So, you’re launching a startup. Congratulations! That’s a massive undertaking, and you’re likely realizing you can’t do it all alone. Bringing in advisors, especially through a startup forum, can be a game-changer. These seasoned pros offer invaluable guidance, connections, and experience. But before you start picking their brains, it’s crucial to formalize the relationship with a solid advisor agreement. This agreement protects both you and your advisor, setting clear expectations and preventing misunderstandings down the line. Think of it as the roadmap for a successful advisory relationship.

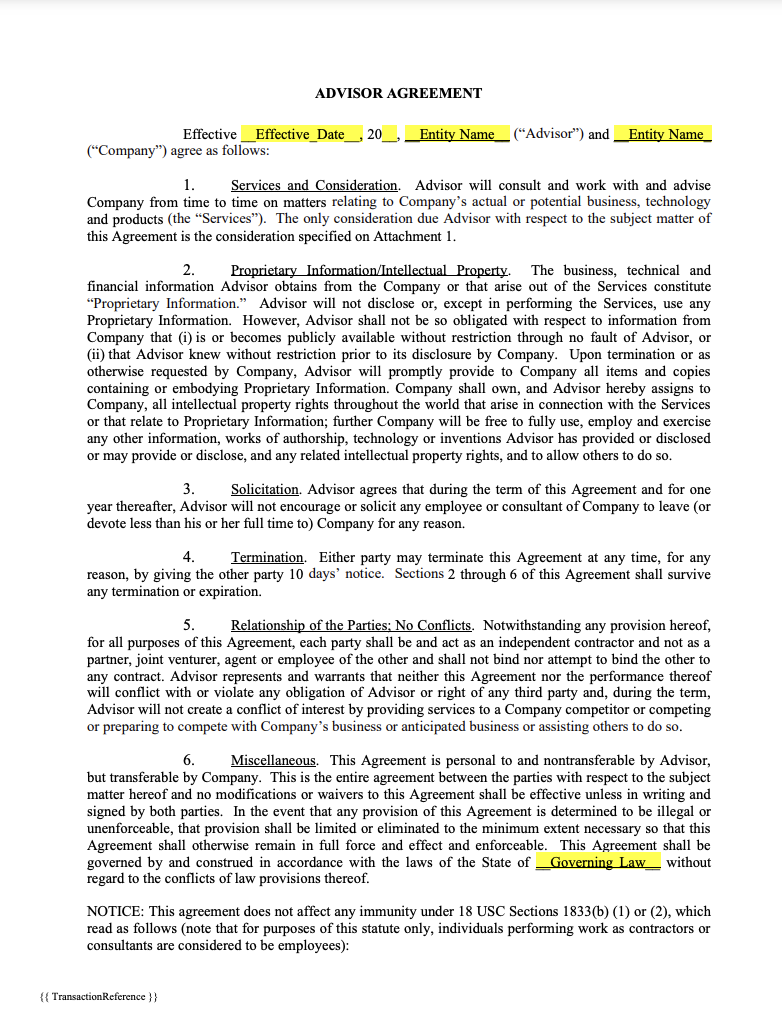

Navigating the startup world is challenging enough without the added stress of legal ambiguities. A well-crafted advisor agreement, especially when sourced from a startup forum advisor agreement template, outlines the scope of the advisor’s role, the compensation they’ll receive (often in the form of equity or options), confidentiality obligations, and termination clauses. This clarity is essential for fostering a trusting and productive working relationship. It’s about setting the stage for a win-win situation where your startup benefits from expert advice and the advisor feels valued and respected.

Without a written agreement, things can get messy. What happens if the advisor’s advice doesn’t pan out? What if they share confidential information? What if you disagree on the level of commitment required? A startup forum advisor agreement template helps address these potential issues upfront, providing a framework for resolving disputes and ensuring everyone is on the same page. It’s about building a foundation of transparency and accountability from the very beginning.

Why You Need a Startup Forum Advisor Agreement Template

A startup forum advisor agreement template isn’t just a piece of paper; it’s a critical tool for managing relationships with your advisors. It’s about protecting your company, clarifying expectations, and fostering a professional environment. Think of it as an investment in the future success of your startup. It addresses crucial aspects of the advisor relationship, preventing misunderstandings and potential legal issues. It’s a proactive step that demonstrates your professionalism and commitment to building a solid foundation for your business.

One of the most important aspects of an advisor agreement is defining the scope of the advisor’s role. What exactly will they be advising you on? Will they be providing strategic guidance, technical expertise, or introductions to potential investors? The agreement should clearly outline the advisor’s responsibilities, so there’s no ambiguity about what’s expected of them. This helps prevent scope creep and ensures that the advisor’s efforts are focused on areas where they can provide the most value.

Compensation is another crucial element. Advisors often receive equity or stock options in exchange for their time and expertise. The agreement should clearly specify the amount of equity, the vesting schedule, and any other relevant terms. This ensures that the advisor is fairly compensated for their contributions and that their interests are aligned with the success of the company. Transparency in compensation is key to maintaining a positive and productive relationship.

Confidentiality is also paramount. Advisors often have access to sensitive information about your company, including business plans, financial data, and customer lists. The agreement should include a strong confidentiality clause that prohibits the advisor from disclosing this information to third parties. This protects your company’s trade secrets and competitive advantage. It ensures that the advisor understands their obligation to keep your information confidential and that there are consequences for violating this obligation.

Finally, the agreement should address termination. What happens if you or the advisor decide to end the relationship? The agreement should outline the process for termination, including any notice periods or severance payments. This provides clarity and protects both parties in the event that the relationship ends. It ensures a smooth and professional transition, minimizing disruption to your business.

Key Components of a Solid Advisor Agreement

A robust advisor agreement should cover several key areas to ensure clarity and protect both parties. It’s more than just a formality; it’s a framework for a successful and mutually beneficial relationship. Without a clear understanding of each party’s responsibilities and rights, the advisory relationship can quickly become strained, potentially leading to conflicts that detract from the startup’s core objectives. A well-defined agreement helps prevent misunderstandings and sets the stage for a productive and collaborative partnership.

First and foremost, the agreement needs to define the services to be provided by the advisor. Be specific. Instead of saying “general business advice,” break it down. Is the advisor helping with marketing, fundraising, product development, or something else? Detailing the specific areas where the advisor’s expertise will be utilized is crucial for managing expectations and ensuring the advisor’s efforts are focused where they are most needed. A clearly defined scope of work also helps to avoid scope creep and ensures that both parties are on the same page regarding the advisor’s role.

Next, the agreement should clearly outline the compensation structure. Will the advisor be paid in cash, equity, or a combination of both? If equity is involved, specify the percentage, vesting schedule, and any other relevant terms. It’s also important to address issues like dilution and liquidity events. Transparency in compensation is essential for maintaining a healthy advisor relationship and ensuring that the advisor feels valued for their contributions. A well-structured compensation package can also incentivize the advisor to provide their best possible guidance and support.

Confidentiality is paramount, especially in the startup world. The agreement must include a strong confidentiality clause to protect your company’s sensitive information. This clause should prohibit the advisor from disclosing confidential information to third parties, both during and after the advisory relationship. It’s also wise to include a clause addressing ownership of intellectual property developed during the advisory engagement. This ensures that your company retains ownership of any valuable innovations or creations that result from the advisor’s input.

Finally, the agreement should address termination and dispute resolution. Clearly outline the circumstances under which the agreement can be terminated, the notice period required, and any severance payments that may be due. It’s also a good idea to include a clause specifying how disputes will be resolved, such as through mediation or arbitration. Having these procedures in place can help to avoid costly and time-consuming litigation in the event of a disagreement.

Startups that formalize their advisor relationships with a startup forum advisor agreement template are more likely to create a lasting and impactful partnership. It signals to the advisor that you are serious about building a successful company and value their expertise.

Investing the time and effort to create a comprehensive agreement is a worthwhile endeavor that can save you headaches and protect your interests down the road. It’s an investment in the future success of your startup and a demonstration of your commitment to building a strong and sustainable business.