So, you’re thinking about leasing to own a business, huh? That’s a pretty smart move, especially if you’re not quite ready to commit to buying outright. It’s like a long-term test drive before you take the plunge. But before you jump in with both feet, you’ll need to understand the ins and outs of a lease to own business agreement template. It’s a vital document that protects both the lessor (the current owner) and the lessee (that’s you, the aspiring owner). This agreement lays out the terms of the lease, the option to purchase, and all the nitty-gritty details that can make or break the deal. Think of it as the roadmap to your future business ownership.

Navigating the world of business agreements can feel like wading through legal jargon. That’s where a solid lease to own business agreement template comes in handy. It provides a framework, a starting point to ensure all the essential elements are covered. Of course, you’ll likely need to tailor it to your specific situation with the help of a legal professional. But having a template as a foundation saves time, money, and a whole lot of potential headaches down the road.

In this article, we’re going to break down what makes a good lease to own business agreement template. We’ll cover the key components, common pitfalls to avoid, and what to look for when choosing the right template for your needs. By the end, you’ll have a much clearer understanding of how these agreements work and how they can help you achieve your business ownership dreams. Let’s get started!

Understanding the Core Components of a Lease to Own Business Agreement Template

A lease to own business agreement template isn’t just a piece of paper; it’s a legally binding contract that outlines the rights and responsibilities of both parties involved. Think of it as a detailed instruction manual for the entire leasing and potential purchasing process. It’s designed to prevent misunderstandings and provide a clear path forward, whether you ultimately decide to buy the business or not. Several crucial elements must be included to ensure its validity and effectiveness.

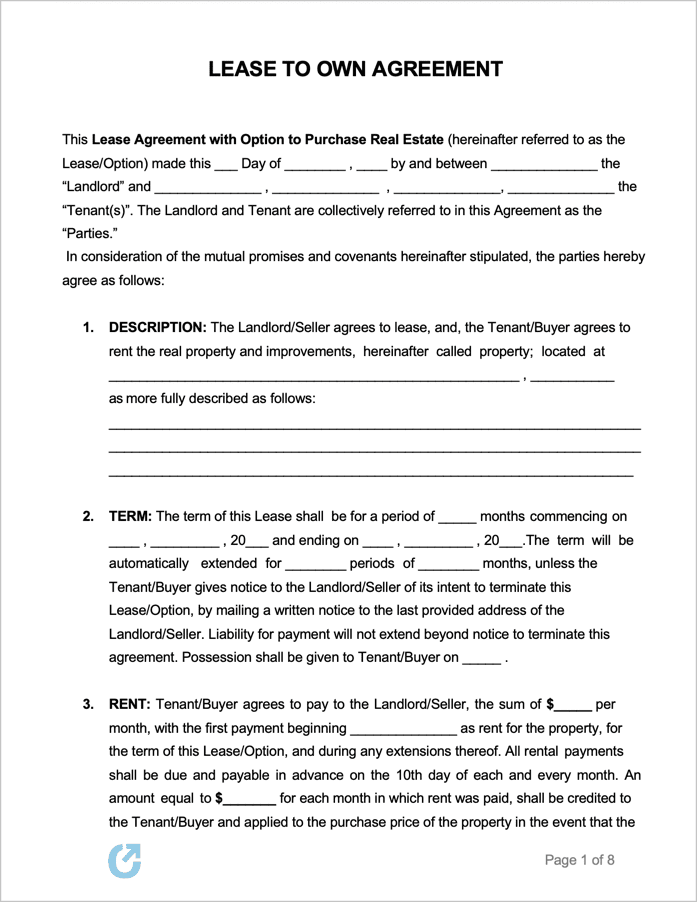

First and foremost, the agreement must clearly identify the parties involved: the lessor (current owner) and the lessee (potential buyer). It should include their legal names, addresses, and contact information. Next, it needs to explicitly describe the business being leased. This isn’t just about stating the business name; it’s about outlining all the assets included in the lease, such as equipment, inventory, intellectual property, and any real estate involved. A detailed inventory list is often a good idea to avoid disputes later on. Don’t forget to specify the duration of the lease term. How long will you be leasing the business before the option to purchase kicks in?

Financial details are, of course, critical. The agreement must clearly state the lease payments, including the amount, frequency, and due date. It should also specify how these payments are applied – whether they contribute towards the eventual purchase price or are strictly for the use of the business. Then there’s the purchase option. This section details the purchase price, the terms for exercising the option (when and how you can buy the business), and any conditions that must be met. Are there performance targets? Deadlines? Make sure everything is clearly defined.

Maintenance and repairs are another key area to address. Who is responsible for maintaining the equipment and property during the lease term? What happens if something breaks down? The agreement should specify who bears the cost of repairs and replacements. Insurance is also crucial. The agreement should outline the insurance requirements for both parties, including the types of coverage and the amount of coverage required. This protects everyone from financial loss in case of accidents, damage, or liability claims.

Finally, the agreement should include clauses addressing default and termination. What happens if the lessee fails to make payments or violates the terms of the lease? What are the consequences, and how can the agreement be terminated? It should also address what happens if the lessee decides not to exercise the purchase option at the end of the lease term. Having a comprehensive lease to own business agreement template can save a lot of time and money. It provides a solid foundation for your potential purchase.

Key Considerations When Choosing a Lease to Own Business Agreement Template

Not all lease to own business agreement templates are created equal. Some are generic, while others are tailored to specific industries or situations. Choosing the right template is crucial to ensure that it adequately protects your interests and meets your specific needs. So, how do you go about selecting the right one?

First, consider the complexity of the business you’re leasing. Is it a simple retail store, or a complex manufacturing operation? A more complex business will require a more detailed and comprehensive agreement. Look for templates that cover a wide range of potential issues, such as intellectual property rights, environmental regulations, and employee contracts. Industry-specific templates can be particularly helpful, as they often address unique challenges and legal requirements relevant to that industry. For instance, a template for a restaurant might include clauses related to food safety and liquor licenses, while a template for a technology company might focus on protecting trade secrets.

Next, evaluate the clarity and comprehensiveness of the template. Is it easy to understand, even if you’re not a lawyer? Does it cover all the key components we discussed earlier, such as lease payments, purchase option terms, maintenance responsibilities, and insurance requirements? Avoid templates that are vague or ambiguous, as these can lead to disputes later on. Look for templates that use clear and concise language, and that provide detailed explanations of each clause. Customer reviews or ratings of the lease to own business agreement template you are considering can offer a lot of guidance.

Don’t be afraid to customize the template to fit your specific situation. A good template should be a starting point, not a rigid set of rules. Work with a legal professional to review the template and make any necessary modifications to address your unique needs and concerns. This might involve adding clauses related to specific assets, adjusting the purchase option terms, or clarifying the responsibilities of each party.

Finally, consider the cost of the template. While there are many free templates available online, they may not be as comprehensive or reliable as paid templates. Investing in a high-quality template from a reputable source can save you time and money in the long run by reducing the risk of disputes and legal complications. Ultimately, the best lease to own business agreement template is one that is clear, comprehensive, customizable, and tailored to your specific needs. Using a lease to own business agreement template can help reduce the costs involved in a lease to own situation.

By taking the time to research and select the right template, you can ensure that you’re entering into a lease to own agreement with your eyes wide open and that you’re adequately protected from potential risks.

Entering into a lease-to-own agreement requires careful planning and consideration. Doing your due diligence is paramount, including thorough research, understanding the agreement, and seeking professional guidance. This way, you can make informed decisions that align with your goals, paving the way for a successful transition to business ownership.

Remember, a lease to own business agreement template is a tool, not a magic bullet. It’s important to actively engage in the process, ask questions, and seek legal advice to ensure that the agreement truly reflects your understanding and intentions. With the right template and a proactive approach, you can navigate the lease-to-own process with confidence.