Navigating the world of real estate can feel like traversing a complex maze. If you’re considering ways to protect your property, maintain privacy, or streamline estate planning in the Sunshine State, a Florida land trust agreement template might be the key you’re looking for. Land trusts offer a unique and often advantageous approach to holding real estate, separating ownership from enjoyment and potentially unlocking significant benefits.

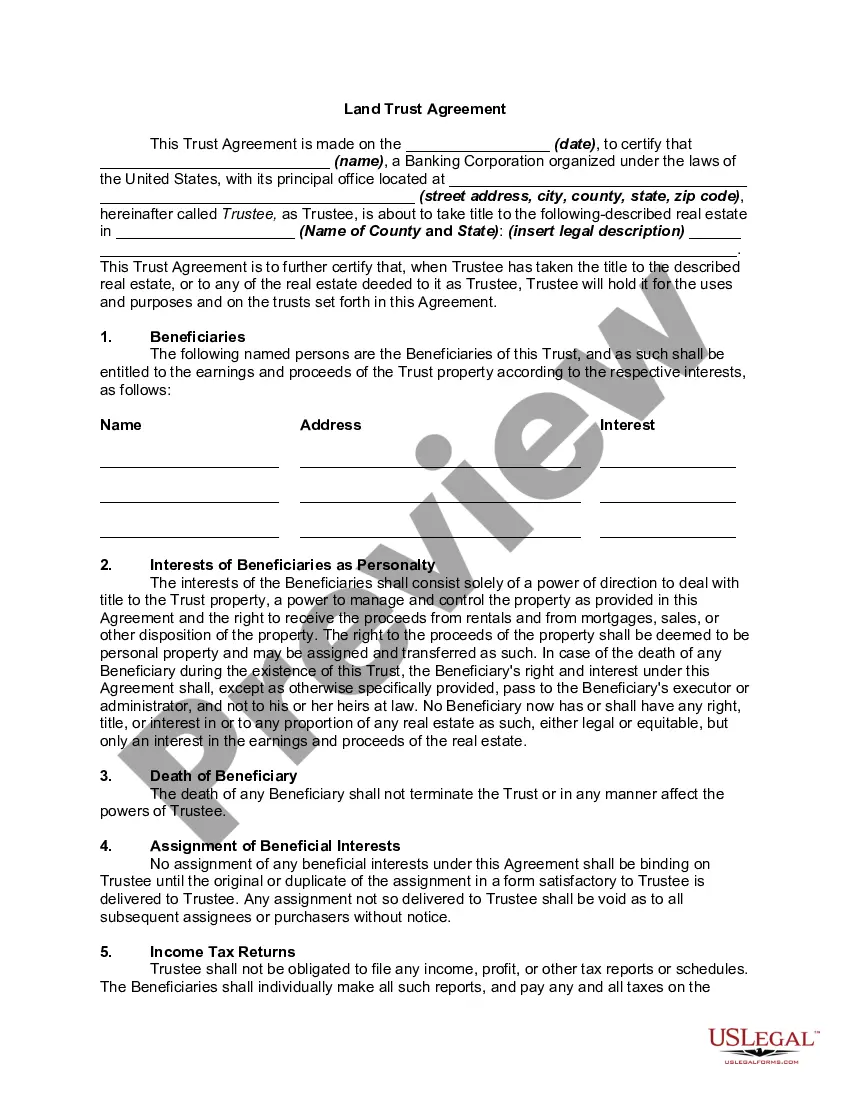

But what exactly is a Florida land trust, and why would you need a template to create one? Simply put, a land trust is a legal agreement where a trustee holds title to real property for the benefit of another person or entity, known as the beneficiary. The trustee manages the property according to the terms outlined in the trust agreement, while the beneficiary retains control and enjoys the benefits of ownership, like receiving rental income or using the property.

This article will explore the intricacies of Florida land trusts, shedding light on their advantages, the essential components of a Florida land trust agreement template, and considerations for creating a trust that aligns with your specific needs and goals. It’s designed to guide you through understanding this powerful real estate tool and empower you to make informed decisions about your property.

Understanding the Nuances of a Florida Land Trust Agreement

A Florida land trust agreement is more than just a piece of paper; it’s the foundation upon which the entire trust structure rests. This document defines the roles, responsibilities, and rights of all parties involved, ensuring clarity and preventing potential disputes down the line. The language should be precise and unambiguous, covering every foreseeable scenario. A well-drafted agreement is crucial for the successful operation of the trust and the realization of its intended benefits. It is advisable to consult with a legal professional to ensure all aspects are in line with the most recent Florida statutes.

Key components of a Florida land trust agreement template typically include the identification of the trustee, the beneficiary, and the property being held in trust. It will also outline the powers and duties of the trustee, such as managing the property, collecting rent, paying expenses, and executing sales. The agreement should also specify the term of the trust, how beneficiaries can be added or removed, and the process for terminating the trust. The beneficiary retains the power to direct the trustee. The trust agreement is not recorded publicly, which helps maintain privacy for the beneficiary.

Furthermore, the agreement must address issues like liability protection and indemnification for the trustee. It’s essential to clearly define the trustee’s responsibilities in managing the property and protecting it from potential claims or lawsuits. The agreement should also outline the process for compensating the trustee for their services.

Another important aspect is the succession plan for the trustee. What happens if the trustee becomes incapacitated or passes away? The agreement should designate a successor trustee to ensure continuity of management and avoid disruption to the trust’s operations. This is particularly important for long-term trusts.

Finally, the agreement should include provisions for amending the trust. Life circumstances change, and the trust agreement may need to be updated to reflect those changes. The amendment process should be clearly defined to ensure that any modifications are legally valid and enforceable. Seeking professional advice from an attorney specializing in Florida real estate and trusts is always recommended before finalizing any Florida land trust agreement template.

Benefits and Considerations of Using a Land Trust

One of the primary advantages of a Florida land trust is the enhanced privacy it offers. Since the beneficiary’s name is not publicly associated with the property, it can help shield them from unwanted attention, such as frivolous lawsuits or unwanted solicitations. This privacy can be particularly valuable for high-profile individuals or those who simply prefer to keep their real estate holdings confidential. Also, the use of a Florida land trust agreement template can simplify the process of transferring property to heirs, avoiding probate.

Land trusts can also simplify the transfer of property ownership. Instead of recording a deed, the beneficiary simply assigns their beneficial interest in the trust. This can be particularly useful when dealing with multiple owners or complex estate planning scenarios. It can also streamline the process of selling the property, as the beneficiary can simply direct the trustee to execute the sale on their behalf.

However, it’s crucial to remember that land trusts are not a magic bullet. They have limitations and potential drawbacks. For example, they do not provide asset protection against all types of creditors. Certain types of claims, such as those arising from environmental contamination or criminal activity, may still be able to pierce the veil of the trust.

Furthermore, it’s essential to ensure that the land trust is properly structured and administered. Failure to comply with legal requirements or to maintain proper records can jeopardize the trust’s validity and expose the beneficiary to liability. Working with an experienced attorney and trustee is crucial to avoid these pitfalls.

Finally, it’s important to consider the potential tax implications of using a land trust. While land trusts are generally considered to be tax-neutral entities, they can have implications for estate taxes and income taxes. Consult with a qualified tax advisor to understand the potential tax consequences before establishing a land trust.

While crafting a Florida land trust agreement template takes time and consideration, it’s a valuable step in estate planning and real estate management. Its flexibility and benefits allow property owners to make provisions for the future while maintaining a level of privacy not always found in traditional ownership structures.

Properly establishing a land trust requires careful thought and consultation with professionals. The peace of mind and potential advantages offered by a well-structured trust, however, can be well worth the effort, solidifying your legacy and protecting your real estate assets for generations to come.