So, you’re starting a limited liability company (LLC) and opting for a member-managed structure? Smart move! It’s a great way to keep things simple and collaborative, especially when you’re dealing with a smaller group where everyone is actively involved. But before you dive in, there’s a crucial document you absolutely need: the operating agreement. Think of it as the constitution for your LLC, outlining the rules, responsibilities, and how you’ll handle pretty much everything from profits and losses to what happens if a member wants to leave.

Now, crafting an operating agreement from scratch can feel overwhelming. That’s where a member managed operating agreement template comes in handy. It provides a solid framework, ensuring you cover all the essential aspects of your LLC’s operation. It’s like having a roadmap that guides you through the potentially complicated terrain of business ownership and management. While you can customize it to fit your specific needs, the template ensures you’re not missing anything important.

This isn’t just about ticking a box; it’s about laying a strong foundation for your business’s future. A well-drafted operating agreement can prevent misunderstandings, disagreements, and even costly legal battles down the line. It’s an investment in the stability and success of your LLC. So let’s explore what makes a member managed operating agreement template so vital and how to use it effectively.

Why a Member Managed Operating Agreement is Essential

An operating agreement is the cornerstone of any well-organized LLC, particularly one that’s member-managed. But why is it so important? It all boils down to clarity, control, and protection. Without a solid operating agreement, your LLC could be subject to state default rules, which may not align with your intentions or the best interests of your business. Think of it like this: if you don’t write the rules, the state will, and you might not like what they come up with.

First and foremost, it clearly defines the roles and responsibilities of each member. Who is responsible for what? Who has the authority to make certain decisions? What are the expectations for each member’s involvement in the business? Addressing these questions upfront can prevent confusion and conflict later on. This is especially crucial in a member-managed LLC, where all members share in the management responsibilities.

The operating agreement also outlines how profits and losses will be distributed among the members. This may seem straightforward, but there are various methods of distribution to consider. Will profits and losses be allocated based on each member’s ownership percentage? Or will there be a different formula that takes into account factors such as contributions or sweat equity? Spelling this out in the agreement ensures everyone is on the same page and avoids potential disputes.

Furthermore, the operating agreement addresses the procedure for adding or removing members. What happens if a member wants to leave the LLC? What happens if a member passes away? These are difficult questions, but it’s essential to have a plan in place. The operating agreement should outline the process for transferring membership interests, as well as the terms and conditions for a member’s departure or expulsion. This provides a clear roadmap for handling these sensitive situations, minimizing disruption to the business.

Finally, a member managed operating agreement template shields you legally. It helps to demonstrate that your LLC is a separate entity from its members, reinforcing the liability protection that an LLC provides. This can be crucial in the event of lawsuits or other legal challenges. By clearly outlining the LLC’s operations and the members’ roles, the operating agreement helps to protect your personal assets from business liabilities.

Key Components of a Member Managed Operating Agreement Template

Now that we’ve established why a member managed operating agreement is so crucial, let’s take a look at the key components that should be included in your template. While every LLC is unique and will require some degree of customization, there are certain essential provisions that should be addressed in every operating agreement. These sections provide a comprehensive framework for governing your LLC and ensuring its smooth operation.

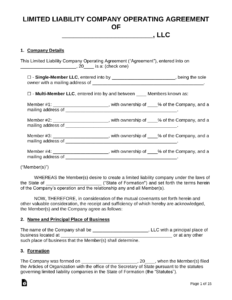

First, you’ll need to clearly identify the name and address of your LLC, as well as the names and addresses of all the members. This information establishes the basic identity of the LLC and its members. It’s also important to specify the LLC’s purpose or business activity. What type of business will the LLC be conducting? This helps to define the scope of the LLC’s operations and provides clarity for future decisions.

The capital contributions section outlines the initial investments made by each member. How much did each member contribute to the LLC? This section also specifies how future capital contributions will be handled. Will members be required to make additional contributions if needed? What happens if a member fails to make a required contribution? Addressing these questions upfront can prevent disputes and ensure the LLC has sufficient capital to operate.

Next, you’ll need to address the management structure of the LLC. In a member-managed LLC, all members share in the management responsibilities. However, the operating agreement can further define the specific roles and responsibilities of each member. Who will be responsible for day-to-day operations? Who will be responsible for financial management? Clearly defining these roles can help to streamline decision-making and ensure that all aspects of the business are properly managed.

Finally, the operating agreement should include provisions for dissolution of the LLC. Under what circumstances will the LLC be dissolved? What happens to the LLC’s assets upon dissolution? This section provides a clear roadmap for winding down the LLC’s affairs in an orderly manner. It can also help to prevent disputes among the members in the event of dissolution.

Using a member managed operating agreement template and customizing it to your specific needs is a prudent step that protects both the business and its members. It provides a stable platform for growth and helps to avoid conflict. It also demonstrates a commitment to sound business practices that investors and lenders will appreciate.

Hopefully, these details have provided you with a solid foundation of knowledge for establishing your LLC on the right foot. By starting with a clear understanding, the likelihood of issues down the road will significantly be reduced. You’re not just setting up a business; you’re building a structure for your future endeavors.