So, you’re thinking about bringing on a consultant, but instead of shelling out a bunch of cash, you’re considering offering equity in your company. Sounds like a startup dream, right? Well, it can be a win-win, but only if you get the details ironed out in a solid consulting for equity agreement template. This isn’t just some handshake deal; it’s a legally binding document that protects both you and the consultant. Think of it as the rulebook for your new, exciting, equity-based partnership.

The idea is simple: the consultant provides their expertise, and in exchange, they receive a piece of the company pie. This can be a fantastic way for early-stage companies to access top-tier talent without breaking the bank. After all, cash is often tight when you’re just starting. But like any agreement involving ownership, there’s a lot to consider. What kind of equity? How much? What happens if things don’t work out? That’s where a good template comes in.

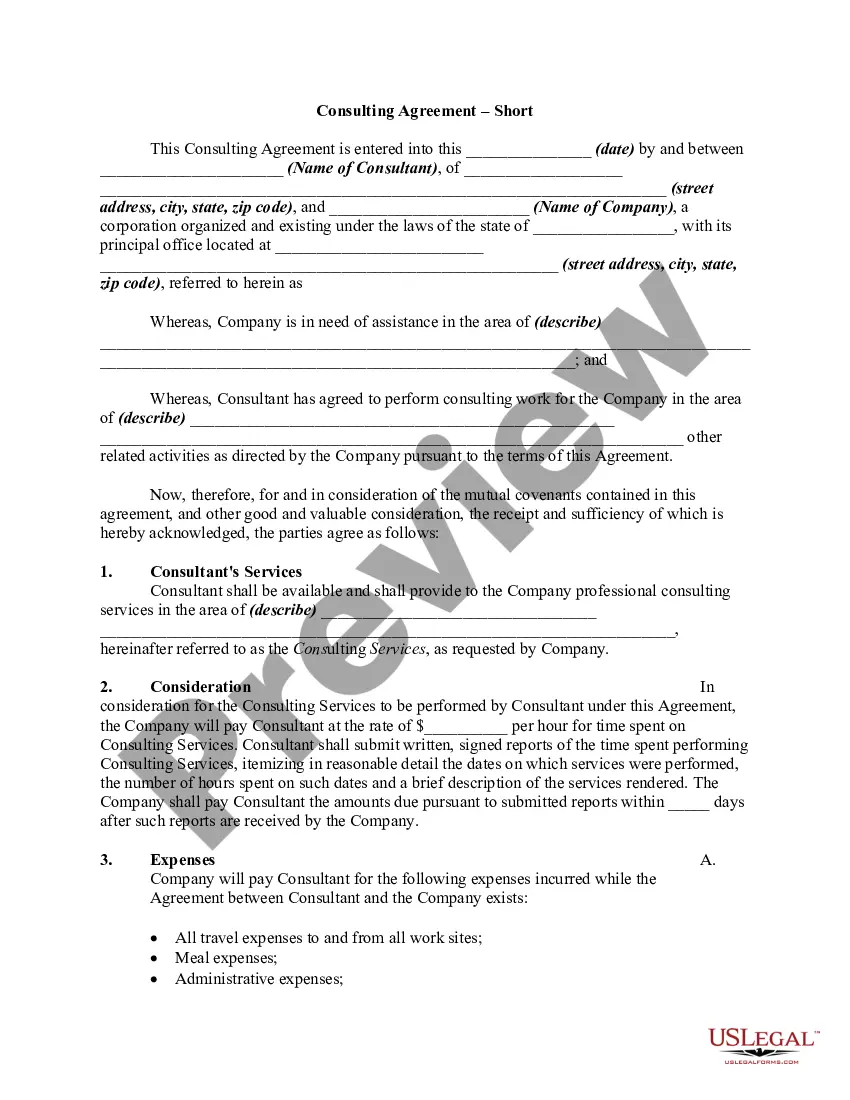

Without a well-defined agreement, you might end up with misunderstandings, disputes, or even legal battles down the road. Believe me, you want to avoid that headache. A solid consulting for equity agreement template provides a framework for clearly outlining the scope of the consulting services, the amount and type of equity being offered, the vesting schedule, and other critical terms. It ensures everyone is on the same page, reducing the risk of future disagreements and protecting the interests of all parties involved. It’s the foundation for a successful and mutually beneficial relationship.

Key Elements of a Consulting for Equity Agreement

Crafting the perfect consulting for equity agreement template is all about nailing down the specifics. You can’t just throw a few sentences together and hope for the best. This document will dictate the terms of a potentially long and profitable relationship. So, let’s dive into some of the most important elements you need to consider.

First, clearly define the scope of work. What exactly will the consultant be doing? This is arguably the most important part of the agreement. Detail the specific tasks, responsibilities, and deliverables expected from the consultant. The more specific you are, the better. Vague descriptions can lead to confusion and disputes later on. If it’s marketing consulting, what kind of marketing? Social media? Content creation? Paid advertising? The more details you provide upfront, the easier it will be to measure the consultant’s performance and ensure they’re meeting your expectations.

Next, you need to specify the type and amount of equity being offered. Is it common stock? Preferred stock? Stock options? Each type has different implications for both the company and the consultant. Then, determine the percentage of equity the consultant will receive. This should be based on the value of their services, the stage of the company, and the potential impact they’ll have on its success. It’s also important to consider the overall cap table and the potential dilution that may occur in the future.

Vesting is another crucial aspect. Equity typically doesn’t vest all at once. Instead, it vests over a period of time, usually several years. This incentivizes the consultant to remain engaged and contribute to the company’s long-term success. A typical vesting schedule might be four years, with a one-year cliff. This means the consultant doesn’t receive any equity until they’ve been working with the company for a year. After the cliff, the equity vests in equal installments over the remaining three years.

Finally, don’t forget about termination clauses. What happens if the consulting agreement is terminated before the equity is fully vested? Will the consultant retain any of the vested equity? What happens if the consultant violates the agreement? These are tough questions, but it’s essential to address them upfront to avoid any surprises down the road. You should also include provisions for dispute resolution, such as mediation or arbitration, in case any disagreements arise.

Important Legal Considerations

Beyond the specific terms of the agreement, there are some important legal considerations to keep in mind. Make sure the agreement complies with all applicable federal and state laws. You may also want to consult with an attorney to ensure the agreement is properly drafted and protects your company’s interests. Consulting with legal counsel is always a good idea when dealing with equity, especially if you’re not familiar with all the ins and outs of securities law.

Finding and Using a Consulting for Equity Agreement Template

Okay, so you’re convinced you need a consulting for equity agreement template. But where do you find one? And how do you use it effectively? The internet is awash with templates, but not all of them are created equal. Some are outdated, incomplete, or even legally unsound. So, how do you sort through the noise and find a template that meets your needs?

One option is to consult with an attorney. A lawyer can draft a custom agreement that is tailored to your specific situation. This is the most expensive option, but it also provides the greatest level of protection. If you have complex legal needs or are dealing with a significant amount of equity, this may be the best approach. However, for many startups, the cost of hiring an attorney can be prohibitive.

Another option is to find a template online. There are many reputable websites that offer legal templates, including consulting for equity agreement template options. Look for templates that are drafted by experienced attorneys and that are regularly updated to reflect changes in the law. Be sure to carefully review any template you find online and customize it to fit your specific circumstances. Don’t just blindly fill in the blanks; make sure you understand each provision and how it applies to your situation.

When using a template, pay close attention to the instructions and guidance provided. Most templates come with detailed explanations of each provision, as well as tips for customizing the agreement. Don’t hesitate to seek legal advice if you have any questions or concerns. Even if you’re using a template, it’s always a good idea to have an attorney review the final agreement before it’s signed.

Remember, a consulting for equity agreement is a binding legal document. It’s essential to get it right. Take your time, do your research, and don’t be afraid to ask for help. The effort you put in upfront will pay off in the long run by protecting your company’s interests and ensuring a successful and mutually beneficial relationship with your consultant.

The beauty of a consulting for equity arrangement lies in its potential to align incentives. When a consultant has a vested interest in the company’s success, they’re more likely to be fully committed and go the extra mile. It’s a partnership built on shared goals and a belief in the company’s future.

Choosing to offer equity is a big decision, but when executed thoughtfully and with the right legal framework in place, it can be a game-changer. It allows you to tap into expertise that might otherwise be out of reach, while also building a team that is deeply invested in your company’s success.