So, you’re diving into the world of real estate investment with partners? That’s fantastic! Combining resources and expertise can be a powerful strategy. But before you start scouting properties and crunching numbers, there’s a crucial document you need to nail down: a real estate investment operating agreement. Think of it as the roadmap for your partnership, outlining everyone’s roles, responsibilities, and how profits (and losses) will be divided. It’s the foundation upon which your successful venture will be built.

Without a solid operating agreement, disagreements and misunderstandings can quickly derail even the most promising real estate deals. Imagine a scenario where partners clash over decision-making authority, capital contributions, or exit strategies. A well-drafted agreement anticipates these potential conflicts and provides a clear framework for resolution. This is where having a real estate investment operating agreement template comes in handy.

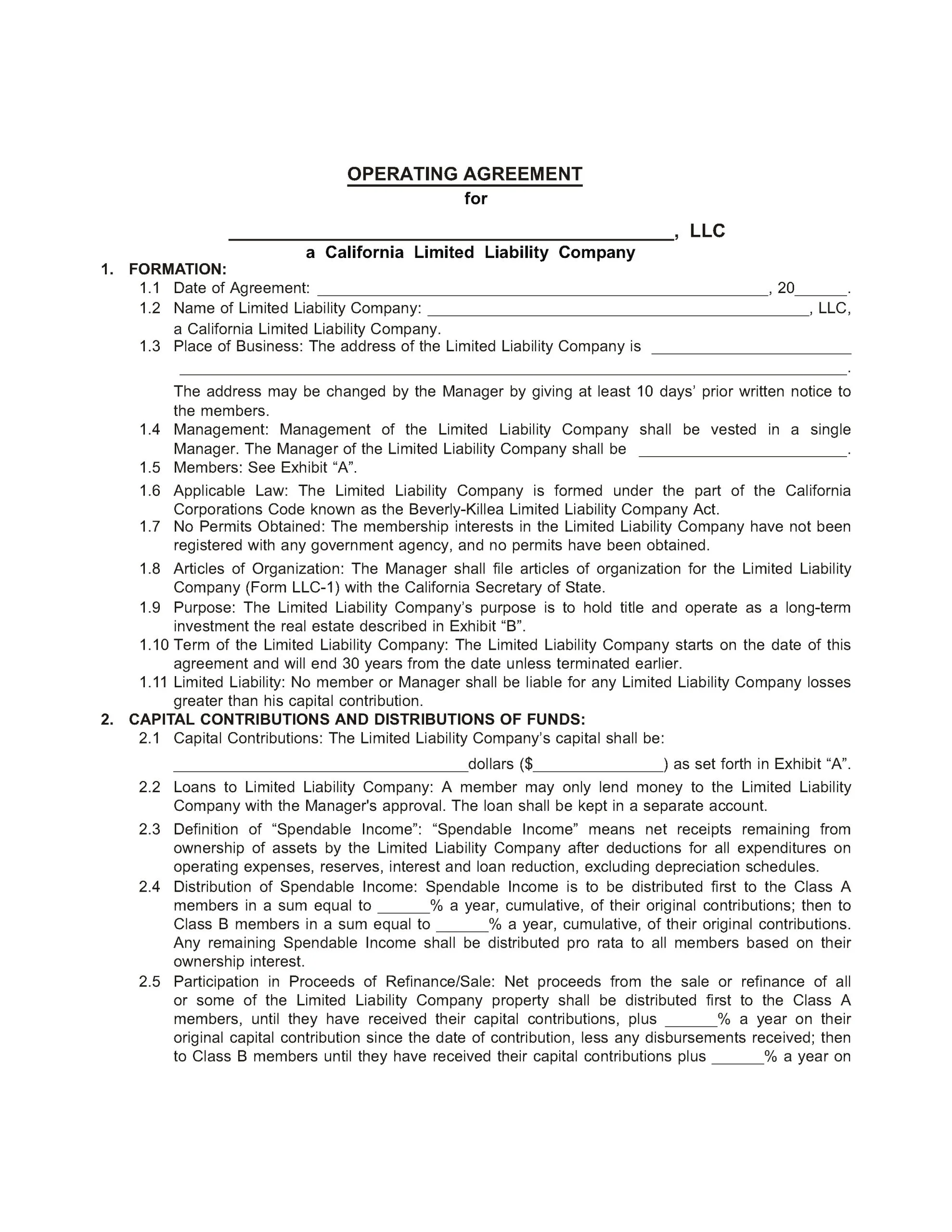

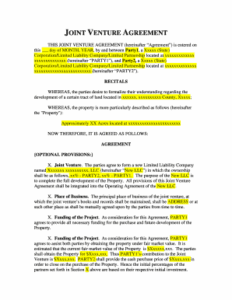

While it’s always recommended to seek legal counsel for a tailored agreement, using a template can be a great starting point. A good real estate investment operating agreement template will cover the essential aspects of your partnership, providing a solid foundation for your lawyer to customize to your specific needs. It helps to formalize your plans, clarify expectations, and protect the interests of all parties involved. Let’s explore what these documents entail.

Why You Absolutely Need a Real Estate Investment Operating Agreement

Let’s face it: partnerships can be tricky. Even with the best of intentions, disagreements can arise when significant sums of money and high-stakes decisions are involved. That’s precisely why a comprehensive operating agreement is non-negotiable for any real estate investment partnership. It’s more than just a legal formality; it’s a safeguard that protects everyone’s interests and ensures the smooth operation of your investment venture.

At its core, the operating agreement defines the structure of your partnership. It clearly identifies the members (partners), their respective ownership percentages, and their roles within the investment. It spells out how decisions will be made – whether it’s a simple majority vote or requires unanimous consent. This clarity is crucial for preventing gridlock and ensuring that decisions are made efficiently and fairly.

The agreement will also detail how capital contributions are handled. How much will each partner contribute initially? What happens if additional funds are needed later on? Are there penalties for partners who fail to meet their capital commitments? Addressing these questions upfront prevents financial disputes down the line and ensures that everyone is on the same page regarding funding the investment.

Furthermore, a robust operating agreement outlines how profits and losses will be allocated among the partners. Will they be distributed based on ownership percentages? Or will there be a different formula that considers factors such as effort, expertise, or capital contributions? Clearly defining the distribution method ensures transparency and fairness, fostering a harmonious partnership.

Finally, the operating agreement should address the exit strategy for the partnership. What happens if a partner wants to leave? Can they sell their stake to an outsider? What are the buy-out provisions? Having a pre-defined exit strategy prevents messy legal battles and ensures a smooth transition if a partner decides to move on. Consider this to be the prenuptial agreement for your real estate investment.

Key Elements of a Real Estate Investment Operating Agreement Template

A comprehensive real estate investment operating agreement template should cover all the essential aspects of your partnership. While every agreement will be tailored to the specific circumstances of the investment, there are some fundamental elements that should always be included. Let’s take a closer look at some of the key provisions.

First, you’ll need to clearly define the purpose of the partnership. What types of properties will you be investing in? What is the geographic focus of your investments? Specifying the scope of the partnership helps to keep everyone aligned and prevents mission creep. This helps to maintain the overall goal for the investment and where you plan to put your money.

Next, the agreement should detail the management structure of the partnership. Who will be responsible for day-to-day operations? Who will make major decisions about acquisitions, sales, and financing? Clearly defining the roles and responsibilities of each partner ensures that everyone knows their place and prevents confusion. This is very important when it comes to how your investments are being handled.

The template must also address the issue of dispute resolution. What happens if the partners disagree on a major decision? Will you use mediation, arbitration, or litigation to resolve the dispute? Having a pre-defined dispute resolution process can save time, money, and aggravation in the long run. When entering into a partnership or agreement, it is important to understand how disagreements will be handled.

Another important element is the provision for amendments. As your investment evolves, you may need to make changes to the operating agreement. The template should outline the process for amending the agreement, ensuring that all partners are on board with any changes. This section should include details such as who has the authority to amend the agreement and the process for doing so.

Finally, the real estate investment operating agreement template should include provisions for termination of the partnership. Under what circumstances can the partnership be terminated? What happens to the assets of the partnership upon termination? Addressing these questions upfront ensures that everyone is aware of the exit strategy and the consequences of termination. This can help you prevent future disagreements that are related to ending the partnership.

Building a successful real estate investment partnership requires careful planning, clear communication, and a well-drafted operating agreement. Using a real estate investment operating agreement template can provide a solid foundation for your partnership, helping you to navigate the complexities of joint ownership and maximize your investment returns.

An operating agreement fosters a strong partnership. With clearly defined roles, contributions, and exit strategies, you’ll be well-equipped for success.