Need a little cash to tide you over until your next paycheck? Maybe an unexpected bill popped up, or you just want to seize a great deal before it disappears. A short term personal loan can be a lifesaver in these situations. But before you borrow or lend any money, it’s crucial to have a clear and legally sound agreement in place. That’s where a short term personal loan agreement template comes in handy. Think of it as a roadmap for your loan, ensuring everyone is on the same page and minimizing potential misunderstandings down the road.

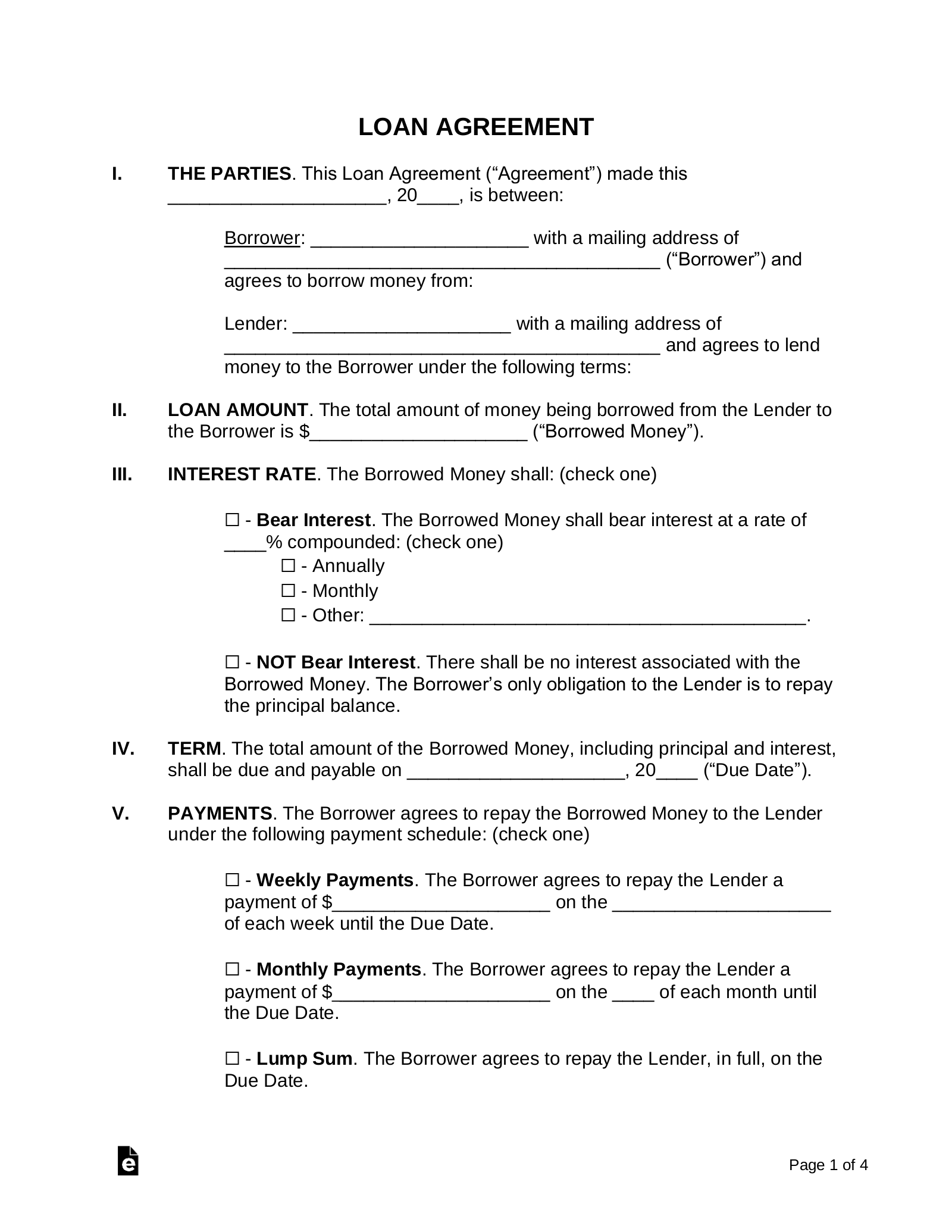

Creating a loan agreement might seem daunting, but it doesn’t have to be. Using a template is a great starting point. It provides a framework that you can customize to fit your specific needs. These templates typically cover all the essential elements, such as the loan amount, interest rate (if any), repayment schedule, and what happens if someone misses a payment. This clarity helps protect both the lender and the borrower, fostering trust and a smoother borrowing experience.

In this article, we’ll explore the ins and outs of short term personal loans and how to use a short term personal loan agreement template effectively. We’ll break down the key components, highlight important considerations, and help you create a document that works for your unique situation. No legal jargon overload – just straightforward advice to help you navigate the world of short term lending with confidence.

Why You Need a Solid Short Term Personal Loan Agreement

Imagine lending a friend a couple hundred dollars with a vague promise to “pay you back soon.” A few weeks turn into months, and suddenly the money feels lost in the ether. Friendships can become strained and uncomfortable, all because the terms of the loan weren’t clearly defined. This scenario highlights why a formal loan agreement, even for small amounts and with people you trust, is incredibly important.

A well-crafted short term personal loan agreement acts as a safeguard. It transforms an informal understanding into a legally binding contract. This means that if either party fails to uphold their end of the bargain, there are legal avenues to pursue. While the hope is that you’ll never need to resort to legal action, having the agreement in place provides a sense of security and clarity for everyone involved.

Furthermore, a written agreement prevents misunderstandings. Memories can be faulty, and assumptions can lead to conflict. A formal document clearly outlines the responsibilities of both the borrower and the lender, leaving no room for ambiguity. This is especially vital when dealing with interest rates, repayment schedules, and potential penalties for late payments.

Think of it this way: a short term personal loan agreement template is a tool that protects your financial well-being and your relationships. It sets clear expectations, reduces the risk of disputes, and ensures that everyone is treated fairly. It demonstrates professionalism and respect, strengthening the bond between lender and borrower.

Finally, in the unlikely event that a dispute does arise, a written agreement provides solid evidence to support your claim. It offers a clear record of the agreed-upon terms, which can be invaluable in resolving the issue quickly and efficiently, potentially avoiding costly legal battles.

Key Components of a Short Term Personal Loan Agreement Template

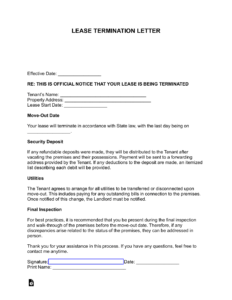

When you’re looking at a short term personal loan agreement template, it’s important to understand what each section is for. Here’s a breakdown of the critical elements you’ll typically find:

Loan Amount and Interest Rate: This is the heart of the agreement. Clearly state the total amount of money being loaned and the interest rate (if any). If you’re not charging interest, explicitly state that the interest rate is 0%. Be precise and leave no room for interpretation.

Repayment Schedule: This section outlines how the loan will be repaid. Will it be a single lump sum payment, or will it be paid in installments? If it’s installments, specify the amount of each payment and the date on which each payment is due. Consider including a table or chart for clarity.

Late Payment Penalties: What happens if the borrower misses a payment? Outline the penalties for late payments, such as late fees or increased interest rates. Be reasonable and avoid penalties that are excessively high or unreasonable.

Default Clause: This section defines what constitutes a default on the loan. Typically, default occurs when the borrower fails to make payments as agreed. It also outlines the lender’s recourse in the event of default, such as the right to take legal action to recover the outstanding debt.

Governing Law: Specify the state or jurisdiction whose laws will govern the agreement. This is important because laws vary from place to place, and it helps ensure that any legal disputes will be resolved in a consistent and predictable manner.

Signatures: Both the borrower and the lender must sign and date the agreement. It’s a good idea to have the signatures witnessed and notarized for added legal validity.

A short term personal loan agreement template is a powerful tool for creating a legally sound agreement that protects both the borrower and the lender. By understanding the key components and tailoring the template to your specific needs, you can ensure a smooth and transparent borrowing experience.

Remember to review your short term personal loan agreement template with care and seek legal counsel if you have any concerns. A little effort upfront can save you a lot of headaches down the road.

Before lending or borrowing money, make sure you fully understand the terms of the agreement, and that it meets your needs.