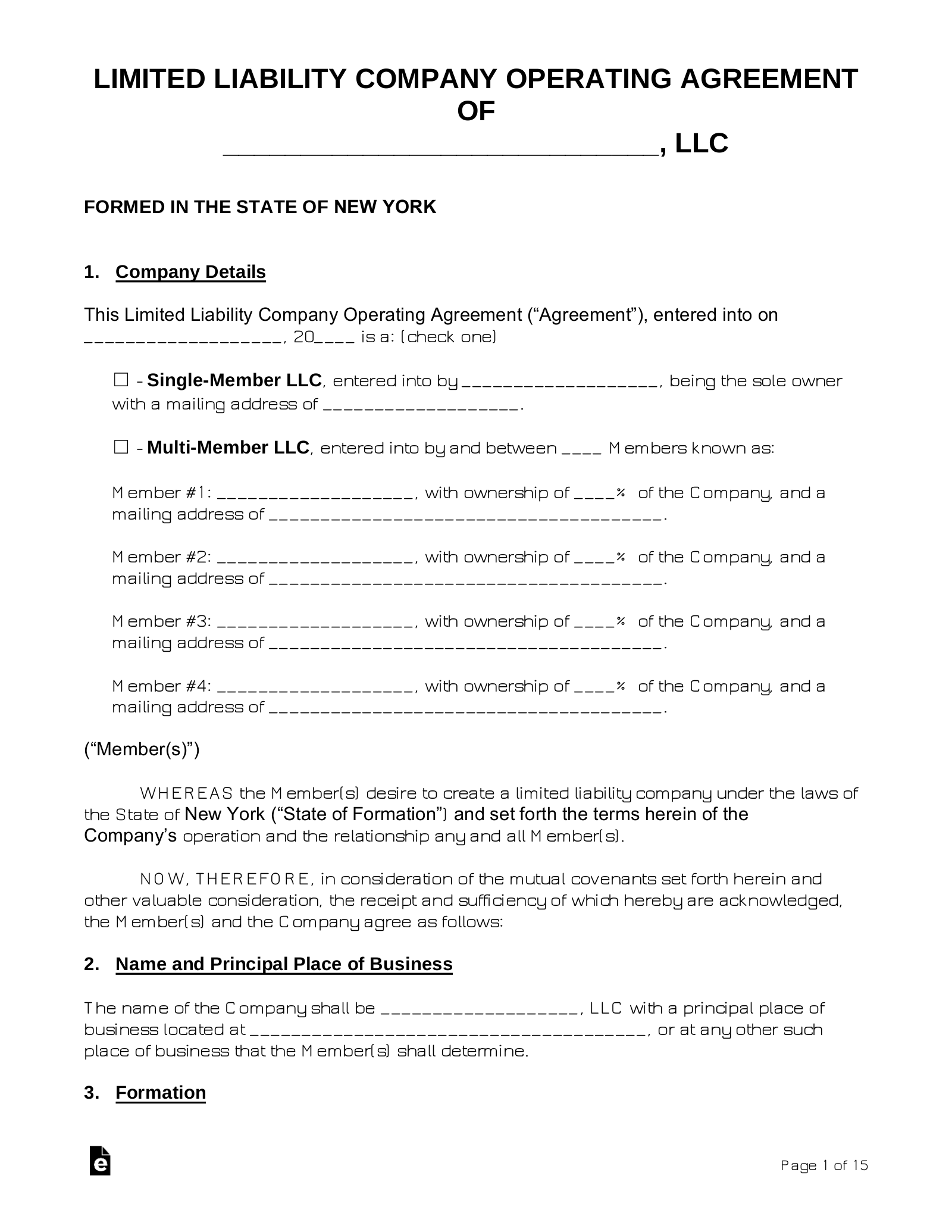

So, you’re taking the plunge and starting an LLC in the Empire State? Congratulations! That’s a huge step toward building your dream business. Now comes the slightly less glamorous, but equally important, part: paperwork. Specifically, we’re talking about your New York State LLC operating agreement template. Don’t let the name intimidate you. Think of it as the rulebook for your company. It’s there to protect you, your partners (if any), and your business from potential misunderstandings and legal headaches down the road.

While New York doesn’t technically require every LLC to have an operating agreement, flying without one is like sailing without a map. Sure, you *might* reach your destination, but you’re far more likely to get lost, run into trouble, or end up somewhere you didn’t intend. An operating agreement provides clarity and structure, preventing disputes and ensuring everyone is on the same page. It’s a valuable tool that outlines how your business will be run and managed.

Consider this article your friendly guide to navigating the world of operating agreements. We’ll break down what it is, why you need one (even if the state doesn’t explicitly demand it), and where you can find a reliable New York State LLC operating agreement template. We’ll walk you through the essential elements you should include to make sure your LLC is set up for success. Let’s dive in!

Why You Absolutely Need a New York State LLC Operating Agreement Template

Even though New York doesn’t legally mandate it for every LLC, you might be wondering why it’s so highly recommended to have a New York State LLC operating agreement template. The short answer? It’s about control, clarity, and protection. Let’s break down the key reasons why skipping this vital document is a bad idea.

First, it helps avoid the state’s default rules. Without an operating agreement, your LLC will be governed by New York’s default rules for LLCs. These rules may not align with your specific business needs or the way you want to operate. The agreement allows you to customize the operational aspects of your LLC, overriding the state’s generic guidelines and tailoring them to your unique situation. This is especially important if you have multiple members with varying roles and responsibilities.

Second, it clearly defines member roles and responsibilities. An operating agreement spells out each member’s contribution, responsibilities, and voting rights. This eliminates potential ambiguity and prevents disputes from arising later. It also clarifies how profits and losses will be distributed, which can be a major source of conflict if not addressed upfront. With a well-defined operating agreement, everyone knows their place and what’s expected of them.

Third, it protects your personal assets. One of the primary benefits of forming an LLC is to separate your personal assets from your business liabilities. A solid operating agreement strengthens this separation by demonstrating that your LLC is a legitimate business entity operating independently from its members. Without this documentation, it can be easier for creditors or legal opponents to “pierce the corporate veil” and come after your personal assets.

Fourth, it addresses unforeseen circumstances. What happens if a member dies, becomes disabled, or wants to leave the company? An operating agreement anticipates these scenarios and outlines procedures for handling them. This foresight can save your business from significant disruption and potential legal battles. It provides a roadmap for dealing with membership changes, transfers of ownership, and dissolution of the LLC.

Finally, it provides a framework for dispute resolution. Even the best business relationships can sometimes encounter disagreements. A well-written operating agreement includes a process for resolving disputes, such as mediation or arbitration. This can help you avoid costly and time-consuming litigation, preserving your business relationships and protecting your bottom line. It also demonstrates to potential investors or lenders that your LLC is well-organized and prepared for potential challenges.

Key Elements to Include in Your New York State LLC Operating Agreement Template

Now that you’re convinced of the importance of having an operating agreement, let’s talk about what should actually be included in your New York State LLC operating agreement template. While every business is unique, there are some essential elements that should be addressed in every agreement.

First, you need to clearly state the LLC’s name and registered agent. This section should match the information on file with the New York Department of State. The registered agent is the individual or entity designated to receive official legal and tax documents on behalf of the LLC.

Second, define the purpose of your LLC. What is the specific business activity your LLC will engage in? Be as specific as possible, but also allow for some flexibility to adapt to future opportunities. This can help protect your LLC from legal challenges if you later expand into related areas of business.

Third, outline the contributions of each member. What did each member contribute to the LLC in terms of cash, property, or services? This section should specify the value of each member’s contribution, as this will often determine their ownership percentage and share of profits and losses.

Fourth, detail the profit and loss allocation. How will profits and losses be distributed among the members? Will it be based on ownership percentage, contribution, or some other formula? This is a critical section that should be carefully considered and clearly defined to avoid future disputes. Also, specify how often distributions will be made to members.

Fifth, outline the management structure. Will the LLC be member-managed or manager-managed? In a member-managed LLC, all members participate in the day-to-day management of the business. In a manager-managed LLC, one or more designated managers (who may or may not be members) are responsible for managing the business. This section should clearly define the roles and responsibilities of the managers or members involved in management. Furthermore, you need to explain the voting rights and procedures. How will decisions be made within the LLC? Will each member have one vote, or will voting power be proportional to their ownership percentage? This section should outline the procedures for holding meetings, taking votes, and making decisions on behalf of the LLC.

Sixth, add the details regarding transfer of membership interests. Can members freely transfer their ownership interests to others? Or are there restrictions in place, such as a right of first refusal for other members? This section should outline the procedures for transferring membership interests, including any required approvals or notifications.

Finally, don’t forget the dissolution procedures. How will the LLC be dissolved if the members decide to terminate the business? This section should outline the procedures for winding up the LLC’s affairs, paying off debts, and distributing remaining assets to the members. Addressing these items in your New York State LLC operating agreement template is incredibly important.

Ultimately, a well-crafted operating agreement is an invaluable asset for any New York LLC. It provides clarity, protection, and a framework for resolving disputes, ensuring that your business can thrive for years to come.

Think of your operating agreement as a living document that can be amended as your business evolves. Review it periodically and make updates as needed to reflect changes in your business structure, member roles, or operational procedures. Doing so will help protect your LLC and ensure that it continues to operate smoothly.