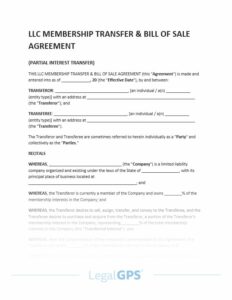

So, you’re looking to transfer your ownership stake in an LLC, huh? Or maybe you’re on the receiving end. Either way, navigating the world of Limited Liability Companies and their ownership structures can feel a bit like trying to understand a foreign language. A key piece of paperwork you’ll need to get right is a membership interest transfer agreement. This document is absolutely critical for legally documenting the change in ownership and protecting all parties involved. Think of it as the official rule book for passing the baton of ownership.

Without a proper agreement, things can get messy fast. Imagine disagreements arising about who owns what percentage, or worse, legal challenges questioning the validity of the transfer. That’s why a well-drafted membership interest transfer agreement template is a lifesaver. It lays out everything clearly: who is selling, who is buying, what percentage of the LLC is being transferred, and, of course, how much money is changing hands. It’s all about making sure everyone is on the same page and that the transfer is handled legally and smoothly.

This guide will walk you through the essentials of understanding and utilizing a membership interest transfer agreement template. We’ll break down the key clauses, explain why they’re important, and give you some insights on how to ensure your transfer is legally sound. Whether you’re a seasoned business owner or just starting out, we’ll equip you with the knowledge you need to confidently handle this important transaction. Let’s dive in!

Understanding the Nuances of a Membership Interest Transfer Agreement

A membership interest transfer agreement is far more than just a simple receipt. It’s a comprehensive legal document that outlines all the critical details of the ownership transfer within an LLC. It defines the rights and responsibilities of both the transferring member (the seller) and the acquiring member (the buyer), and it protects the interests of the LLC itself. Ignoring the details can have serious legal and financial consequences, so paying close attention is paramount.

One of the first things to consider is the specific percentage of the membership interest being transferred. This might seem obvious, but clarity is key. Is it a full transfer of the member’s entire stake, or just a portion? The agreement needs to explicitly state this percentage to avoid any future ambiguity. Think about the implications for voting rights, profit distribution, and overall control of the LLC. The agreement must clearly define how these rights shift as a result of the transfer.

Next, the purchase price and payment terms must be crystal clear. How much is the membership interest being sold for? Is it a lump sum payment, or will it be paid in installments? If installments are involved, the agreement should outline the payment schedule, interest rates (if any), and any penalties for late payment. Furthermore, the agreement should specify the method of payment, such as wire transfer, check, or other agreed-upon method. Leaving these details vague can open the door to disputes and potential breaches of contract.

Representations and warranties are another crucial component of the agreement. These are statements made by the transferring member about the ownership interest being sold. For example, the transferring member might warrant that they have the full right and authority to sell the membership interest, and that there are no liens or encumbrances on the interest that would prevent the transfer. These representations provide assurance to the buyer and can serve as a basis for legal action if the statements prove to be false.

Finally, consider the governing law and dispute resolution mechanisms. The agreement should specify which state’s laws will govern the interpretation and enforcement of the agreement. It should also outline the process for resolving any disputes that may arise. This might include mediation, arbitration, or litigation. Having these provisions in place can help avoid costly and time-consuming legal battles down the road.

Key Clauses to Include in Your Membership Interest Transfer Agreement Template

A robust membership interest transfer agreement template includes several critical clauses that safeguard the interests of all parties involved. Let’s take a look at some of the most important elements to include.

First and foremost is the “Transfer of Membership Interest” clause. This section clearly and unequivocally states that the transferring member is selling and transferring their membership interest to the acquiring member. It must specify the exact percentage of the interest being transferred, and the date on which the transfer will become effective. This clause is the foundation of the entire agreement, so it needs to be precise and unambiguous.

The “Consideration” clause outlines the purchase price for the membership interest. This section details the agreed-upon price and the method of payment. If the price is to be paid in installments, the schedule of payments, interest rates (if any), and penalties for late payments should all be clearly stated. It’s also essential to include a provision that addresses the allocation of responsibility for taxes associated with the transfer.

Another important clause is the “Representations and Warranties” section. As mentioned earlier, this section includes statements made by the transferring member about the membership interest being sold. These statements might include affirmations that the transferring member has the legal right to sell the interest, that the interest is free from any liens or encumbrances, and that the financial information provided to the buyer is accurate and complete. These warranties offer crucial protection to the buyer and provide a basis for legal action if the statements prove to be untrue.

The “Indemnification” clause provides further protection to the acquiring member. This clause states that the transferring member will indemnify and hold harmless the acquiring member from any losses, damages, or liabilities arising from the transferring member’s actions or omissions prior to the transfer date. This clause can be particularly important if there are any outstanding debts or liabilities associated with the LLC.

Finally, the “Governing Law and Dispute Resolution” clause specifies the jurisdiction whose laws will govern the agreement and the process for resolving any disputes that may arise. As mentioned earlier, this clause can help avoid costly legal battles and provide a clear framework for resolving disagreements.

Using a high-quality membership interest transfer agreement template provides a solid starting point. From there, you can tailor the document to reflect the specific circumstances of your transfer, ensuring that all relevant issues are addressed. This proactive approach will help you avoid potential pitfalls and ensure a smooth and legally sound transfer of membership interest.

Crafting a carefully thought-out membership interest transfer agreement protects everyone involved. A solid, well-executed agreement sets the stage for a successful transition of ownership.