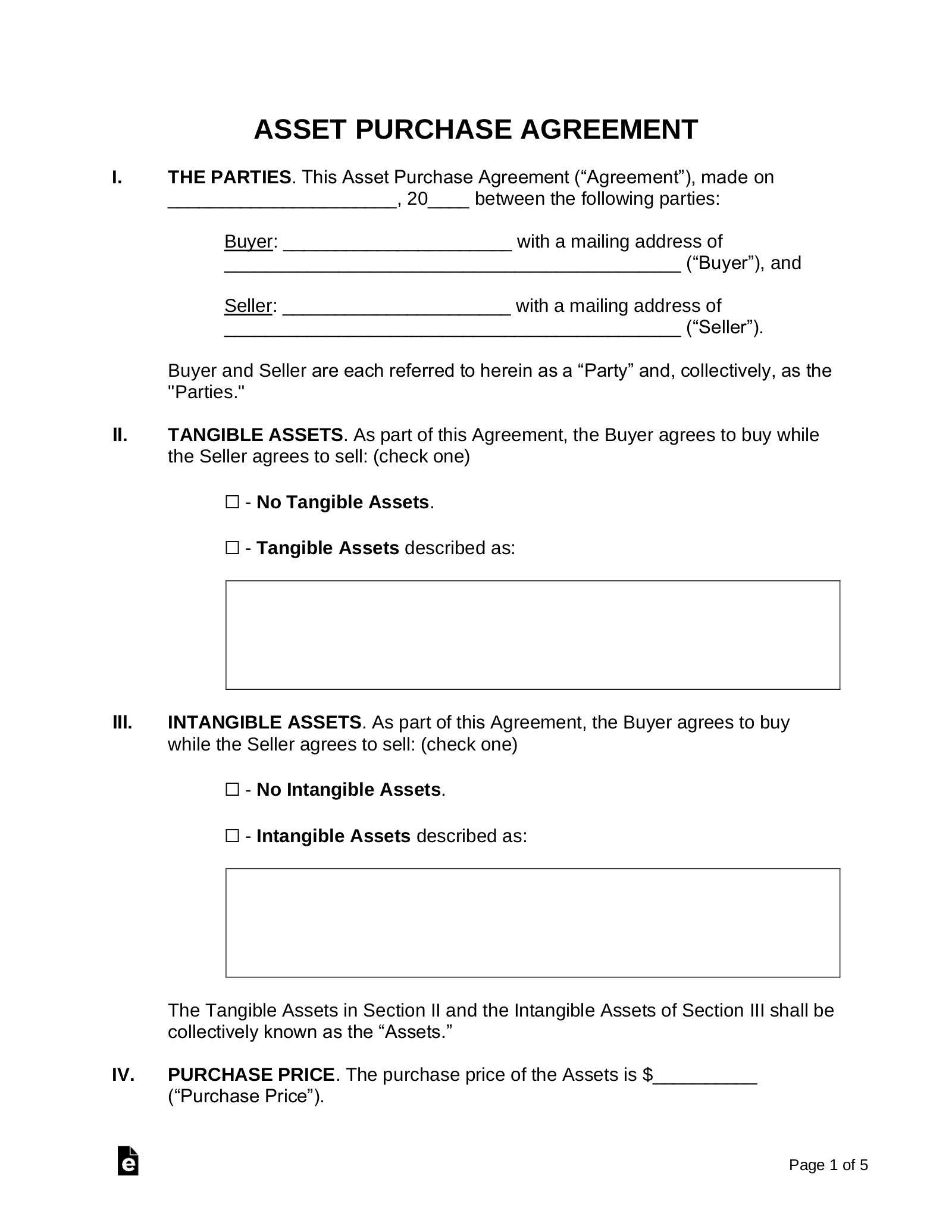

Every solid business asset purchase agreement template includes several vital sections. The first section usually defines the parties involved: the buyer and the seller. It also specifies the date the agreement is made. Clearly identifying the parties helps to avoid confusion later.

Next, the agreement will detail the specific assets being sold. This section is crucial. Are you buying the equipment, inventory, customer lists, or intellectual property? Each item should be listed with a clear description to avoid any disputes about what is included in the sale. Attaching an exhibit listing all assets is a good practice.

The purchase price and payment terms form another critical section. How much is the buyer paying for the assets? What is the method of payment? Are there any contingencies, such as financing, that need to be met before the sale can be completed? A well-written agreement will outline these details precisely.

Representations and warranties are promises made by the seller about the condition of the assets and the business. For instance, the seller might warrant that they have clear title to the assets and that they are free from any liens or encumbrances. These representations and warranties provide the buyer with legal recourse if the seller’s promises turn out to be false. Indemnification clauses specify who is responsible for covering any losses or liabilities that arise from the transaction. This section can protect the buyer from inheriting unwanted liabilities from the seller’s business. If someone makes a claim based on prior actions from the seller, who is responsible? The indemnification outlines that.

Finally, the agreement should include provisions for governing law, dispute resolution, and termination. Governing law specifies which state’s laws will apply to the agreement. Dispute resolution outlines how any disagreements will be resolved, such as through mediation or arbitration. Termination provisions specify the circumstances under which either party can terminate the agreement. These are all safety nets to ensure a smooth and fair process.

Crafting a solid agreement is an involved process. However, paying attention to details now can prevent problems later. Understanding the components of a business asset purchase agreement template is an essential start.

Navigating a business asset purchase can be intricate. Both parties should carefully consider their positions and work diligently to achieve mutually agreeable terms.