So, you’re lending money to a friend, family member, or acquaintance? Awesome! Helping someone out is a great thing. But let’s be real, when money’s involved, even the closest relationships can get a little… complicated. That’s where a private party loan agreement template comes in handy. It’s not about distrust; it’s about clarity and protecting everyone involved. Think of it as insurance for your friendship (or family bond!).

A solid loan agreement lays out all the details of the transaction, leaving no room for misunderstandings down the road. What’s the loan amount? What’s the interest rate (if any)? What’s the repayment schedule? When is the final payment due? These are all important questions to answer, and a loan agreement is the perfect place to do it. It makes sure everyone’s on the same page. No awkward conversations later trying to remember what you agreed on over coffee six months ago.

Think of it this way: It’s like a roadmap for the loan. It helps both the lender and the borrower navigate the repayment process smoothly. And while it might seem a bit formal, having a written agreement is far better than relying on a verbal promise. Verbal agreements are notoriously difficult to enforce, especially if memories fade or interpretations differ. A well-drafted private party loan agreement template provides a record of the terms, protects your financial interests, and preserves the relationship by minimizing potential conflict.

Why You Need a Private Party Loan Agreement Template

Let’s dive deeper into why using a private party loan agreement template is so crucial. Imagine lending a significant amount of money without documenting the terms. What happens if the borrower’s circumstances change? What if they lose their job, encounter unexpected expenses, or simply “forget” about the loan? Without a written agreement, you’re relying solely on their good faith, which, while hopefully strong, isn’t always enough. A private party loan agreement template provides a legal framework for the loan, outlining the rights and responsibilities of both parties.

One of the most important aspects of a loan agreement is specifying the interest rate. While you might be tempted to offer a zero-interest loan to a loved one, consider the time value of money. Inflation erodes the purchasing power of your money over time. Charging a modest interest rate can help offset this effect and ensure that you’re not losing out financially. Plus, clearly stating the interest rate avoids any potential disputes later on. It’s not about gouging your friend or family member; it’s about being fair and transparent.

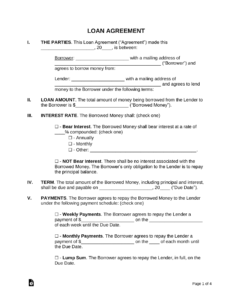

The repayment schedule is another critical element of the loan agreement. Will the borrower make weekly, bi-weekly, or monthly payments? What is the exact amount due each time? When is the final payment due? A clearly defined repayment schedule helps the borrower budget their finances and ensures that you receive your money back in a timely manner. It also provides a mechanism for tracking payments and identifying any defaults. If the borrower misses a payment, the loan agreement outlines the consequences, such as late fees or acceleration of the loan.

Another benefit of using a private party loan agreement template is that it can help prevent misunderstandings. Memory is fallible, and people often remember things differently, especially when money is involved. A written agreement serves as a clear and unambiguous record of the loan terms, minimizing the potential for disagreements and disputes. It ensures that both parties are on the same page from the outset and have a shared understanding of their obligations.

Furthermore, a well-drafted loan agreement can be invaluable if you ever need to pursue legal action to recover the loan. If the borrower defaults and refuses to repay the money, the loan agreement serves as evidence of the debt and the terms of the loan. It strengthens your case in court and increases your chances of successfully recovering the funds. Without a written agreement, it can be difficult to prove that a loan even existed, let alone the specific terms and conditions.

Key Elements of a Solid Private Party Loan Agreement

So, what should a good private party loan agreement template include? First and foremost, it needs to clearly identify the parties involved: the lender and the borrower. Include their full legal names and addresses to avoid any confusion. Next, specify the loan amount. State the exact amount of money being loaned in clear and unambiguous terms. Avoid using vague or ambiguous language that could lead to misinterpretations.

The interest rate is another critical element. If you’re charging interest, state the annual interest rate (APR) and how it will be calculated. Be sure to comply with all applicable usury laws, which limit the amount of interest that can be charged on a loan. The repayment schedule should also be clearly outlined. Specify the frequency of payments (weekly, bi-weekly, monthly), the amount of each payment, and the due date. Also, include a section on late payment fees, if applicable. This outlines the penalty for missing a payment deadline.

Collateral, if any, should be described in detail. If the loan is secured by collateral, such as a car or a piece of jewelry, describe the collateral in sufficient detail so that it can be easily identified. Include the make, model, and vehicle identification number (VIN) for a car, or a detailed description and appraisal for a piece of jewelry. The loan agreement should also specify the lender’s rights in the event of default, such as the right to repossess the collateral.

Don’t forget to include a section on default. Define what constitutes a default, such as missing a payment or failing to maintain insurance on the collateral. The loan agreement should also specify the lender’s remedies in the event of default, such as the right to accelerate the loan (demand immediate payment of the entire outstanding balance) or to pursue legal action to recover the funds. A severability clause is also a good addition, stating that if one part of the agreement is deemed unenforceable, the remaining parts still hold.

Finally, make sure the loan agreement is properly signed and dated by both the lender and the borrower. It’s also a good idea to have the signatures notarized, which provides additional verification of the agreement’s authenticity. While not always legally required, notarization can help prevent challenges to the validity of the agreement later on. Using a reliable private party loan agreement template ensures all these key elements are covered.

Using a private party loan agreement template makes the process much simpler and less stressful. It ensures that everyone understands their roles and responsibilities, minimizing the risk of conflict and preserving valuable relationships.

In conclusion, remember that a little bit of planning and documentation can go a long way in protecting your financial interests and maintaining positive relationships. A well-crafted private party loan agreement template is a valuable tool for anyone lending money to friends, family, or acquaintances.