Ever felt like navigating the world of loans is like trying to decipher a foreign language? Especially when traditional banks aren’t an option, and you’re turning to private lenders for financing? That’s where the importance of a solid private money loan agreement comes into play. It’s the roadmap, the rule book, and the safety net all rolled into one document. Think of it as your peace of mind neatly packaged in legal jargon, but don’t worry, we’re here to break it down.

This isn’t just some formality to check off the list; it’s the foundation of a successful lending relationship. A well-crafted agreement clearly outlines the terms of the loan, protecting both the lender and the borrower. From interest rates to repayment schedules and potential penalties, every detail is laid out in black and white, minimizing the risk of misunderstandings or disputes down the road. Because let’s face it, no one wants a financial disagreement to sour a relationship, especially when money is involved.

In the following sections, we will delve into the key elements of a private money loan agreement template, what to include, and where you can find a suitable template to get you started. We’ll aim to simplify the often-complex world of loan agreements, empowering you to make informed decisions and protect your interests whether you’re lending or borrowing funds. After all, knowledge is power, especially when it comes to your financial future.

Why You Need a Robust Private Money Loan Agreement

Imagine lending a significant amount of money to a friend or family member without clearly defining the repayment terms. Sounds like a recipe for disaster, right? The same principle applies to private money loans, regardless of the relationship between the lender and the borrower. A well-structured private money loan agreement serves as a legally binding contract that protects the interests of all parties involved. It’s not just about the money; it’s about establishing clear expectations and preventing future disputes.

So, what exactly makes a private money loan agreement so crucial? Firstly, it provides clarity regarding the principal loan amount, the interest rate, and the repayment schedule. It spells out exactly when and how the money will be repaid, leaving no room for ambiguity. Secondly, it addresses potential risks and contingencies, such as late payment penalties, default provisions, and the process for resolving disagreements. By anticipating potential issues and outlining clear procedures, the agreement helps to minimize the risk of costly legal battles.

Furthermore, a comprehensive agreement fosters transparency and trust between the lender and the borrower. When both parties understand their rights and obligations, it creates a more comfortable and collaborative lending environment. This can be especially important in private lending situations where personal relationships are often involved. Having everything in writing ensures that everyone is on the same page and reduces the likelihood of misunderstandings.

Consider this: without a formal agreement, disputes can easily arise over seemingly minor details. What happens if the borrower is unable to make a payment on time? How will late fees be calculated? What recourse does the lender have if the borrower defaults on the loan? A detailed agreement provides answers to these questions, preventing them from escalating into major conflicts. It’s essentially an insurance policy against potential problems.

In essence, a private money loan agreement is an indispensable tool for anyone involved in private lending. It protects your financial interests, promotes transparency, and fosters a healthy lending relationship. Taking the time to create a thorough and well-drafted agreement is an investment in your peace of mind and the success of the lending transaction.

Key Components of a Private Money Loan Agreement Template

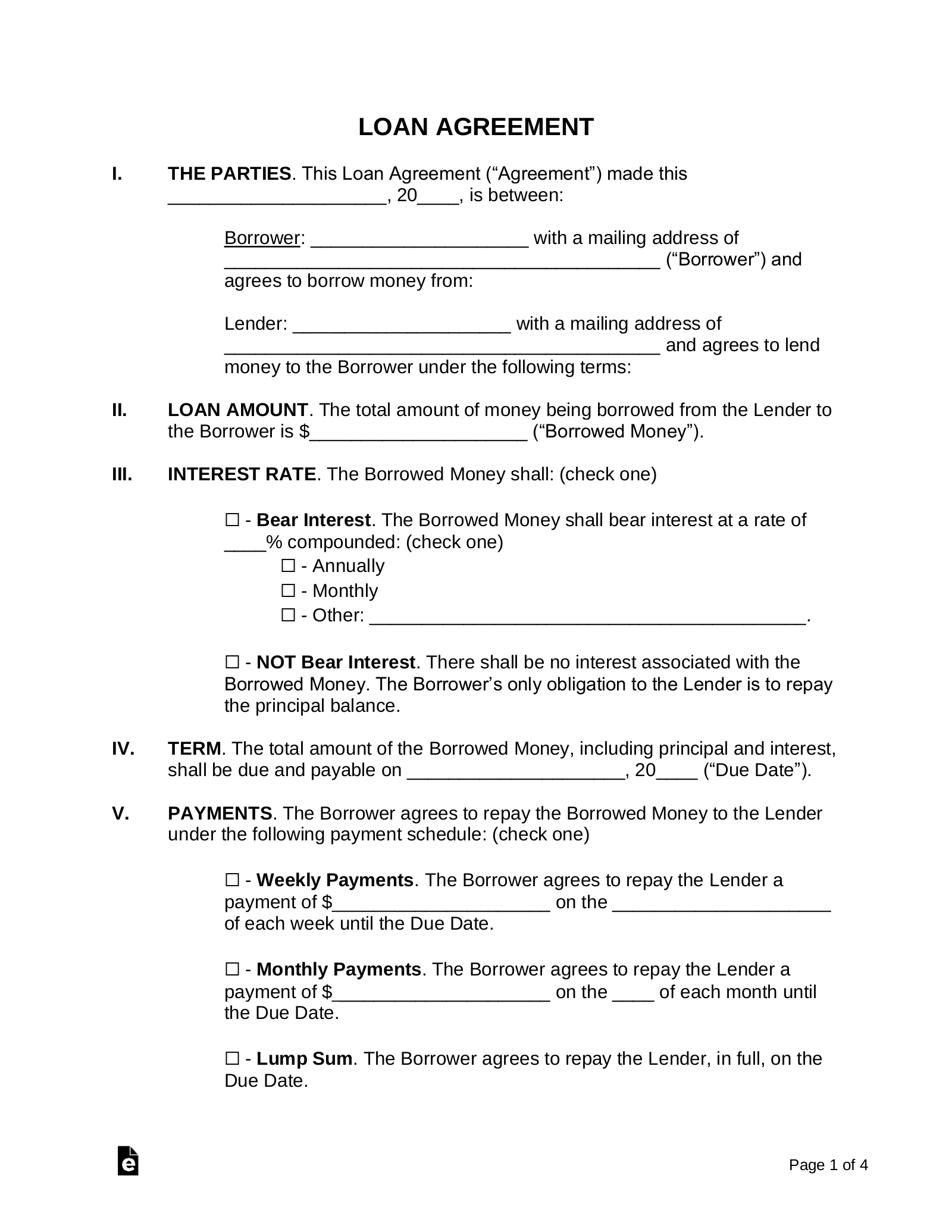

Now that we understand the importance of a private money loan agreement, let’s dive into the essential components that should be included in any template. While specific terms may vary depending on the nature of the loan and the relationship between the parties, certain elements are fundamental to ensure clarity and enforceability.

First and foremost, the agreement must clearly identify the parties involved: the lender and the borrower. Include their full legal names and addresses to avoid any confusion. Next, specify the principal loan amount – the exact amount of money being borrowed. This is a critical detail that should be stated clearly and unambiguously. The agreement should then outline the interest rate, including whether it’s a fixed or variable rate, and how it will be calculated. Be sure to comply with all applicable usury laws in your jurisdiction.

Another crucial element is the repayment schedule. This section should detail the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date. Specify the acceptable methods of payment (e.g., check, electronic transfer) and where the payments should be sent. Also include details on how payments will be applied (e.g., first to interest, then to principal).

The agreement should also address potential consequences of late payments or default. Clearly outline the late payment penalties, such as a late fee or an increase in the interest rate. Define what constitutes a default (e.g., failure to make payments for a certain period) and specify the lender’s recourse in the event of a default. This may include the right to accelerate the loan (demand immediate repayment of the entire balance), foreclose on any collateral securing the loan, or pursue legal action.

Finally, the agreement should include provisions for governing law and dispute resolution. Specify the state or jurisdiction whose laws will govern the agreement and outline the process for resolving any disputes that may arise. This may include mediation, arbitration, or litigation. By addressing these key components, you can create a comprehensive and enforceable private money loan agreement that protects the interests of both the lender and the borrower. Using a private money loan agreement template can help ensure that all these essential elements are covered. Remember to consult with an attorney to ensure that the agreement complies with all applicable laws and regulations.

Navigating private money lending requires caution and a clear understanding of the terms involved. A meticulously drafted private money loan agreement template is a critical tool for mitigating risk and fostering a transparent relationship between lenders and borrowers.

Ultimately, whether you are providing or receiving funds, protecting your interests with a comprehensive and legally sound private money loan agreement template is a step you won’t regret.