Starting a Limited Liability Company (LLC) in California is an exciting venture! But before you jump in, there’s a crucial document you’ll need: the operating agreement. Think of it as the blueprint for your business, outlining how things will be run, who’s responsible for what, and how profits and losses will be divided. Getting this right from the beginning can save you headaches and disagreements down the road.

While California doesn’t legally *require* an operating agreement for single-member LLCs, it’s highly recommended. For multi-member LLCs, it’s even more essential. It acts as a shield, protecting your personal assets by clearly separating your business from your personal finances. Plus, it provides a framework for conflict resolution and decision-making, ensuring everyone is on the same page.

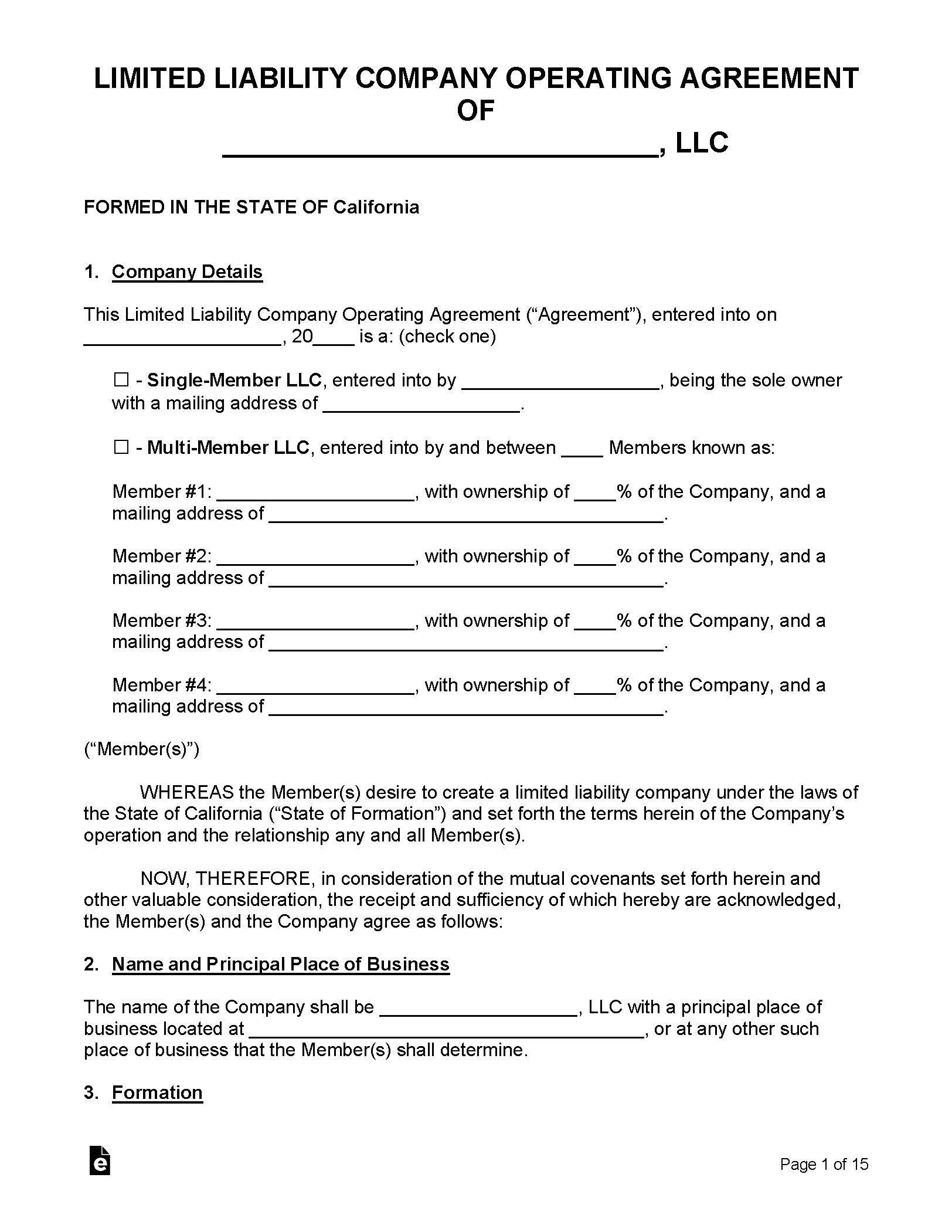

So, where do you begin? Well, many entrepreneurs turn to an llc operating agreement template california. These templates offer a starting point, a framework you can customize to fit the specific needs of your business. But remember, not all templates are created equal. Choosing the right one and tailoring it properly is key to a solid foundation for your LLC.

Why You Absolutely Need an Operating Agreement in California

An operating agreement is more than just a formality; it’s the backbone of your LLC. It clearly defines the roles, responsibilities, and rights of each member, preventing misunderstandings and disputes. Without one, your LLC defaults to California’s state laws, which might not align with your specific business needs. Imagine trying to build a house without a blueprint – that’s what running an LLC without an operating agreement feels like!

Think of it as a prenuptial agreement for your business. It outlines what happens if a member leaves, dies, or becomes incapacitated. It details how profits and losses are allocated, how decisions are made, and how the LLC can be dissolved. It even covers things like capital contributions, voting rights, and transfer of ownership. Having these things clearly defined in writing can avoid costly legal battles in the future.

The beauty of an operating agreement is its flexibility. You can tailor it to fit the unique circumstances of your business. Do you want a manager-managed or member-managed LLC? How will you handle disputes? What happens if a member wants to sell their interest? These are all questions you can answer in your operating agreement. While the state provides default rules, you have the power to customize these to suit your specific needs and preferences.

Furthermore, an operating agreement can strengthen your LLC’s credibility. It demonstrates to banks, investors, and other stakeholders that you’ve taken the time to establish a solid legal foundation for your business. This can be particularly important when seeking funding or entering into contracts. A well-drafted operating agreement signals that you’re serious about your business and committed to its long-term success.

Finding the Right Template

When searching for an llc operating agreement template california, be sure to look for one that’s specifically designed for California LLCs. State laws vary, and a generic template might not cover all the necessary provisions required by California law. Look for templates that are comprehensive, easy to understand, and customizable to your specific needs. Legal websites and online business resources often offer free or low-cost templates.

Key Elements to Include in Your California LLC Operating Agreement

A solid operating agreement should address several key areas. First, it should clearly identify the members of the LLC, their ownership percentages, and their initial capital contributions. It should also define the roles and responsibilities of each member, whether the LLC is member-managed or manager-managed. This section needs to clearly spell out who is responsible for what tasks, and what authority each person holds within the company.

Next, the agreement needs to outline the profit and loss allocation. How will profits and losses be divided among the members? Will it be based on ownership percentage, capital contributions, or some other formula? Be specific and avoid vague language. You want to make sure everyone understands exactly how these are handled.

Decision-making processes are another crucial element. How will major decisions be made? Will it require a unanimous vote, a majority vote, or some other method? The operating agreement should clearly define the voting rights of each member and the procedures for holding meetings and making decisions. This could involve in-person meetings, electronic voting, or a combination of both.

The agreement should also address what happens if a member wants to leave the LLC or transfer their ownership interest. Are there restrictions on transferring ownership? Does the LLC have the right of first refusal to purchase the departing member’s interest? These are important considerations to address to maintain control over the membership of your LLC.

Finally, the operating agreement should outline the procedures for dissolving the LLC. What circumstances will trigger dissolution? How will assets be distributed upon dissolution? Having a clear dissolution plan in place can help avoid disputes and ensure a smooth winding-down process. Remember that this is not something you want to gloss over.

Protecting your personal assets and defining the future of your business starts with a well-crafted operating agreement. While an llc operating agreement template california can be a useful tool, make sure you customize it to fit the specific needs of your business and consult with an attorney if you have any questions or concerns.

Creating a strong foundation from the beginning allows you to focus on growing your business with confidence.