So, you’re starting a multi member LLC? Congratulations! That’s a fantastic step towards building your business and setting the stage for a successful future. One of the most crucial documents you’ll need is an operating agreement. Think of it as the constitution for your company, outlining the rules and responsibilities of each member. While it might sound daunting, crafting an operating agreement doesn’t have to be a headache. That’s where an operating agreement template for multi member LLC comes in handy, giving you a solid foundation to build upon.

An operating agreement is essential for several reasons. It clearly defines each member’s roles, responsibilities, and ownership percentage. It also specifies how profits and losses will be distributed, how decisions will be made, and what happens if a member wants to leave or sell their stake in the company. Without a well-defined agreement, you risk future disputes and misunderstandings that can seriously damage your business and relationships with your partners.

This article will guide you through the ins and outs of using an operating agreement template for multi member LLC, explaining what key elements to include and why they’re important. We’ll cover everything from basic information about the LLC to more complex topics like voting rights and dispute resolution. By the end, you’ll have a much better understanding of how to create a solid operating agreement that protects your business and your fellow members.

Why You Absolutely Need an Operating Agreement Template for Your Multi Member LLC

Imagine embarking on a long road trip without a map or GPS. You might eventually reach your destination, but the journey will likely be filled with detours, disagreements, and unnecessary stress. That’s what running a multi member LLC without an operating agreement feels like. You’re essentially navigating the business world blindfolded, hoping for the best but unprepared for the worst.

An operating agreement template for multi member LLC acts as your roadmap, providing clarity and structure for how your company will operate. It addresses key issues that can arise as your business grows and evolves. By outlining the rights and responsibilities of each member, you reduce the risk of conflict and ensure that everyone is on the same page. This is particularly important in multi member LLCs where differing opinions and management styles are common.

Furthermore, having a well-drafted operating agreement can protect your personal assets. By clearly separating the business from its owners, you reinforce the limited liability status of your LLC. This means that if the business incurs debts or faces lawsuits, your personal assets (like your home or savings) are typically shielded from creditors or legal claims.

Another often overlooked benefit is that a comprehensive operating agreement can make your LLC more attractive to potential investors or lenders. They’ll want to see that you’ve taken the time to formalize your business structure and that you have a clear plan for how the company will be managed. This can instill confidence and make it easier to secure funding or loans when you need them.

Finally, state laws regarding LLCs can be quite vague. In the absence of an operating agreement, state laws will govern your LLC, which might not be ideal for your specific business needs. An operating agreement allows you to customize the rules and regulations that apply to your LLC, ensuring they align with your unique circumstances and goals. Using an operating agreement template for multi member LLC is not just a good idea; it’s a crucial step towards building a successful and sustainable business.

Key Elements of a Robust Operating Agreement

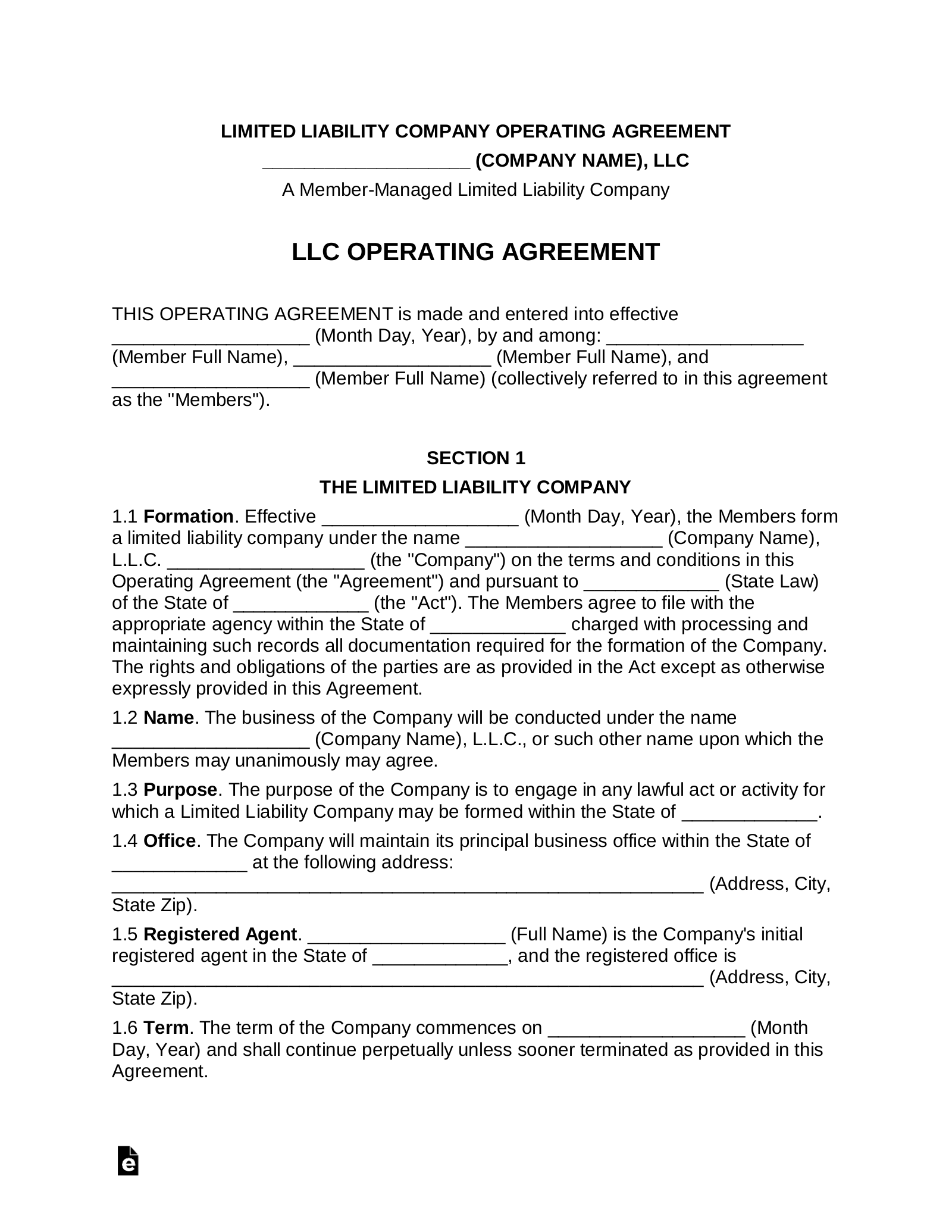

Now that you understand why an operating agreement is so important, let’s delve into the essential elements that should be included in your document. Each section plays a vital role in defining the structure and operation of your LLC.

First and foremost, you’ll need to clearly identify the LLC’s name, address, and purpose. This information establishes the legal identity of your business and sets the stage for the rest of the agreement. You’ll also want to specify the effective date of the agreement, which marks the day it officially takes effect.

Next, you should outline the members’ contributions, both initial and future. This includes the amount of cash, property, or services each member is contributing to the LLC. It’s crucial to accurately record these contributions, as they often determine each member’s ownership percentage and share of profits and losses. You also need to define how additional capital contributions will be handled, including whether members are obligated to make further contributions and what happens if they fail to do so.

The operating agreement must also detail how profits and losses will be allocated among the members. This can be based on ownership percentage, capital contributions, or another formula agreed upon by the members. You should also specify how distributions of profits will be made, including the frequency and timing of such distributions.

Another critical section addresses the management structure of the LLC. Will the LLC be member managed, where all members participate in the day-to-day operations, or will it be manager managed, where one or more designated managers are responsible for running the business? The operating agreement should clearly define the roles, responsibilities, and authority of the managers or members involved in management.

Finally, the operating agreement should include provisions for member withdrawals, transfers of ownership, and dissolution of the LLC. These sections should outline the procedures for a member to leave the LLC, sell their stake to another party, or dissolve the business altogether. By addressing these issues upfront, you can avoid potential disputes and ensure a smooth transition in the event of significant changes.

Taking the time to carefully craft your multi member LLC operating agreement is an investment that will pay dividends down the road. It’s far better to address potential issues proactively than to scramble to find solutions when problems arise.

Consider consulting with an attorney or business advisor to ensure that your operating agreement is comprehensive, legally sound, and tailored to your specific business needs. While an operating agreement template for multi member LLC can be a great starting point, professional guidance can help you avoid costly mistakes and protect your interests.