So, you’re thinking about diving into the exciting world of real estate investing, but you don’t want to go it alone? Smart move! Partnering up can leverage your resources, knowledge, and even spread the risk. But before you start dreaming of flipping houses or managing apartment buildings, you need a solid foundation. That’s where a real estate investment partnership agreement template comes in handy. Think of it as the rule book for your team, ensuring everyone is on the same page and knows their role in the grand scheme of things.

This isn’t just some formality; it’s a critical document that outlines the responsibilities, contributions, and profit-sharing arrangements for each partner. Without it, you’re essentially building your real estate empire on shaky ground, potentially leading to disagreements, misunderstandings, and even legal battles down the road. Trust me, a little bit of planning upfront can save you a whole lot of headache later on. A real estate investment partnership agreement template will protect your interest.

In this article, we’ll break down the key components of a real estate investment partnership agreement template, explaining why each section is important and how it can benefit your partnership. We’ll also explore some common pitfalls to avoid and offer tips for customizing the template to fit your specific needs. By the end, you’ll have a much clearer understanding of what this agreement entails and how to use it to create a successful and harmonious partnership.

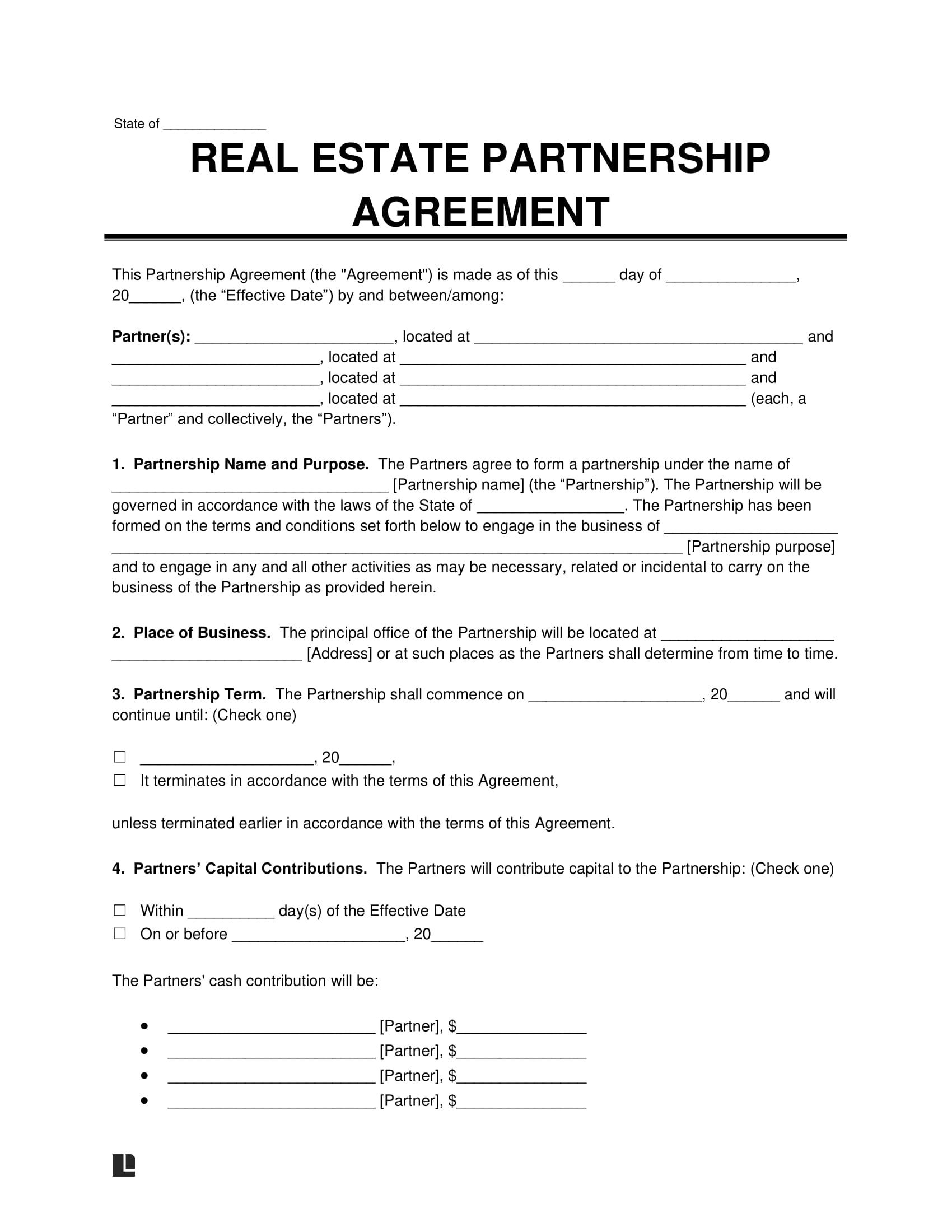

Understanding the Core Elements of a Real Estate Partnership Agreement

The real estate investment partnership agreement template serves as the blueprint for your joint venture. It’s not a one-size-fits-all solution, but rather a framework that you need to tailor to the specific details of your partnership. Let’s dive into some of the essential elements that should be included:

First and foremost, clearly define the partnership’s purpose and scope. What type of real estate investments will you be pursuing? What geographic areas will you focus on? What’s the overall objective of the partnership? Be as specific as possible to avoid any ambiguity down the line. This might seem obvious, but differing expectations about the partnership’s goals can be a major source of conflict later on.

Next, you need to outline the contributions of each partner. This includes not only financial investments but also any expertise, time, or resources that each partner brings to the table. For example, one partner might be responsible for finding and analyzing potential deals, while another might handle the financing and legal aspects. Clearly define the value of each partner’s contribution and how it will be factored into the profit-sharing arrangement.

Speaking of profit-sharing, this is where things can get a bit complex. How will profits be divided among the partners? Will it be a straight percentage split based on initial investment, or will there be other factors involved, such as sweat equity or management responsibilities? Consider using a tiered profit-sharing structure that rewards partners based on performance. Also, be sure to address how losses will be handled, as well.

The agreement should also include provisions for decision-making. Who has the authority to make key decisions on behalf of the partnership? Will decisions be made by majority vote, or will unanimous consent be required? What happens if the partners disagree on a critical issue? Having a clear decision-making process in place can prevent gridlock and ensure that the partnership can move forward efficiently.

Finally, don’t forget to address the exit strategy. What happens if a partner wants to leave the partnership? How will their share of the assets be valued and distributed? Will the remaining partners have the option to buy out the departing partner’s interest? Having a well-defined exit strategy can prevent messy disputes and ensure a smooth transition in the event of a partner’s departure.

Essential Clauses to Include in Your Agreement

Beyond the core elements, there are several other clauses that you should consider including in your real estate investment partnership agreement template. These clauses can help protect your interests and prevent potential conflicts down the road. Let’s take a look at a few of the most important ones:

A confidentiality clause is crucial for protecting sensitive information about the partnership’s business operations, investment strategies, and financial data. This clause should prohibit partners from disclosing confidential information to third parties without the consent of the other partners. This is especially important in today’s competitive real estate market, where insider information can be incredibly valuable.

A non-compete clause can prevent partners from engaging in competing real estate investments that could harm the partnership’s interests. This clause should define the scope of the non-compete restriction, including the geographic area and the types of real estate investments that are prohibited. Without a non-compete clause, a partner could potentially use their knowledge and resources gained from the partnership to compete against it.

A dispute resolution clause outlines the process for resolving any disagreements or conflicts that may arise between the partners. This clause could specify that disputes will be resolved through mediation, arbitration, or litigation. Mediation and arbitration are often preferred over litigation, as they are typically faster and less expensive. Having a clear dispute resolution process in place can prevent conflicts from escalating into costly legal battles.

An amendment clause specifies how the agreement can be modified or amended in the future. This clause should require that any amendments be made in writing and signed by all partners. This ensures that any changes to the agreement are properly documented and agreed upon by all parties. Over time, as the partnership evolves and market conditions change, it may be necessary to update the agreement to reflect these changes.

Lastly, a severability clause states that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will still remain in effect. This prevents the entire agreement from being invalidated due to a single unenforceable clause. This is a standard clause that is included in most contracts to protect the overall validity of the agreement.

Crafting a successful real estate investment partnership requires careful consideration, open communication, and a commitment to collaboration. Don’t rush the process, and be sure to consult with legal and financial professionals to ensure that your agreement is comprehensive and tailored to your specific needs.

A well-structured real estate investment partnership agreement template isn’t just about protecting yourself legally; it’s about fostering a strong and productive working relationship with your partners, creating a foundation for long-term success in the exciting world of real estate. By carefully considering each element and customizing the agreement to fit your specific circumstances, you can set your partnership up for a prosperous future.