So, you’re thinking about bringing in some investors to help your business grow? That’s fantastic! But before you pop the champagne and start planning your next big move, there’s a crucial piece of paperwork you need to get sorted: an equity investment agreement. Don’t worry, it doesn’t have to be a terrifying legal maze. This is where a simple equity investment agreement template comes in handy.

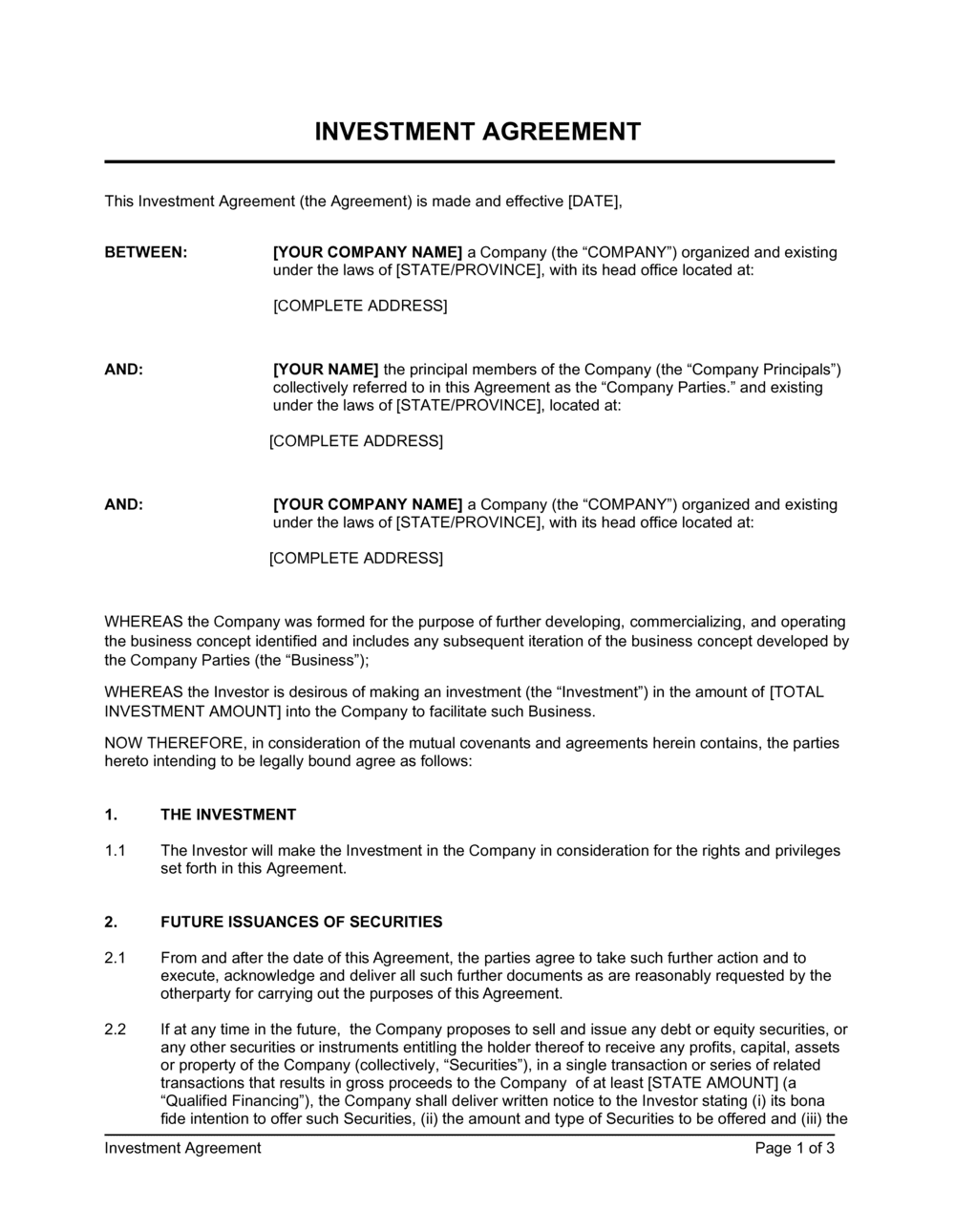

Think of it as a clear roadmap that outlines the terms of the investment. It protects both you, the business owner, and your investors, ensuring everyone is on the same page and understands their rights and responsibilities. It lays out everything from how much equity the investor gets in exchange for their money, to what happens if things don’t go exactly as planned. It’s essentially a legally binding promise.

Without a solid agreement, things can get messy down the line. Imagine disagreements arising over ownership percentages, voting rights, or even the future direction of the company. A well-drafted agreement can prevent these conflicts and provide a framework for resolving any issues that might crop up, allowing you to focus on what you do best: building your business.

Understanding the Key Elements of an Equity Investment Agreement

Equity investment agreements, even the simple ones, cover a lot of ground. They’re designed to be comprehensive, leaving little room for interpretation and ambiguity. While every agreement is unique and should be tailored to the specific situation, there are some key elements that are common to almost all of them. Let’s break down some of the most important aspects.

First and foremost, the agreement will clearly state the amount of investment being made and the percentage of equity the investor will receive in return. This seems obvious, but it’s crucial to have this clearly defined to avoid any future disputes. The type of equity being issued is also important; is it common stock, preferred stock, or something else? Each type carries different rights and privileges.

Another vital section details the closing conditions. These are the specific requirements that must be met before the investment can actually take place. This could include things like completing due diligence, obtaining necessary approvals, or finalizing other legal documents. Think of it as the checklist that needs to be completed before the deal is officially done.

The agreement will also outline the rights and obligations of both the company and the investor. This includes things like voting rights, information rights (the investor’s right to access company information), and pre-emptive rights (the investor’s right to participate in future funding rounds). From the company’s perspective, it could include obligations such as providing regular financial reports or adhering to certain operational guidelines.

Finally, it’s important to have provisions that address what happens in certain specific scenarios, such as a sale of the company, a liquidation event, or a dispute between the parties. These clauses, often referred to as “exit provisions,” dictate how the investor’s investment will be handled in these situations and help protect their interests. This is where a simple equity investment agreement template can really help to provide a starting point and ensure you haven’t missed anything crucial.

Why Use a Simple Equity Investment Agreement Template?

Creating an equity investment agreement from scratch can be a daunting task, especially if you don’t have a legal background. The legal jargon alone can be enough to make your head spin! That’s where a simple equity investment agreement template comes in as a lifesaver. It provides a pre-written framework that you can customize to fit your specific needs, saving you time, money, and a whole lot of stress.

One of the biggest advantages of using a template is that it ensures you don’t overlook any important clauses or provisions. These templates are typically drafted by legal professionals and include all the standard terms and conditions that are essential for a comprehensive agreement. This helps to protect both you and your investors and minimizes the risk of future disputes.

Templates also offer a significant cost savings compared to hiring a lawyer to draft an agreement from scratch. While it’s always a good idea to have a lawyer review the final document, using a template can significantly reduce the amount of billable hours. This is particularly beneficial for startups and small businesses that are operating on a limited budget.

Customization is key. A template is a starting point, not a final solution. Be sure to tailor the language to accurately reflect the specific details of your investment. This might involve adjusting the equity percentage, modifying the closing conditions, or adding specific clauses that address unique aspects of your business. A simple equity investment agreement template is just a tool to get you started.

Remember, clarity is crucial. Ensure that the agreement is written in plain language that everyone involved can understand. Avoid using overly technical jargon or ambiguous terms. The goal is to create a document that is clear, concise, and easy to interpret, minimizing the potential for misunderstandings or disagreements. Getting legal advice to review the finalized template is always a good idea.

Ultimately, bringing in investors can be a game-changer for your business. By using a solid framework for your agreement, you’re setting the stage for a successful and mutually beneficial partnership. Don’t be intimidated by the process; take it one step at a time, and remember that a clear and well-defined agreement is the foundation for a strong and lasting relationship.

Taking the time to craft a thoughtful and comprehensive agreement will pay dividends in the long run, creating a solid foundation for your investor relationships and allowing you to focus on growing your business without the added stress of potential legal disputes. It’s an investment in peace of mind and a clear path to success.